- The Federal Reserve is set to deliver another .75 point interest rate hike tomorrow—and a few more before the end of the year

- The largest beneficiary in such a scenario is the US dollar

- Here are 3 strategies to take advantage of the trend

Tomorrow the Federal Reserve will release its highly-awaited July interest rate decision. Jerome Powell’s corresponding press conference will follow shortly, giving investors more clues on the Fed’s plans for the US economy.

If everything goes as expected, the Fed will repeat the last meeting's 0.75 points hike, bringing the rate to 2.25-2.50%.

This is probably not the last time we see a hawkish Fed, as rate hikes should proceed through the following meetings. At the next FOMC, in September, we could see another 0.50 or 0.75 point increase, and by the end of the current fiscal year, we could see the federal funds rate exceeding 3.5%.

It is a rather complicated scenario for the US economy, as the Fed has to be careful to ensure that the cure is not worse than the disease.

During the past 8 bear markets, the Fed responded to plunging stock prices by lowering interest rates. Yet, this time, it is doing so by hiking them—a backdrop not seen since the 1980s under 12th Fed chairman Paul Volcker.

The dollar is one of the largest beneficiaries in such a scenario. With that in mind, we devised 3 strategies to take advantage of this fact.

1. Investing In The Dollar Index (DXY)

The US dollar index is a measure of the dollar's value in relation to the value of a basket of currencies, among which the most important are, in this order, the euro, the Japanese yen, the pound sterling, the Canadian dollar, the Swedish krona, and the Swiss franc.

The dollar index was created in 1973 with a price of 100. Therefore, if the index trades at 130, the greenback has appreciated 30% against the basket of currencies. Contrariwise, if the index is at 70, the dollar has depreciated by -30% against the basket of currencies.

It is currently hovering near a 20-year high because of the Fed's monetary tightening. Its bullish strength should continue if the Fed maintains its hawkish stance in the following meetings.

2. Investing In ETFs

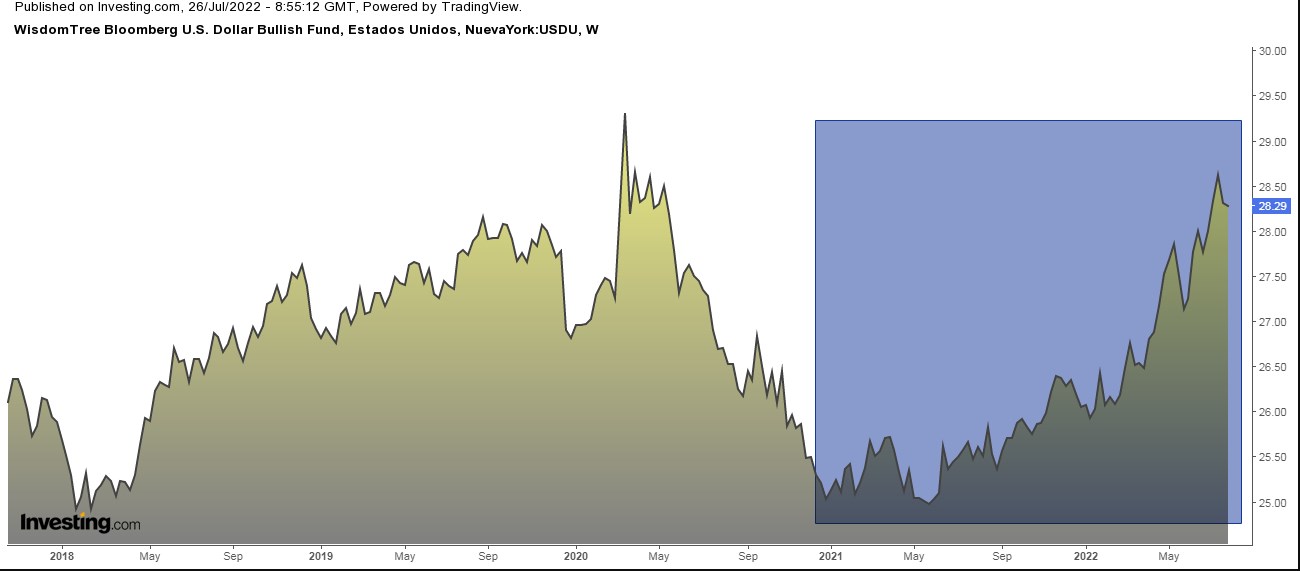

- WisdomTree Bloomberg U.S. Dollar Bullish Fund (NYSE:USDU): seeks to provide a return, before fees and expenses, that exceeds the performance of the Bloomberg Dollar Total Return.

The index is structured to potentially benefit from the appreciation of the US dollar relative to a basket of global currencies that includes developed and emerging market currencies.

Year-to-date performance is +8.56%, and over the past 12 months, it is +10.21%.

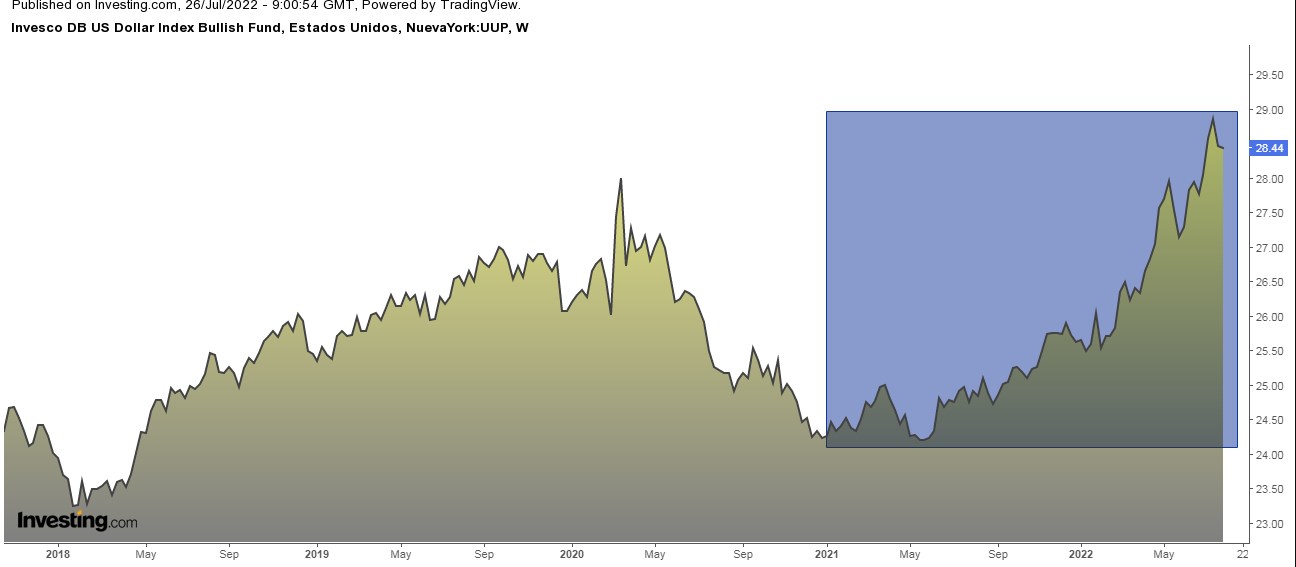

- Invesco DB US Dollar Index Bullish Fund (NYSE:UUP): the fund seeks to track the performance of the Deutsche Bank US Dollar Index.

Year-to-date performance is +10.96% and over the last 12 months is +13.85%.

3. Investing In European Companies With Significant U.S. Exposure

European companies listed in the STOXX 600 index have significant exposure to the United States. In fact, 23% of their sales come from the world's largest economy. This is important as a stronger dollar is favorable for their profits.

Let's take a look at some of the best picks for the current environment:

- Grifols (NASDAQ:GRFS): about 60% of its sales come from the United States. Short- and long-term growth is expected, driven by solid demand.

In addition, there will be more plasma collection, probably at a lower cost, allowing it to improve its profit margins. - Sanofi (EPA:SASY) (NASDAQ:SNY): it can continue to act as a safe haven in the current environment given its high cash generation, minimal debt level, and significant dollar sales.

- Roche (OTC:RHHVF): new patents and next-generation products favor long-term growth prospects. It is also relevant that positive earnings should help it maintain strong returns on invested capital at current levels in the coming years.

- ACS (OTC:ACSAY): is the largest public and private works contractor in the United States, with over half a dozen subsidiaries. It has a turnover of almost 16,000 million euros in the US, representing more than half of its annual turnover.

- Ferrovial (OTC:FRRVY): immersed in a mega public investment project with the purchase of 1,000 million dollars of the controlling stake in the company that will build Terminal 1 of JFK airport in New York. Also in its favor is the recovery of traffic and its solid financial position.

- Anheuser Busch Inbev (NYSE:BUD): the brewing group has significant exposure in the United States through Budweiser and other brands.

Disclosure: The author currently does not own any of the securities mentioned in this article.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »