Wall Street finished the trading week on a high note on Friday as Fed Chair Powell’s long awaited speech at the Jackson Hole conference was received with mild aplomb, with currency markets again moving in the USD’s favour. A slew of central bank speeches and indications that interest rates will have to stay higher for longer over the weekend from the BOE and BOJ among others may change that trajectory this morning on the weekend gap opening. The Euro and Pound Sterling both stayed at their recent weekly lows while the Australian dollar again pulled back to the 64 cent level.

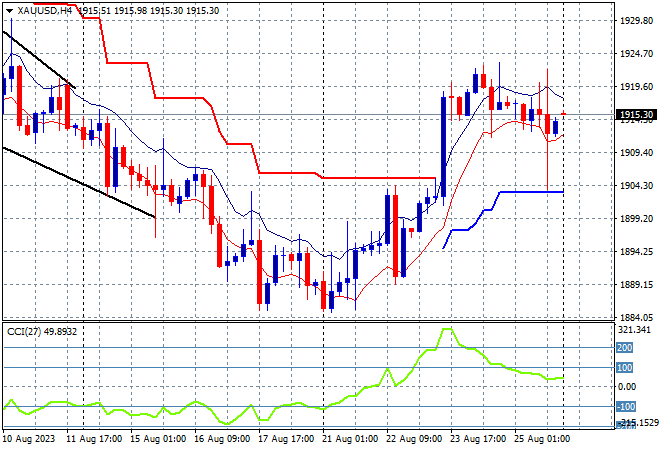

US bond markets saw small changes across the yield curve with the 10 year Treasury actually pulling back slightly to the 4.2% level while oil prices were able to hold on as OPEC again suggested more production cuts, with Brent crude steady just above the $84USD per barrel level. Gold held on to its recent gains just above the $1915USD per ounce level but is showing no upside potential.

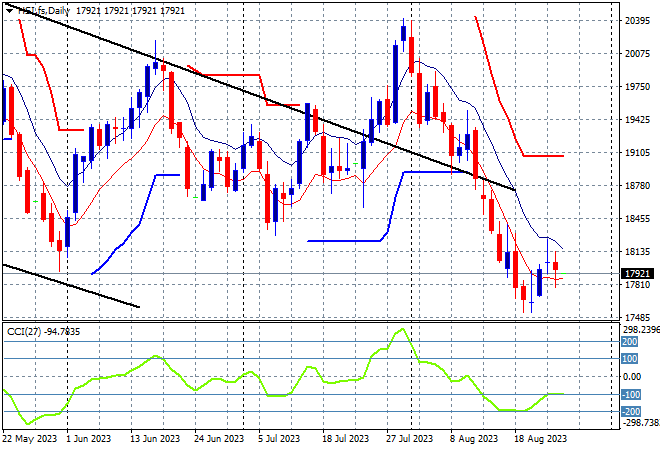

Looking at share markets in Asia from Friday’s session with mainland Chinese share markets fell further going into the close with the Shanghai Composite down nearly 0.7% at 3064 points while in Hong Kong the Hang Seng Index there was a similar reversal, falling just over 1.3% to close at 17956 points.

The daily chart is now showing a near complete selloff that has gone below the May/June lows with the 19000 point support level a distant memory as price action stays well below the dominant downtrend (sloping higher black line) following the previous month long consolidation. Daily momentum readings are trying to get out of oversold mode despite the recent rebound so I expect another rollover from here as a dead cat bounce plays out:

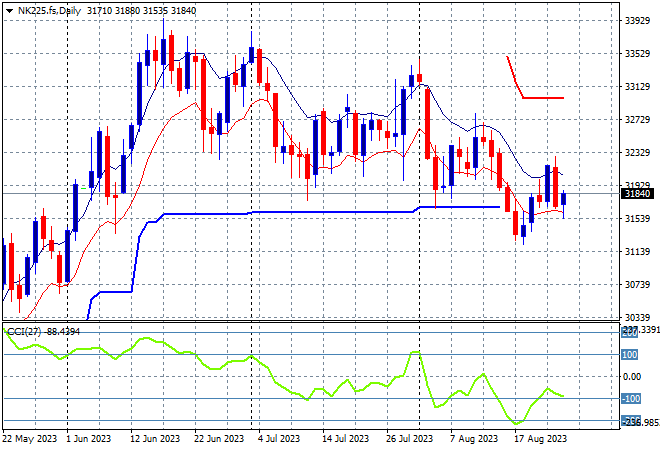

Japanese stock markets were also in full sell mode, with the Nikkei 225 off more than 2% closing at 31624 points.

Trailing ATR daily support had been paused for sometime now as the market went sideways after a big lift recently, with a welcome consolidation above that level but that has now turned into a proper dip. Daily momentum broke into the oversold levels but has now retraced as price action bounced back from the support zone with the potential for a swing building here, as futures are indicating a small lift in line with Wall Street:

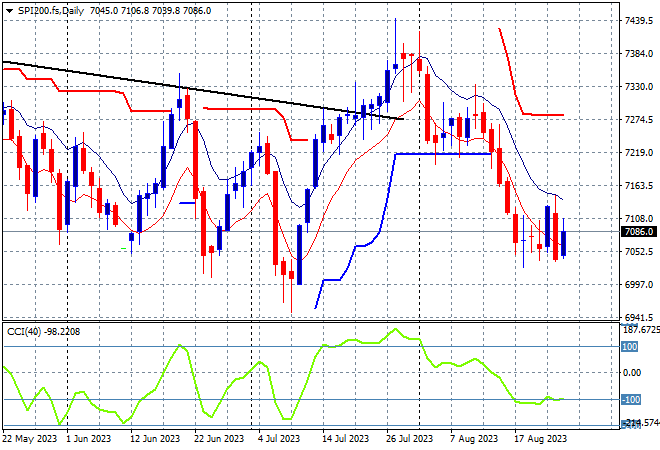

Australian stocks joined in the selling, at one stage down by more than 1% but eased off a little at the close as the ASX200 finished some 0.9% lower at 7115 points.

SPI futures are up around 0.3% this morning given the small lift on Wall Street Friday night, with the 7300 point level remaining strong as short term resistance. Medium term price action is now moving sideways with the short term pattern looking like decelerating here before last night’s move, so expect a retest of the July lows next:

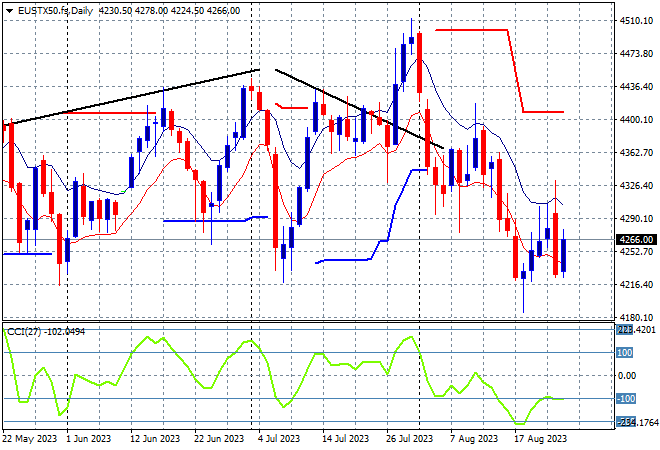

European markets were able to just make it into the green across the continent with minor gains as the Eurostoxx 50 Index closed 0.1% higher at 4236 points.

While the daily chart shows weekly support at 4200 points barely defended, weekly resistance at the 4400 point resistance level has now pushed the point of control well below the 4300 point level. There are signs of stability returning here as daily momentum tries to get out of oversold mode but I remain cautious:

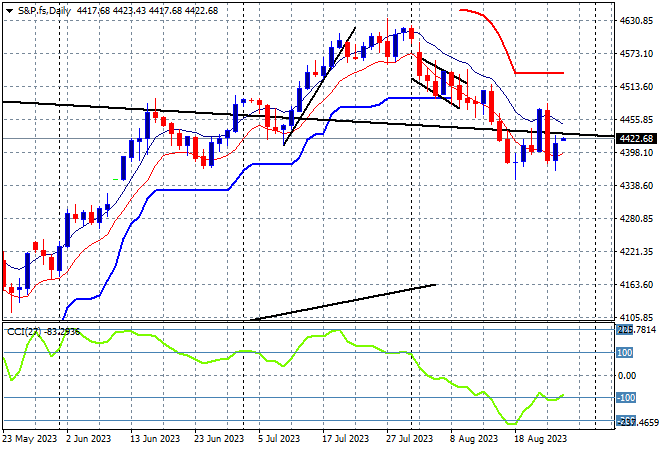

All eyes on Wall Street after listening to Fed Chair Powell, where US stocks breathed a small sigh of relief as all three bourses lifted with the NASDAQ leading the way, up nearly 1% while the S&P500 gained almost 0.7% to finish at 4405 points.

The daily chart is still showing price action well below the previous downtrend channel with short term ATR resistance at the 4500 point level some distance away as the mid week breakout looks like a dead cat bounce. The 4400 point level is for now proving strong support but daily momentum remains very negative:

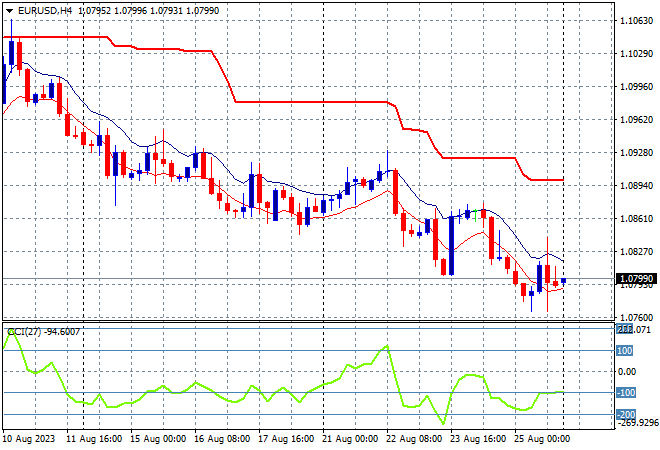

Currency markets are failing to push back against USD as the run to King Dollar continues post the Jackson Hole conference Powell speech. The release of the latest initial jobless claims strengthened the USD against almost everything prior to the speech with Euro still below the 1.08 level alongside a weak Pound Sterling despite both the ECB and BOE signalling higher interest rates..

The union currency really needed to have a strong return above trailing ATR resistance just below the 1.10 handle in recent weeks but failed despite a mid week rally to decline back to the previous weekly lows just above the mid 1.09 level. Short term momentum is back to being oversold as price action remains below the August lows:

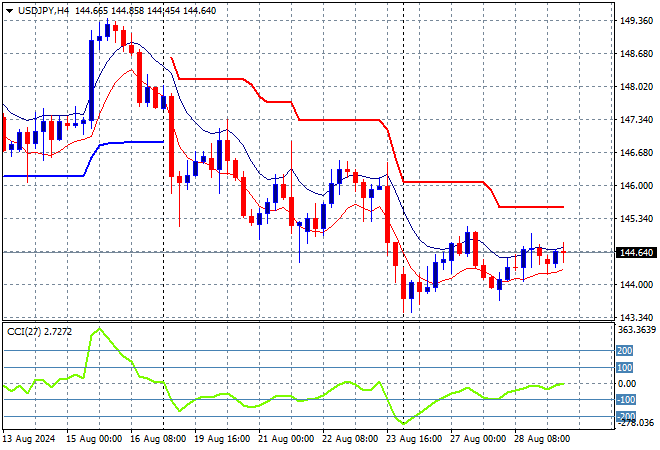

The USDJPY pair rebounded mid week to return to its recent highs just above the 146 level, surging on Fed Chair Powell’s comments and staving off what looked like a very bearish triple top pattern on the four hourly chart.

Four hourly momentum shows a return to overbought settings with overhead ATR resistance and the previous highs at the 146 level cleared, the latter which had turned into short term resistance. I’m looking for another positive session before this bounce turns into a proper uptrend:

The Australian dollar had been under the pump against King Dollar for sometime here although a possible bottom is still brewing at the 64 handle, but the recent breakout remains thwarted, with no lift above the 64 level on Friday night.

Four hourly momentum is nearly oversold again as price action from the Pacific Peso looks like returning to the recent lows:

Oil markets continue to unwind their recent bullishness with news of more potential OPEC cuts keeping Brent crude off its recent lows to just above the $85USD per barrel level, barely holding on to its three month high and current uptrend.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now putting aside resistance at the $80 level. Daily momentum has retraced below previously overbought readings with price action rolling over – watch short term support at $80 to hold:

Gold was able to hold on to its recent positive sessions, again closing above the key $1900USD per ounce level on Friday night but not making a new daily high.

The four hourly chart shows the attempt at getting back up to the psychologically important $2000USD per ounce level has been over for sometime now as the recent oscillations turn into a proper unwinding here below $1900. With the downtrend entrenched the potential for a reversal is building in the short term with four hourly momentum now extremely overbought as priece action bursts through trailing ATR resistance: