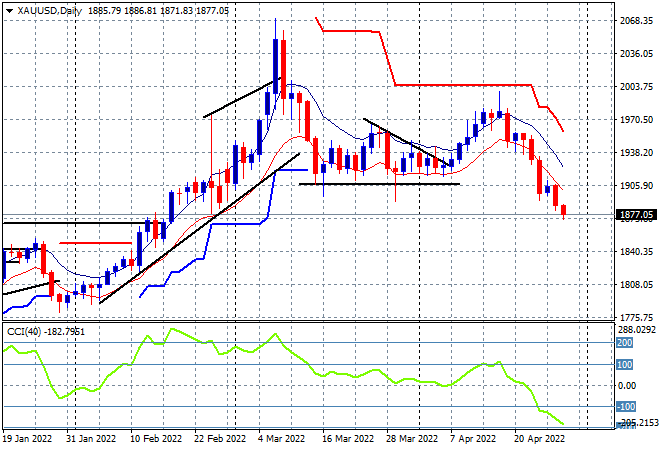

A much better session across Asian share markets today with the bounceback on Chinese stocks extending to other bourses as Wall Street tried to stabilise overnight. The USD is getting super strong against all the majors with Euro taking a deep dive alongside the Australian dollar and Yen. Oil markets are slipping again in the wake of the energy crisis in Europe with Brent crude starting to move slightly below the $105USD per barrel level while gold is also struggling following its big slump below the $1900USD per ounce level, as daily momentum remains sharply negative:

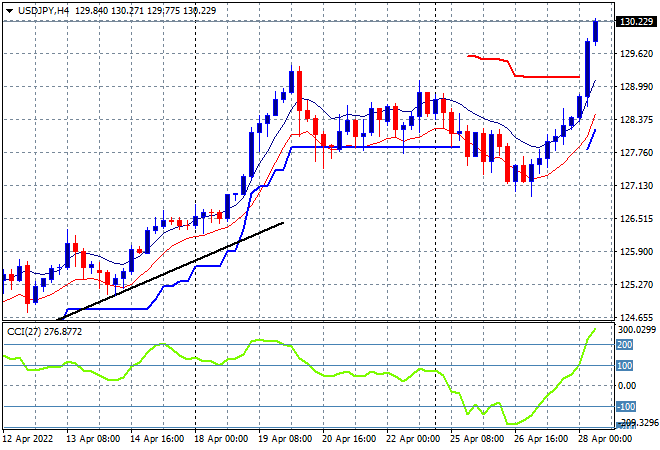

Mainland Chinese share markets are the relative laggards across the region but still rising going into the close with the Shanghai Composite up nearly 0.5% at 2972 points while the Hang Seng Index is doing even better, up 0.9% at 20116 points. Japanese stock markets are rebounding the fastest as Yen takes a steep dive, with the Nikkei 225 closing 1.7% higher at 26847 points while the USDJPY pair has been released after being under pressure as it zooms past the 130 handle to a new multi decade high, blasting through the previous high:

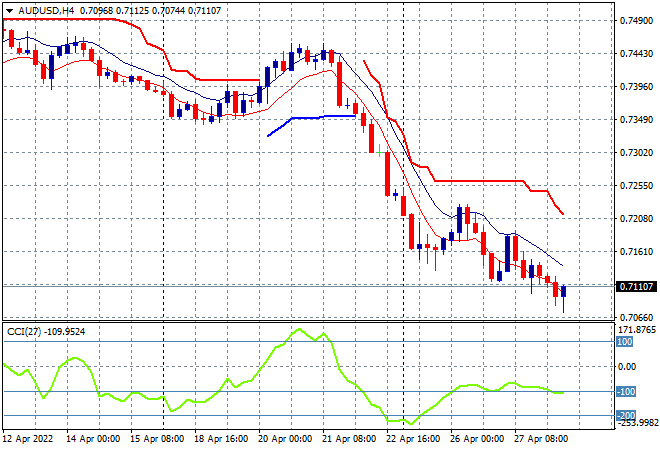

Australian stocks ended up a bit better than expected, with the ASX200 climbing nearly 1.3% to try to clawback some of its poor start to a truncated trading week, closing at 7356 points. Meanwhile the Australian dollar has returned to form – down – after the tiniest of bouncebacks following the CPI print – now threatening the 71 handle:

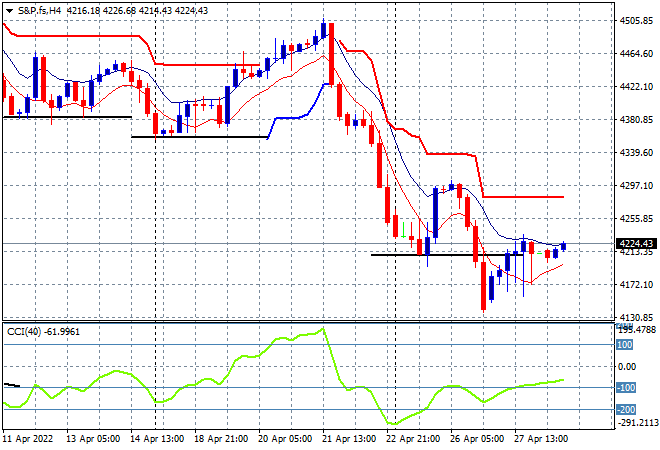

Eurostoxx and Wall Street futures are looking a bit better here as the S&P500 four hourly chart shows price desperately trying to find a bottom here after continuing down a frightful set of steps, wanting to get bounce of the recent lows and not get back to the 4000 point level:

The economic calendar includes German inflation and the advanced Q1 GDP print for the US.