A fairly solid session for Asian share markets although Chinese shares and their Australian satellites are trying hard to get back on track. Other equity markets are reflecting the somewhat mixed mood on Wall Street as oscillations around the Fed’s rate cut agenda is pushing USD around again. This time King Dollar is losing ground against most of the majors with Euro nearly above the 1.12 handle while the Kiwi and Australian dollar are both up strongly.

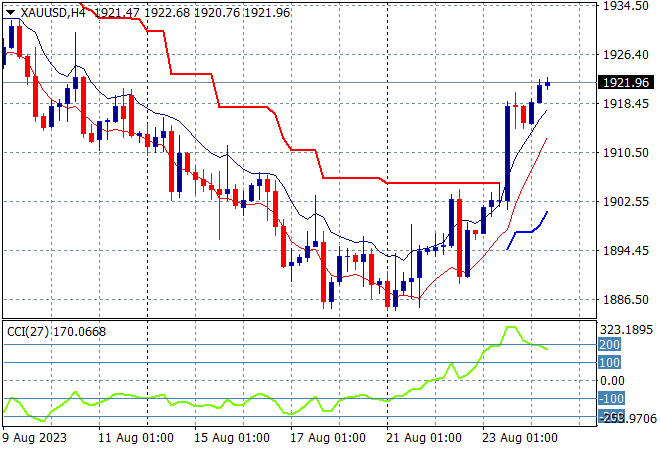

Oil prices are trying to get back on trend over the weekend gap as Brent crude oscillates around the $80USD per barrel level while gold is also trying hard to hold on to its return above the $2500USD per ounce level after the last week’s retreat:

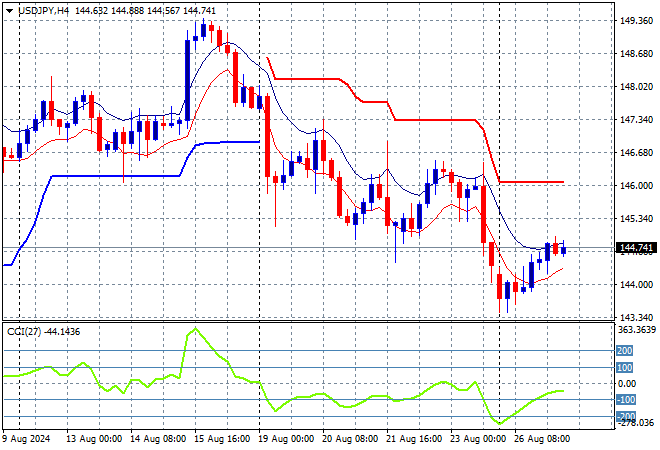

Mainland Chinese share markets are directionless again with the Shanghai Composite down more than 0.2% while the Hang Seng Index has lifted just 0.2% to 17830 points. Meanwhile Japanese stock markets are pushing higher as Yen weakens with the Nikkei 225 closing more than 0.5% higher at 38288 points while trading in USDPY has seen a bounce back above the 144 level:

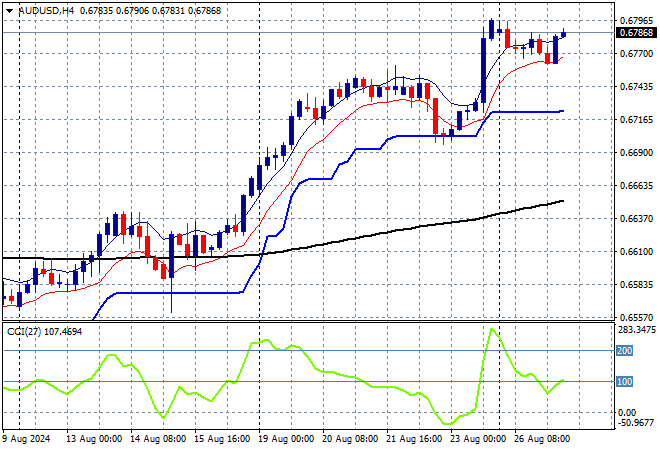

Australian stocks were the odd ones out with the ASX200 losing a little ground to close at 8071 points while the Australian dollar is trying to get back to its Friday night’s breakout level above 68 cents:

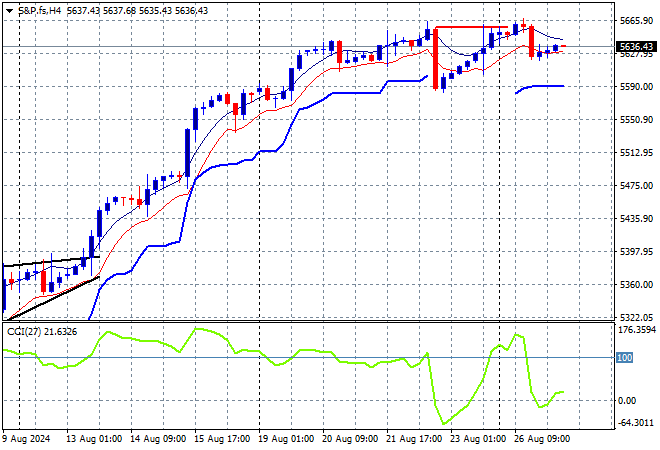

S&P and Eurostoxx futures are tracking slightly higher, but still basically unchanged from Friday with the S&P500 four hourly chart showing momentum is back in the neutral zone after Friday night’s rebound:

The economic calendar will first hear the latest German consumer confidence, followed by US house prices and consumer confidence figures.