Overnight saw more wobbles on equity markets as bond markets led the risk charge, notably European fixed income on the back of the French political imbroglio and US 2 year Treasuries in the wake of the latest US consumer confidence figures. The USD retreated against the majors, with most returning to last Friday’s strong post Powell speech position, with Euro almost above the 1.12 handle while the Australian dollar is also threatening the 68 cent level.

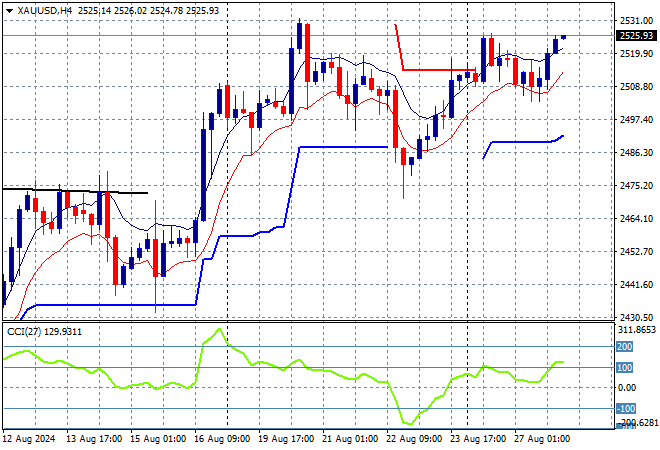

10 year Treasury yields are up nearly 2 points to extend above the 3.8% level while oil prices came back strongly with oil prices remain volatile as Brent crude retraced below the $78USD per barrel level. Gold was able to hold again above the $2500USD per ounce zone and almost matched the Friday night high.

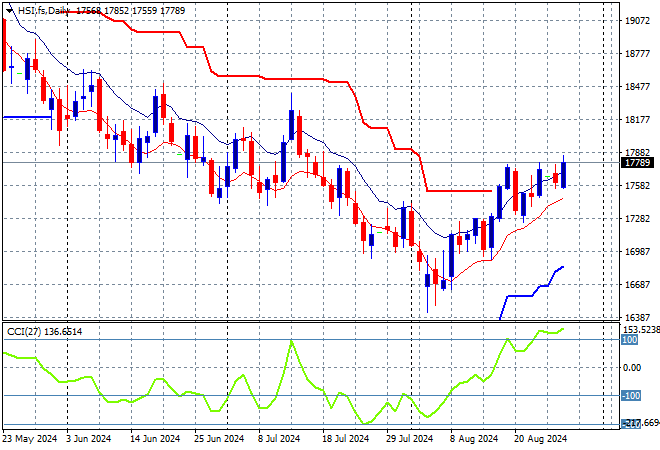

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets are directionless again with the Shanghai Composite down more than 0.2% while the Hang Seng Index has lifted just 0.2% to 17830 points.

The Hang Seng Index daily chart was starting to look more optimistic a few months back but price action has slid down from the 19000 point level and continues to deflate in a series of steps as the Chinese economy slows. A few false breakouts have all reversed course and another downside move was looming here but this breakout has some potential if it clears short term resistance:

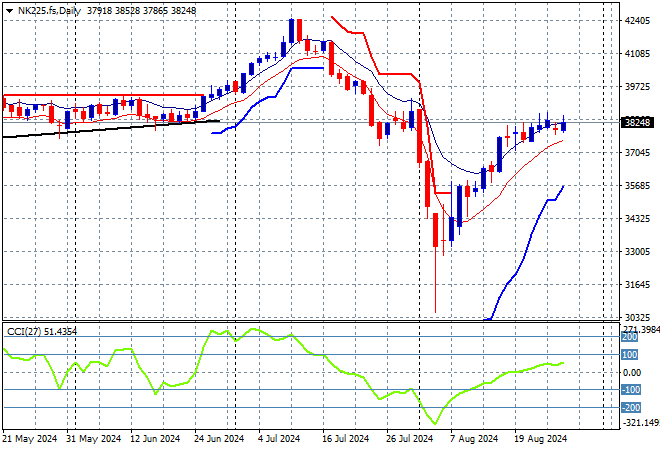

Meanwhile Japanese stock markets are pushing higher as Yen weakens with the Nikkei 225 closing more than 0.5% higher at 38288 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term support subsequently broke on that retracement, and then the front fell off. We are now seeing a big fill here but Yen volatility is coming back so a return to the 38000 point level from May/June is still possible but could be a rough road:

