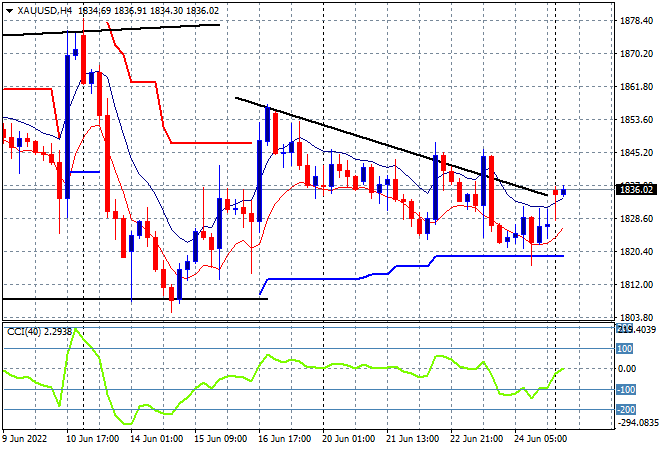

Some very solid gains to start the new trading week on Asian share markets with risk sentiment firming following some big moves on Friday night on Wall Street. The USD remains strong against most of the undollars, with the Australian dollar trying to push a little higher but still thwarted by the interest rate differential problem. Oil prices are trying to stabilise after their falls on Friday night with Brent crude still below the $110USD per barrel level while gold has gapped higher in today’s session after being depressed at the $1820USD per ounce level, now at $1840:

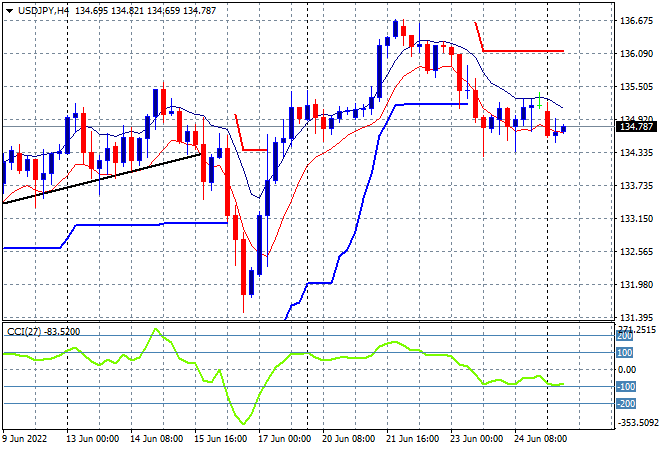

Mainland Chinese share markets are again pusher higher into the close with the Shanghai Composite up more than 0.8% to 3378 points while the Hang Seng Index has lifted more than 2%, currently at 22184 points. Japanese stock markets are also doing well, with the Nikkei 225 index about to close more than 1.3% higher at 26848 points while the USDJPY pair is remaining fairly depressed, hovering at its Friday session lows just below the 135 handle:

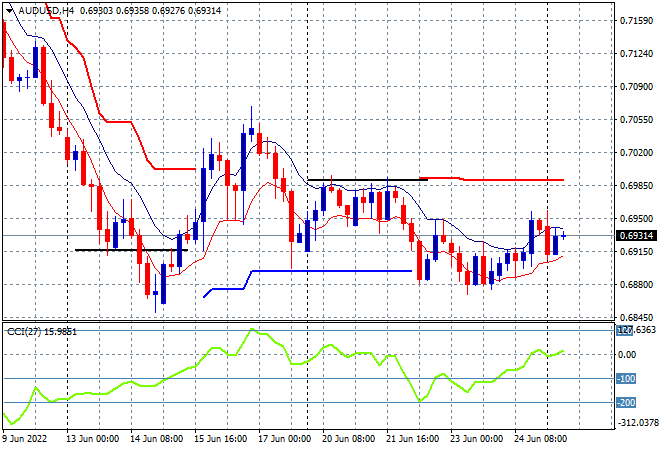

Australian stocks are putting in some very solid gains with the ASX200 about to finish more than 2% higher, currently at 6710 points. The Australian dollar is still trying to find a bottom here, having been depressed below the 70 cent level against USD all last week, it struggling to move higher due to Governor Lowe’s comments of modest rises over the weekend:

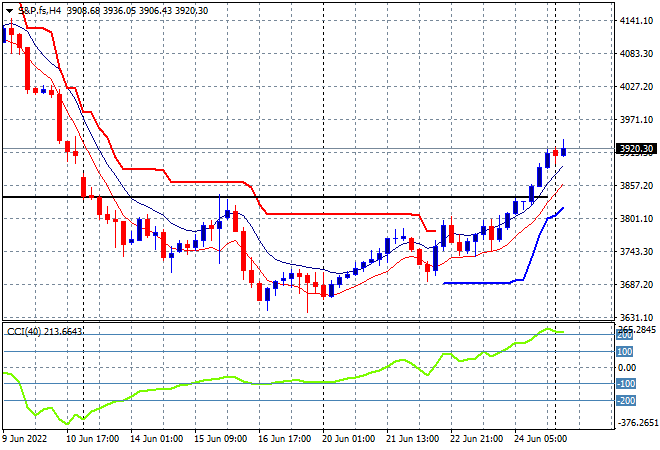

Eurostoxx and Wall Street futures are pushing higher going into the European open, currently up 0.5% or so with the S&P500 four hourly futures chart showing price action bursting above the 3800 point level that had acted as firm resistance, with a bullish inverse head and shoulders pattern now complete:

The economic calendar opens up the new trading week with US durable goods orders for May, and a couple of speeches from ECB bankers to watch out for.