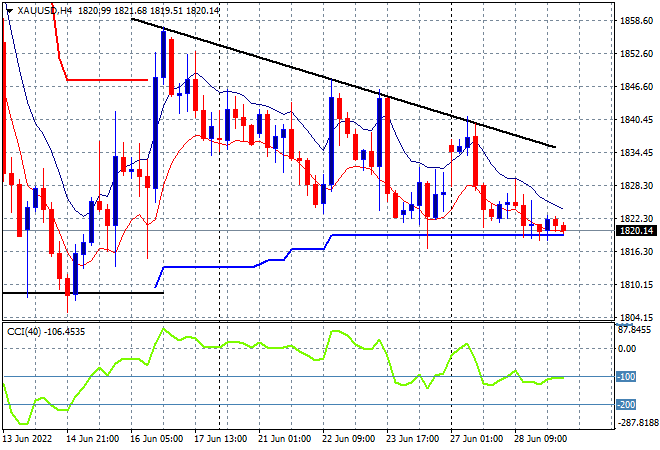

A sea of red across Asian share markets as the sharp reversal in risk sentiment on Wall Street overnight spreads to all risk markets. The USD is continuing its surge in strength against most of the undollars, with the Australian dollar smacked down below the 69 cent level as oil prices are trying to stabilise with Brent crude holding on to its gains above the $113USD per barrel level while gold is now struggling to keep the biggest bears away, depressed and ready to breakdown at the $1820USD per ounce level:

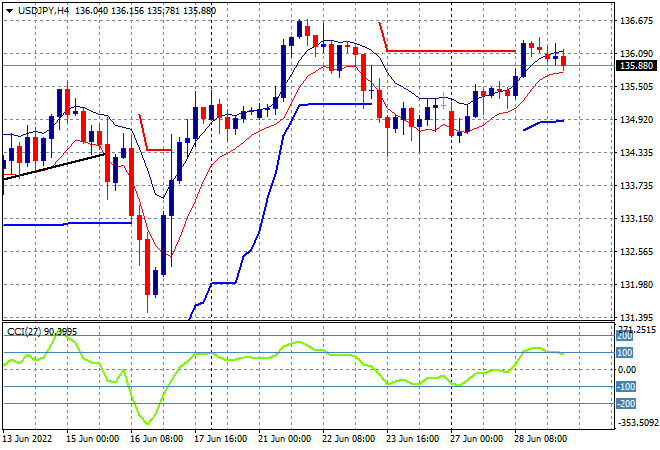

Mainland Chinese share markets are slumping towards the close with the Shanghai Composite down more than 0.5% to 3385 points while the Hang Seng Index is in full reverse mode with a 1.5% loss, currently at 22034 points. Japanese stock markets are also under stress, with the Nikkei 225 index closing 1% lower at 26788 points while the USDJPY pair has retraced slightly to be back below the 136 handle:

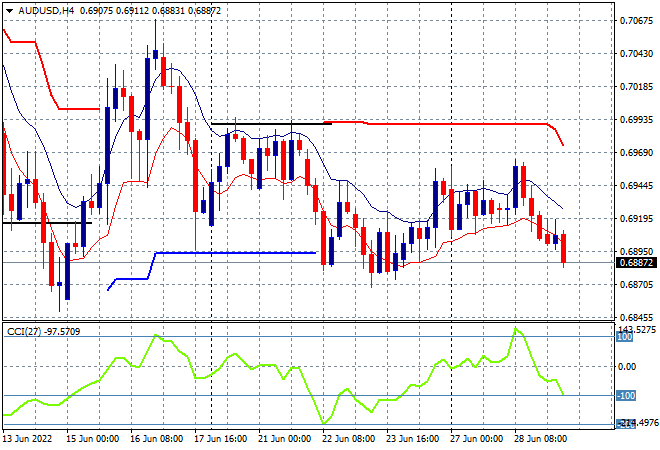

Australian stocks couldn’t escape the selling with the ASX200 finishing more than 0.9% lower, closing at exactly 6700 points. The Australian dollar can’t find a bottom here, having failed to get back above the 70 cent level against USD, its now rolled over and heading towards the previous weekly low at the 68.80 level:

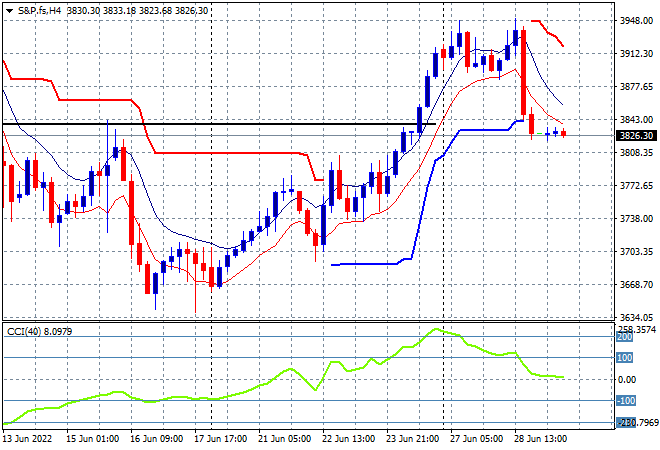

Eurostoxx and Wall Street futures are down as we head into the European open, with the S&P500 four hourly futures chart showing price action now fully retraced below the previous resistance level, with the bullish inverse head and shoulders pattern proving quite false indeed:

The economic calendar includes the all too critical German inflation print, followed by the final US GDP print and a trio of central banker head speeches later in the evening.