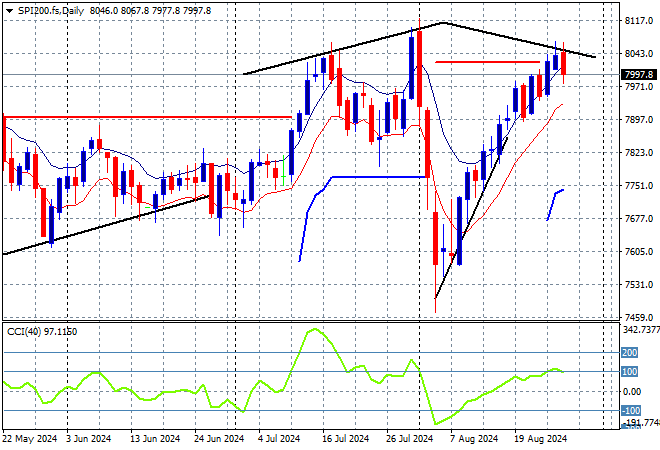

Australian stocks were the odd ones out with the ASX200 losing a little ground to close at 8071 points.

SPI futures are down 0.4% despite the moves higher on Wall Street overnight as the stronger AUD weighs on the market. Former medium term support at the 7700 point level will remain under pressure here as trader’s absorb the RBA’s signalling of no punchbowl for the rest of 2024, but short term momentum is starting to look good again here:

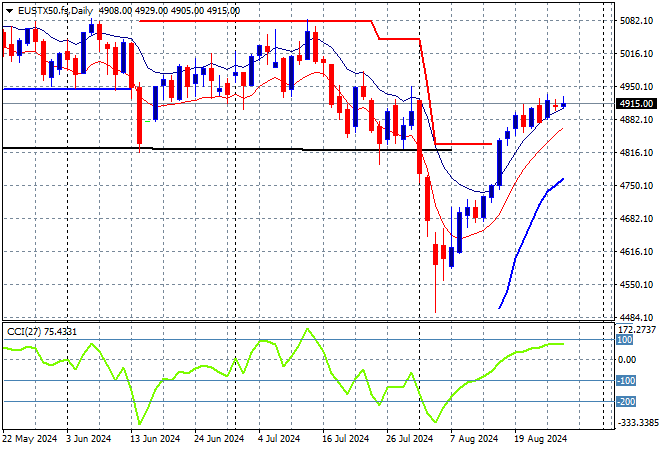

European markets were unable to put on any meaningful gains as all eyes are on France as the Eurostoxx 50 Index dead flat at 4896 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price has cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum is slowing:

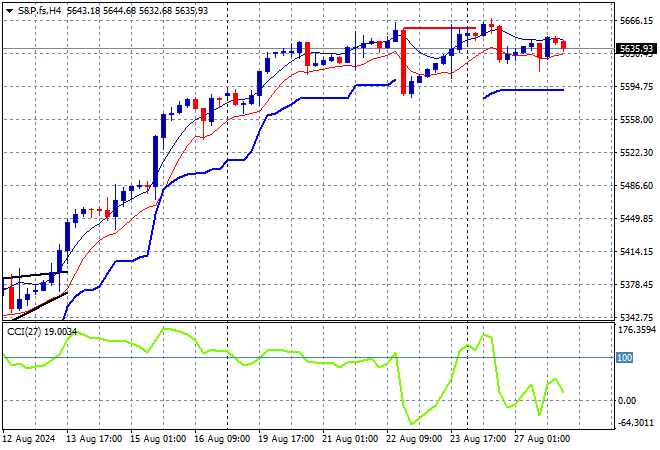

Wall Street was also mixed with some mild lifts on both the NASDAQ and the S&P500, each closing just 0.2% higher, the latter at 5626 points.

The four hourly chart illustrates how this bounceback had cleared the mid 5300 point level with momentum retracing fully from oversold to very positive these past two weeks. The potential for a positive breakout is again building with a swift return to the early August highs but price seems to be anchored at short term support:

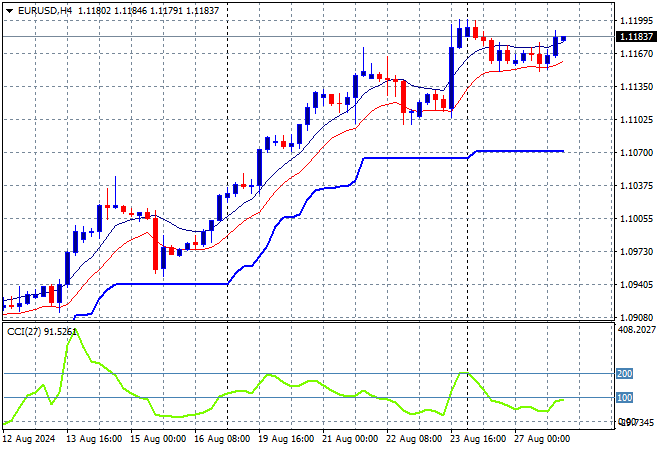

Currency markets had continued moves against USD in the wake of the latest Treasury auction with most major currency pairs rebounding again to match or almost match the Friday night highs. Euro pushed up towards the 1.12 level although it failed to breach, it still looks strong here.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier in the week with more momentum building to the upside with the 1.0750 mid level as support but there was still too much pressure from King Dollar. This is looking overbought in the short term again, but structurally supportive so I don’t expect any large dips soon:

