Wall Street reopened from its long weekend and due to NVIDIA (NASDAQ:NVDA) earnings, only the NASDAQ advanced while the broader indicies slightly retreated or put in a scratch session. European shares gave up all their early week gains while the latest US consumer confidence figures came in better than expected, which drove the USD higher. The Australian dollar failed to continue its move above the mid 66 cent level as a result.

US Treasury markets reopened with a lift across the yield curve as the 10 year gained nearly 8 points to push above the 4.5% level while oil prices lifted strongly on the reopen with Brent crude pushing right through the $84USD per barrel level. Gold managed another mild pusher higher as it tries to recover, finishing just above the $2360USD per ounce level.

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets pulled back at the close with the Shanghai Composite down nearly 0.5% while the Hang Seng Index was able to put in a scratch session to be down 0.1% at 18803 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. Price action was looking way overextended but this retracement is now taking some heat out of the market before a potential second run:

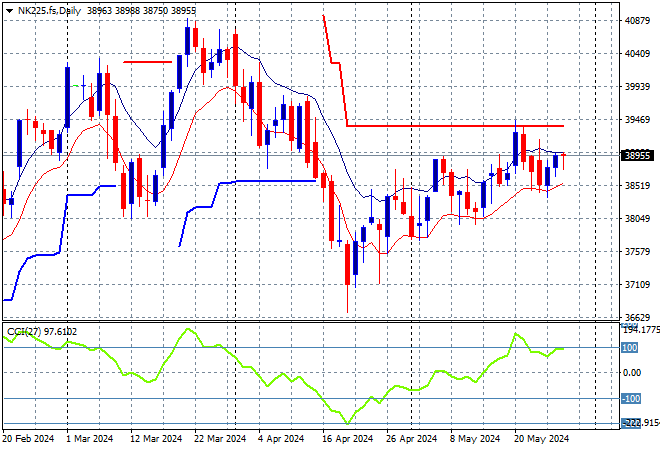

Meanwhile Japanese stock markets also put in a similar return with the Nikkei 225 managing a 0.1% loss to 38855 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance had been defended with short term price action now rebounding off former support at the 39000 point level with short term momentum still indicating a potential breakout, with futures steady for now:

Australian stocks failed to bounce back, with the ASX200 down nearly 0.3% to 7766 points.

SPI futures are also down nearly 0.7% despite a good lead from Wall Street overnight. The daily chart was showing a potential bearish head and shoulders pattern forming with ATR daily support tentatively broken, taking price action back to the February support levels. Momentum was finally getting out of its oversold condition but it looks like any potential upside is sliding back again:

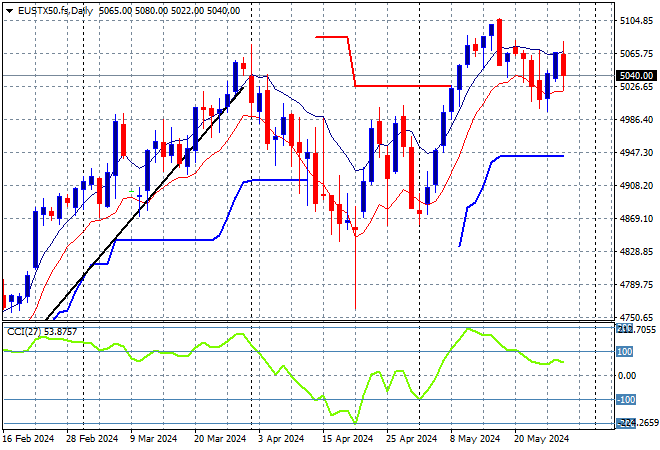

European markets reversed all across the continent with the Eurostoxx 50 Index closing nearly 0.6% lower at 5030 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This is still looking to turn into a larger breakout with support at the 4900 point level quite firm but resistance maybe too strong overhead:

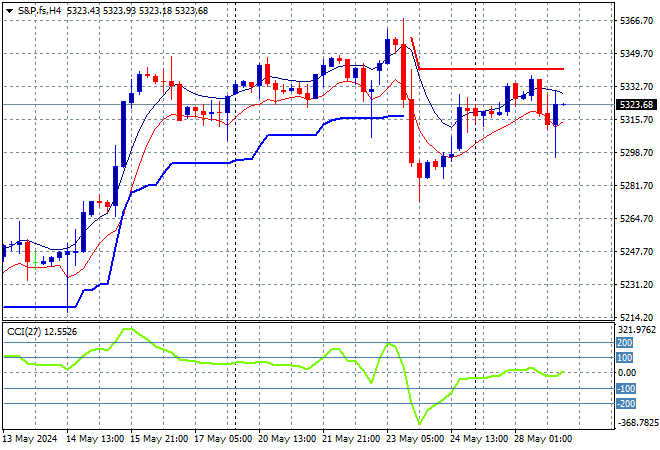

Wall Street reopened from the Memorial Day long weekend with the NASDAQ the odd one out to gain nearly 0.6% while the S&P500 put in a scratch session, finishing at 5306 points.

The daily chart was showing a large move higher as all Fed roadblocks seemingly were cleared with price action getting well out of its previous slightly stalled position above the 5200 point area. However the four hourly chart shows a lot of hesitation here at the 5300 point level as short term momentum cannot get into the positive zone:

Currency markets were moving away from USD again before last night’s US consumer confidence print but that changed promptyl with Euro losing most of its ground taken in the week so far, heading back to the mid 1.08 level as a result.

The union currency had previously bottomed out at the 1.07 level at the start of April as medium term price action with a reprieving reversal in price action back towards the 1.09 level before its own inflation print. Short to medium term support at the 1.0630 level has been respected but momentum settings did get into strongly negative territory, and have now gone positive with the potential to refill the lost ground:

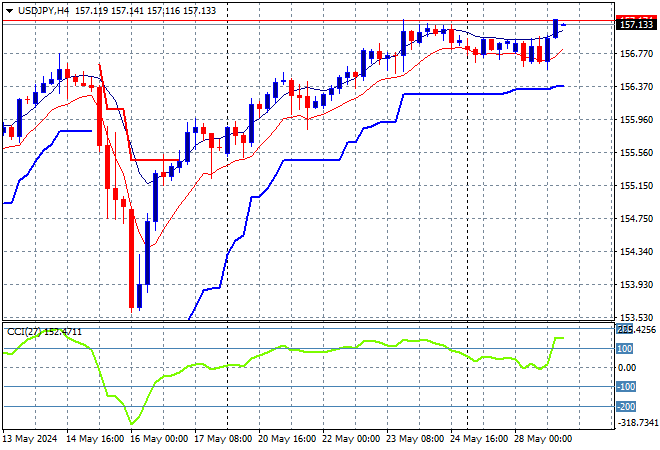

The USDJPY pair was able to advance further from its new weekly high to get back above the 157 handle after looking positive anyway before the consumer confidence print.

This price action post the epic BOJ meeting volatility was much more welcome but this reversal is not that surprising given the weakness of the USD. ATR support at the mid 156 handle continues to be defended:

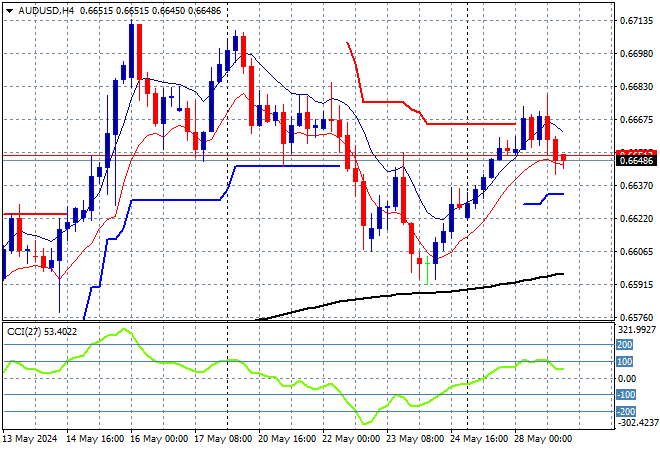

The Australian dollar was facing increasing pressure as more pro-US economic measures come in while the local economy is staring down recession, but the Pacific Peso wasn’t able to stave off last night’s latest print to head back below the mid 66 level.

The Aussie has been under medium and long term pressure for sometime before the recent RBA and Fed meetings and while there was optimism in the last couple of weeks, resistance at 67 cents was too high to breach. I still reckon the 66 handle will break soon as successive levels of resistance continue to ramp down:

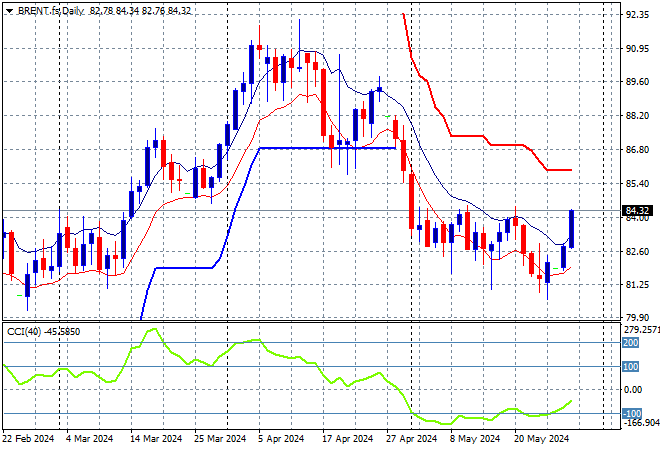

Oil markets are trying harder to get back on track as the trend remains down throughout April and May with Brent crude able to get well above the $84USD per barrel level overnight after only very recently making a new weekly low at the $81 level.

After breaking out above the $83 level last month, price action has stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Watch daily ATR support here at the $86 level which is still broken and will likely be resistance for sometime:

Gold was able to stop falling on Friday night and has rebounded coming out of the weekend gap but still remains well below the $2400USD per ounce level, finishing just above the $2350 level this morning.

Short term momentum has retraced out of oversold mode but remains negative with the target to reach in this rebound at trailing short term ATR resistance at the $2380 level: