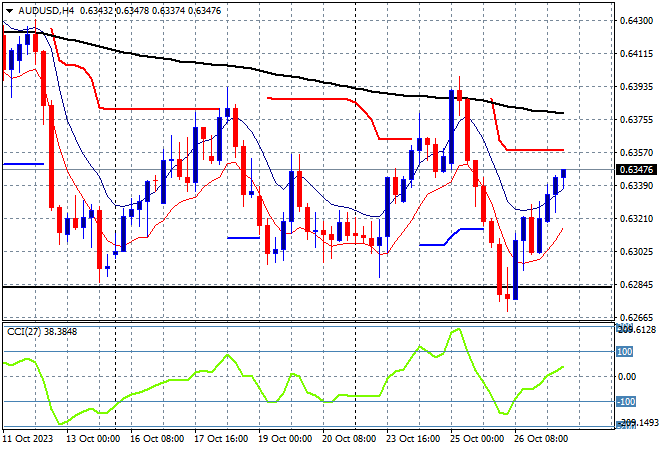

Asian share markets are trading higher across the board with a relief rally going into the last session of the trading week with Eurostoxx and S&P futures lifting while safe haven buying in USD is abating. The Australian dollar has been pushed up to the mid 63 cent level as a result, but this still keeps it near a monthly low.

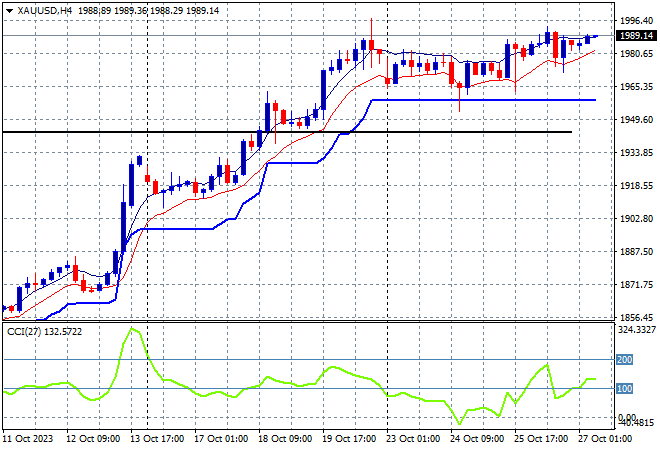

Oil prices have lifted slightly from their reversal overnight, with Brent crude consolidating around the $89USD per barrel level while gold is getting ready for another attempt at breaking through the $2000USD per ounce level after building support all week:

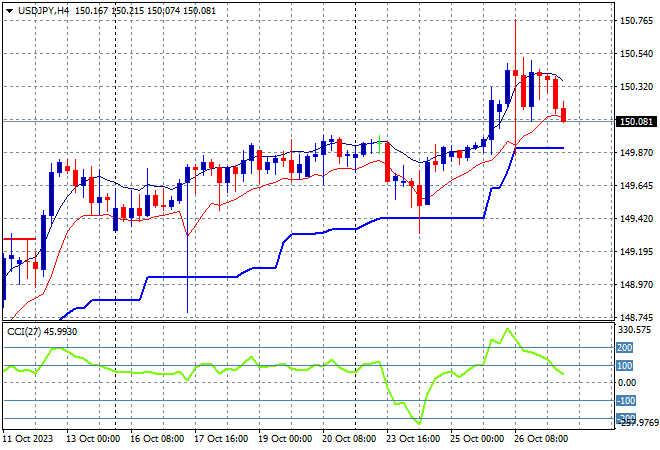

Mainland Chinese share markets have lifted higher with the Shanghai Composite gaining nearly 1% to close at 2999 points while in Hong Kong the Hang Seng Index is doing twice as well, up 2% to 17419 points. Japanese stock markets are going along for the ride with the Nikkei 225 closing some 1.2% higher at 30991 points. Trading in the USDJPY is somewhat muted with a small pullback to the 150 level:

Australian stocks were the worst in the region with only a small lift as the ASX200 closed just 0.2% higher at 6826 points, confirming the break below at 7000 points from last trading week while the Australian dollar was able to continue its overnight bounceback, currently at the mid 63 level:

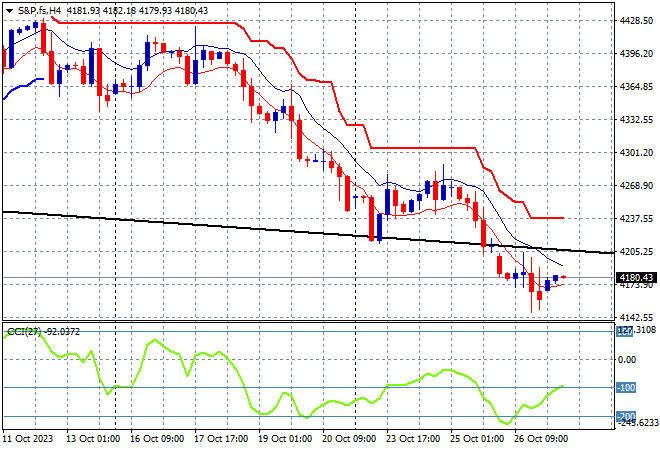

S&P and Eurostoxx futures are up only slightly going into the London open as the S&P500 four hourly chart shows support crumbling at the 4200 point level as short term momentum remains very negative:

The economic calendar concludes the trading week with the US core PCE index and Michigan consumer sentiment numbers.