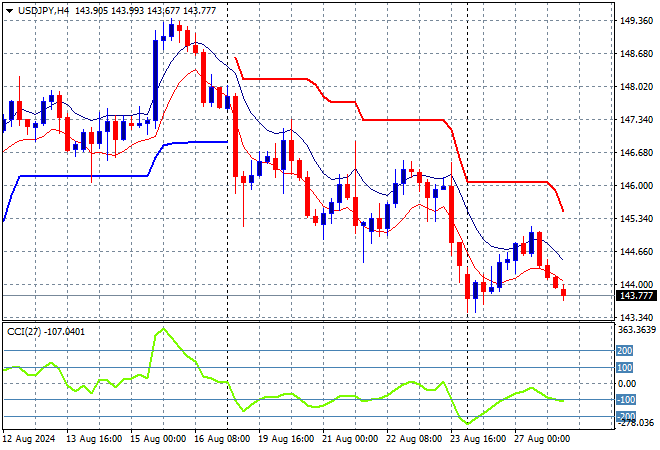

The USDJPY is failing to get out of its downwards medium term pattern with another rollover overnight below the 144 handle that almost matches the previous low.

The overall volatility speaks volumes as it pushed aside the 158 level as longer term resistance in the weeks leading up to the BOJ rate hike. Momentum was suggesting a possible bottom was brewing as the BOJ wants to get this under control but it doesn’t look like they have any influence here:

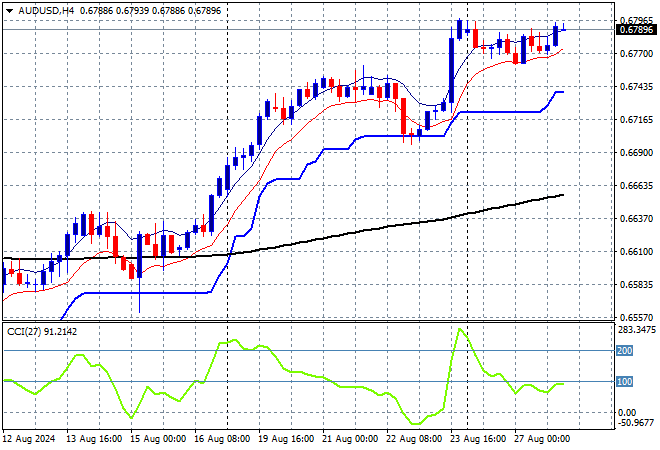

The Australian dollar was pushing higher on the weaker USD and the recent soft unemployment print, with a mild mid week rollover and retracement back to the 67 handle completely filled and rebounding on Friday night as the 68 cent level is now again under threat.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. A breakout is brewing here on the four hourly chart as price action matches the previous high:

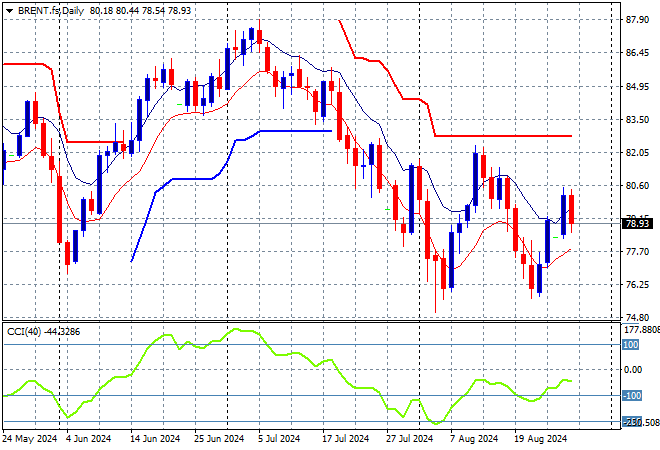

Oil markets are trying to move out of their previously weak position as volatility builds with Brent crude pulling back slightly to retreat below the $79USD per barrel level again.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum still in oversold mode as this swings into higher volatility:

Gold is keeping above the $2500USD per ounce level from the previous weekend gap and almost manged to return to its previous high as it closed at the $2525 level.

The longer term support at the $2300 level remains firm while short term resistance at the $2470 level was the target to get through last week as I indicated. This is still looking a little overextended so I expect a minor pullback unless USD weakness continues tonight: