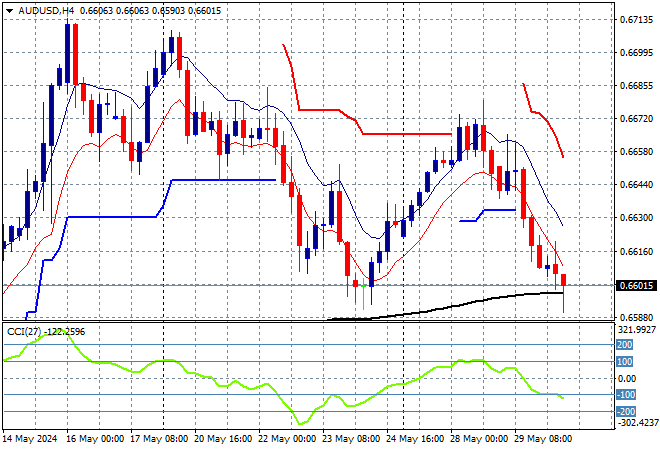

Asian stocks are going deeper into the red as the risk mood further sours due to the continued negative lead from Wall Street. The USD continues to firm although it lost ground against Yen while the Australian dollar is doing well to hold on despite its recent falls to be right on the 66 cent level.

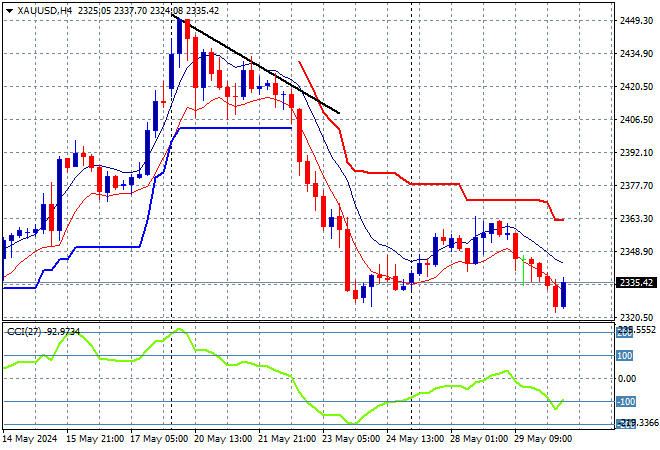

Oil prices are failing to hold on to their recent gains as Brent crude opens just below the $84USD per barrel level while gold is also trying hard to steady itself but is barely holding on to the $2340USD per ounce level this afternoon:

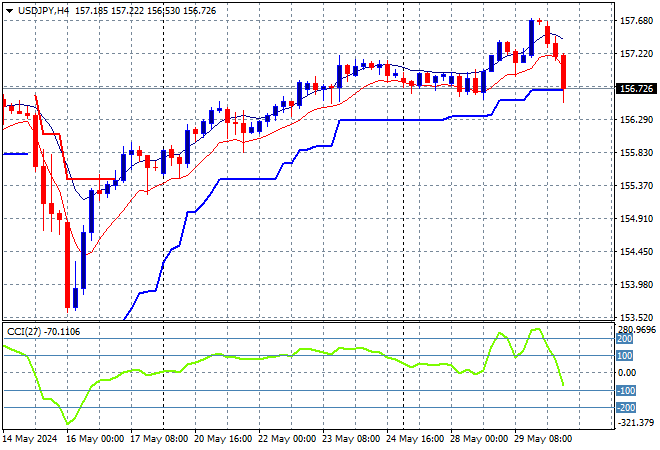

Mainland Chinese share markets were again up initially but gave up their gains and then more towards at the close with the Shanghai Composite off by 0.6% while the Hang Seng Index lost over 1% to 18239 points. Meanwhile Japanese stock markets are speeding up their losses with the Nikkei 225 putting in a 0.9% loss to 38056 points as the USDJPY pair sharply reversed well below the 157 level:

Australian stocks was the best performer relatively speaking, with the ASX200 down 0.5% to 7628 points while the Australian dollar has held on to the 66 cent level after dipping below on the CAPEX results:

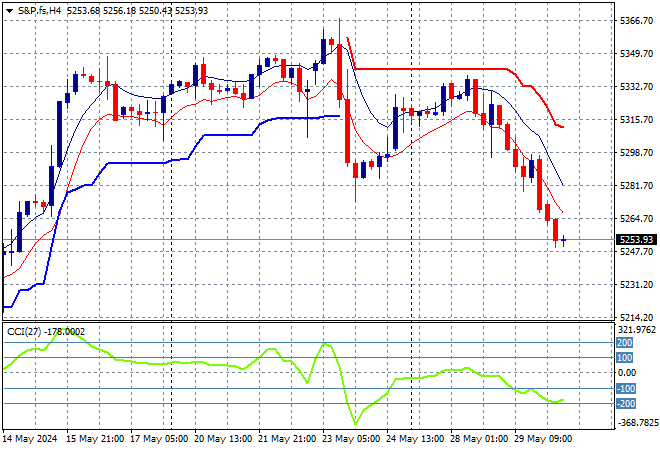

S&P and Eurostoxx futures are both down 0.5% as the risk off mood widens. The S&P500 four hourly chart shows price action breaking well below the 5300 point level which has turned into short term resistance:

The economic calendar continues with the latest US GDP figures for Q2 and pending home sales.