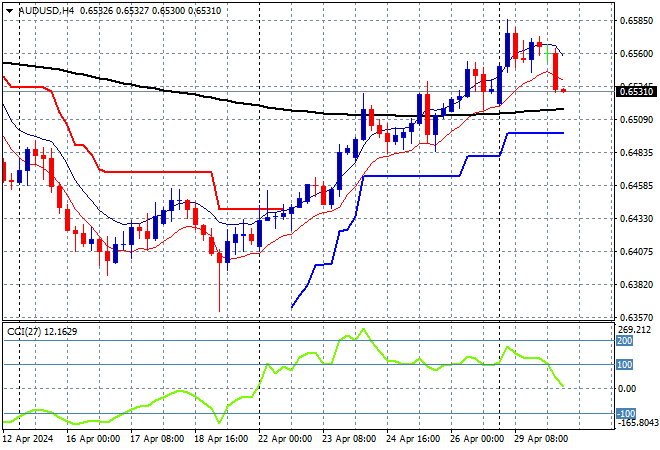

The return of Japanese traders to their desks after a long weekend break has seen some reduction in volatility in Yen today following the spike from last week’s meeting while Chinese stocks are broadly unchanged while the local market is absorbing a poor retail sales print. This sent the Australian dollar down to just above the 65 cent level in afternoon trade.

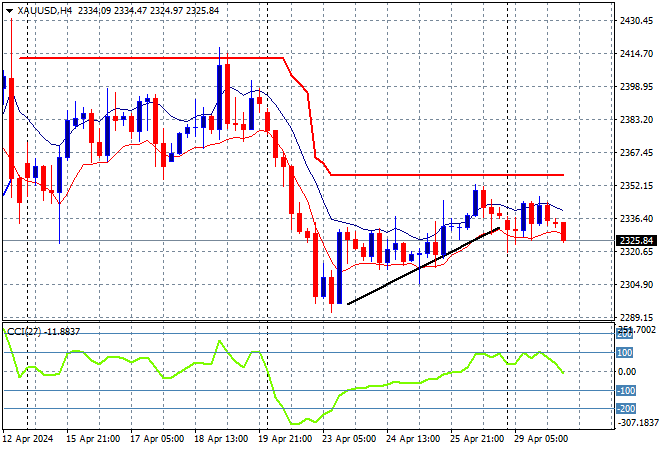

Oil prices are slipping further following the weekend gap down with Brent crude down to the $87USD per barrel level while gold is still struggling to recover from its recent rough retracement, heading below the $2330USD per ounce level this afternoon:

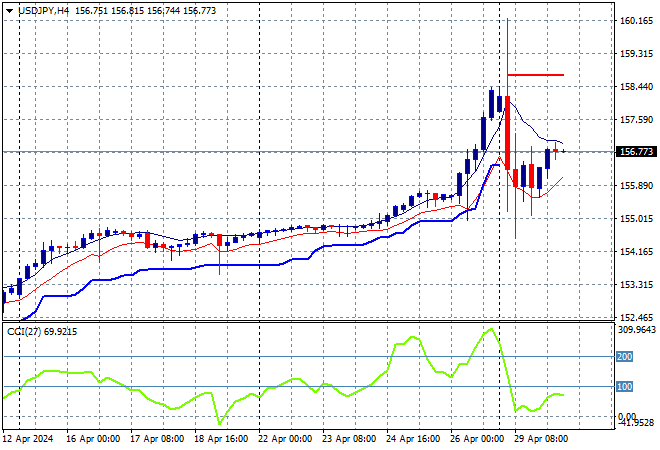

Mainland and offshore Chinese share markets are heading somewhat in the same direction with the Shanghai Composite down a handful of points while the Hang Seng Index has lifted barely at all, going into the close at 17762 points. Japanese stock markets reopened from their long weekend with the Nikkei 225 lifting more than 1% while the USDJPY pair is trying hard to normalise post its recent high volatility as it returns to a more sustainable 156 level:

Australian stocks were the poor performers relatively speaking with the ASX200 up just 0.3% going into the close at 7659 points while the Australian dollar slumped on the latest retail sales data, currently dicing with the 65 cent level in afternoon trade:

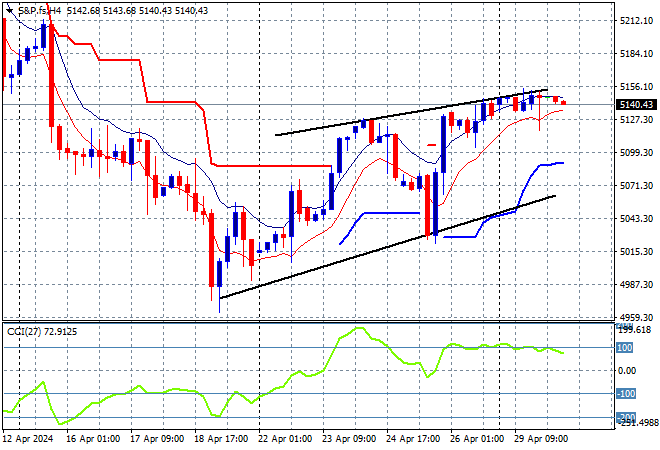

S&P and Eurostoxx futures are meandering along as we head into the London session with the S&P500 four hourly chart showing price action now out its small correction, possibly finding some resistance however at the 5150 point zone:

The economic calendar is pretty packed tonight with German unemployment, Euro inflation and US consumer confidence figures.