Asian share markets are seeing a very solid bid across the region, save for mainland China as newsflow and macro events over the weekend have not overshadowed the solid gains on Wall Street from Friday night. A little bit of stability in currency markets has returned due to the series of interest rate decisions that are forthcoming this week with the USD holding against most of the majors while Yen continued its descent. The Australian dollar was able to push itself off the floor but remains stuck below the 66 cent level.

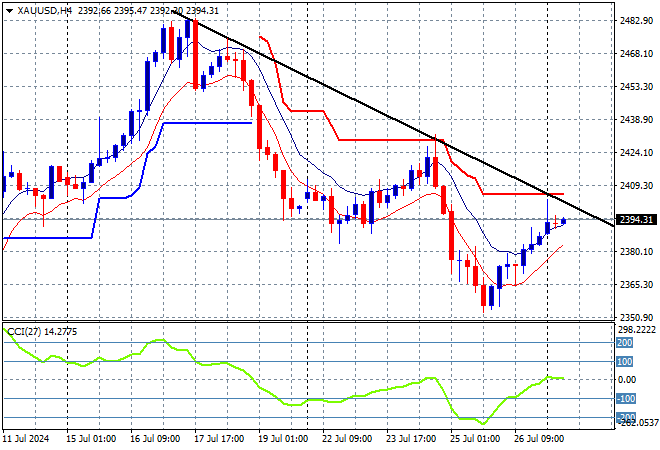

Oil prices rebounded a little over the weekend with Brent crude trying to get back above the $80USD per barrel level while gold has bounced back somewhat, currently just below the $2400USD per ounce level:

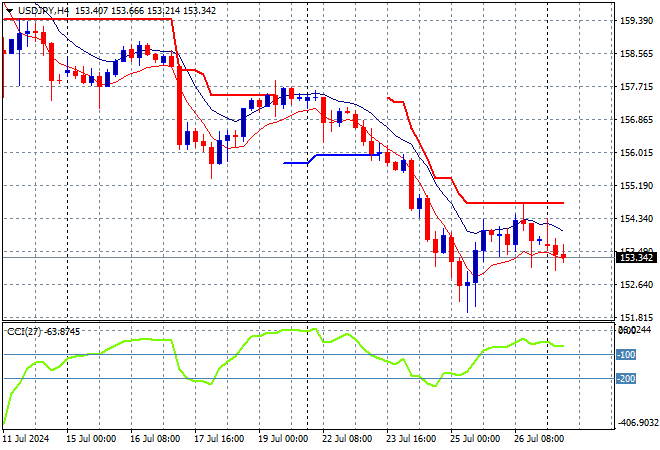

Mainland Chinese share markets are flat at best with the Shanghai Composite off by a handful of points while the Hang Seng Index is zooming higher, currently up nearly 1.7% to 17305 points. Meanwhile Japanese stock markets are starting the trading week in fine form with the Nikkei 225 launching more than 2% higher to close at 38525 points as the USDJPY pair continues to deflate as it loses momentum below the mid 153 level in afternoon trade:

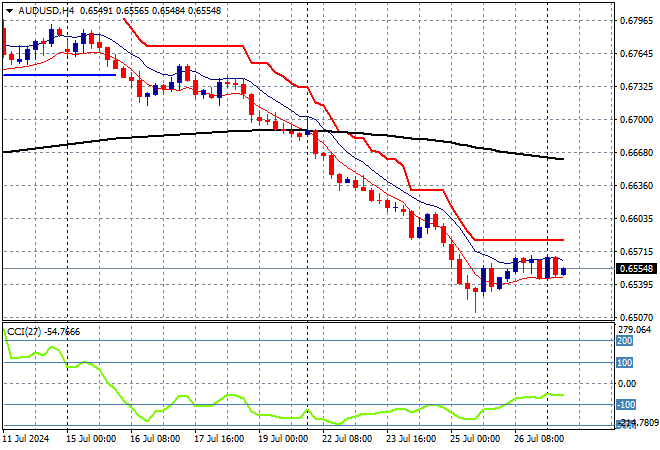

Australian stocks were able to put on some solid gains to start the week on a good note with the ASX200 closing 0.8% higher at 7989 points while the Australian dollar is still in pause mode awaiting this week’s cavalcade of interest rate decisions and inflation data as short term momentum tries to get out of extreme oversold mode:

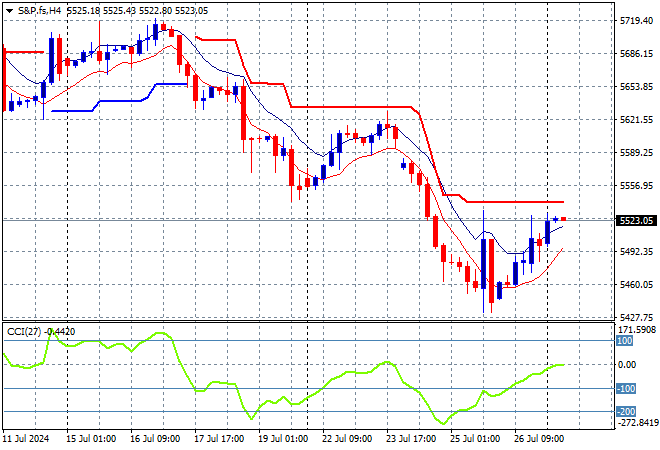

S&P and Eurostoxx futures are up slightly as we head into the London session with the S&P500 four hourly chart showing how a potential bottom at the 5400 point level is forming but if it doesn’t break through overhead short term resistance, the next target is 5200 points:

The economic calendar starts the week slowly as anticipation builds for the upcoming interest rate decisions from the big central banks.