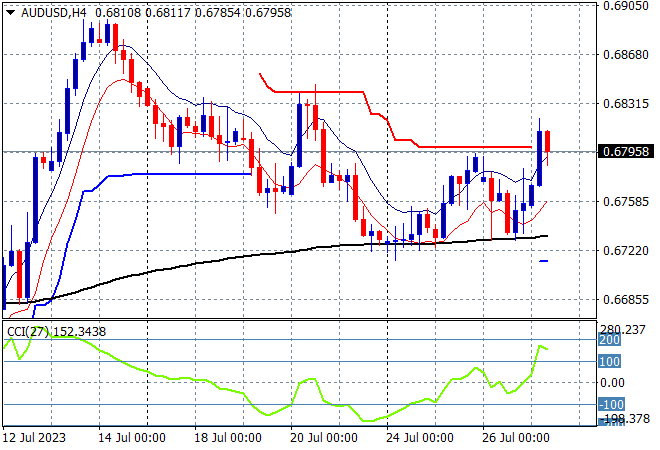

Asian stock markets are having a solid day after yesterday’s Chinese led stumble, absorbing the as expected rate rise from the US Federal Reserve overnight. Tonight however we wait to see if the ECB will do anything different as currencies have overshot a little into USD strength with the Euro trying to break back above the 1.11 handle. The Australian dollar is also lifting following the CPI print earlier this week but is finding resistance at the 68 cent level vs USD.

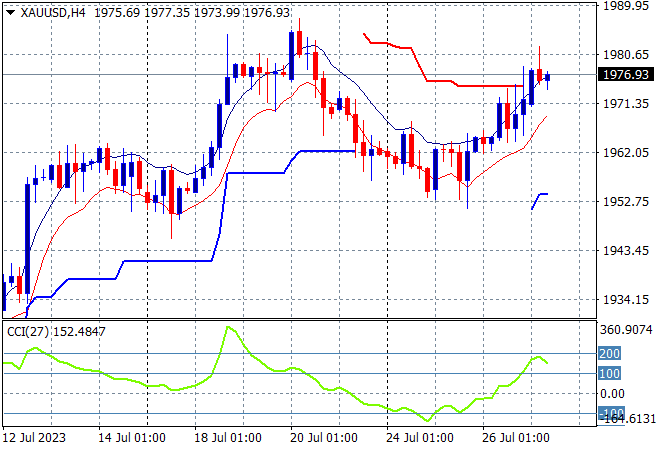

Oil prices are holding on to their recent gains as Brent crude pushes slightly above the $83USD per barrel level while gold is finally finding some life after hovering around its Friday night dip levels, currently pushing towards the $1980USD per ounce level:

Mainland Chinese share markets are down mid-afternoon with the Shanghai Composite looking to finish some 0.3% lower at 3213 points while in Hong Kong the Hang Seng Index has pulled back slightly after its epic 4% rise yesterday, up nearly 1% at 19554 points.

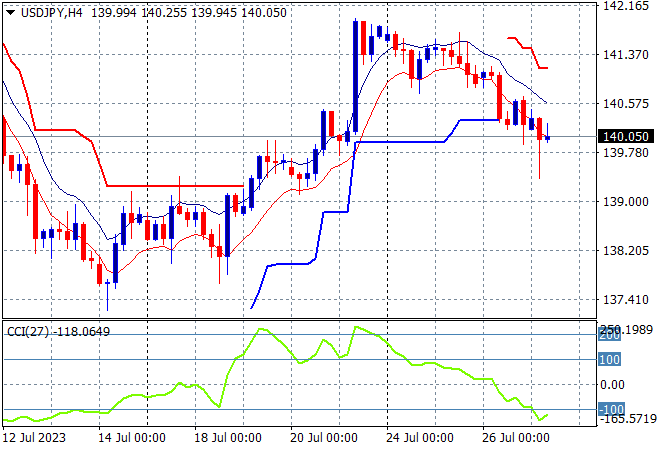

Japanese stock markets have finally lifted with the Nikkei 225 closing 0.7% higher at 32891 points while the USDJPY pair has deflated again, still unable to convert its recent breakout above the 141 level into something more sustainable:

Australian stocks are again moving forward, with the ASX200 closing 0.7% higher at 7455 points. The Australian dollar has tried to push back above the 68 cent level in a second attempt following the Fed hike overnight but is getting thwarted here as support remains firm at the 67 cent level:

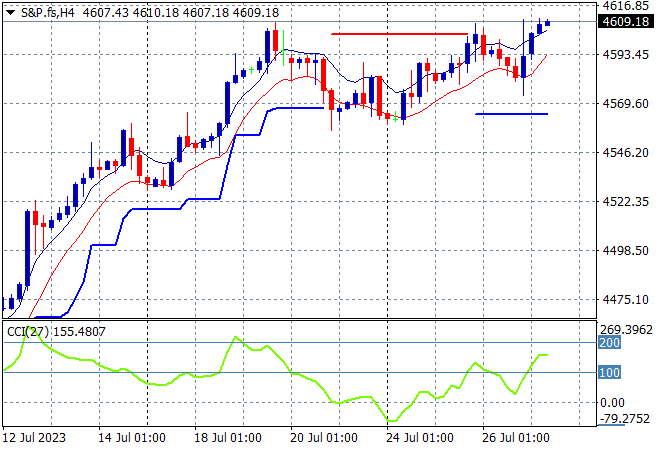

Eurostoxx and S&P futures are up nearly 0.5% as traders expect a European lead bounce before tonight’s ECB meeting. The S&P500 four hourly chart is showing price action wanting to surpass the recent weekly highs above the 4600 point level:

The economic calendar will now focus squarely on the ECB Meeting tonight.