Wall Street was again the big downer overnight although a lot of volatility at the close shows the struggle between tech and industrial stocks as earnings profiles are quite different this season. European shares continue to take a hit as well while Euro moderated somewhat against USD as currency markets reduce somewhat in volatility despite the overnight US GDP print which came in a little stronger than expected. The Australian dollar and other commodity/China proxies still can’t escape the Chinese slowdown risks however, with the Pacific Peso almost threatening the 65 cent level.

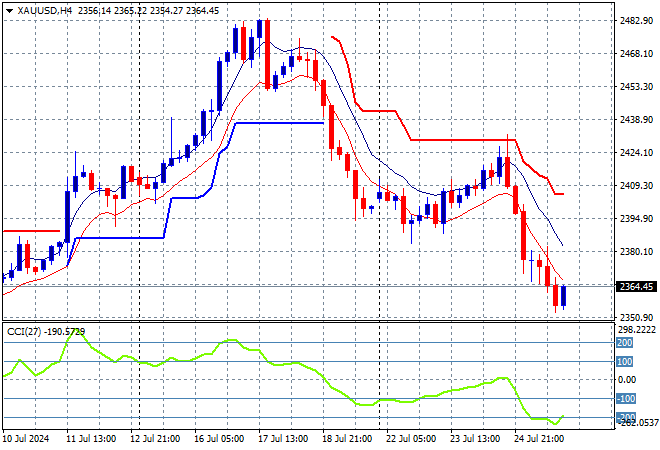

US Treasuries saw the yield curve steepen yet again with 10 year yields up nearly 5 points to almost cross the 4.3% level while oil prices rose slightly after their poor start to the trading week as Brent crude was able to get back above the $82USD per barrel level. Meanwhile gold prices reversed course sharply with a solid break below the $2400USD per ounce level, finishing at $2365 this morning.

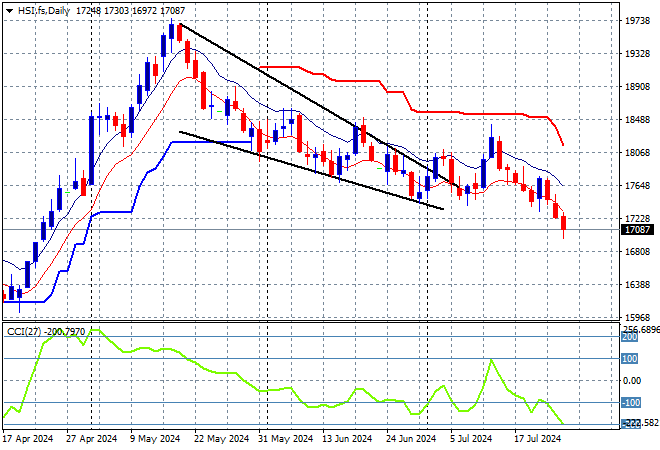

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets are still going down with the Shanghai Composite losing more than 0.4% while the Hang Seng Index is following suit, down by over 1.3% to 17011 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. Price action looked like turning this falling wedge pattern into something more bullish but is looking like a dead cat bounce instead:

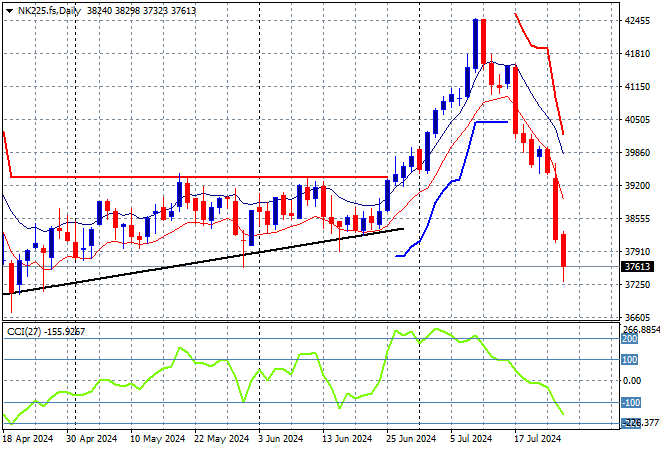

Meanwhile Japanese stock markets were the worst off with the Nikkei 225 slumping more than 3% to close at 37859 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term support is now broken however on this retracement, with futures are indicating a major pullback this morning:

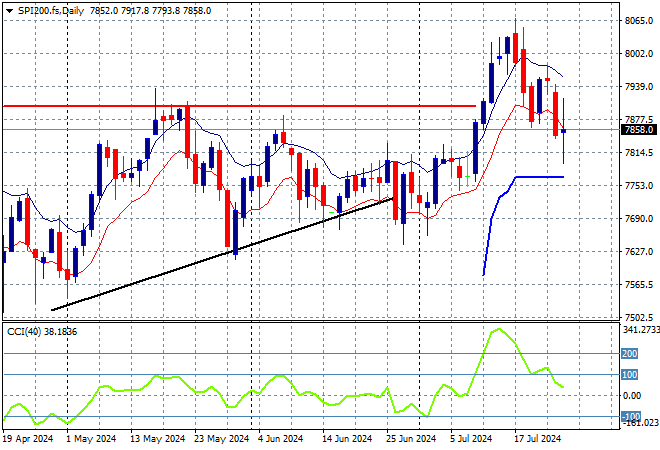

Australian stocks weren’t able to escape the carnage with the ASX200 closing 1.3% lower at 7861 points.

SPI futures are up 0.4% despite the bad mood on Wall Street overnight. The daily chart was showing a potential bearish head and shoulders pattern forming with ATR daily support tentatively broken, taking price action back to the February support levels in mid April. Momentum has retraced fully from being overbought so this could be a false breakout that spreads into a proper rout amid volatility on Wall Street:

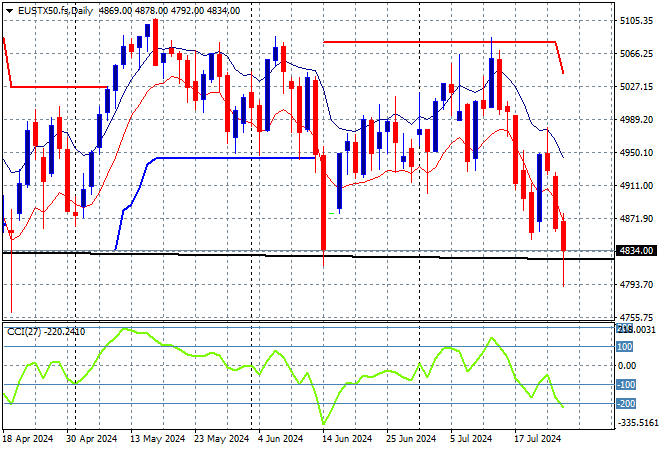

European markets are falling again with losses across the continent with the Eurostoxx 50 Index closing 1% lower to 4861 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance still looming at the 5000 point barrier. Former ATR support at the 4900 point level remains the anchor point but has failed previously so watch for a break below tonight:

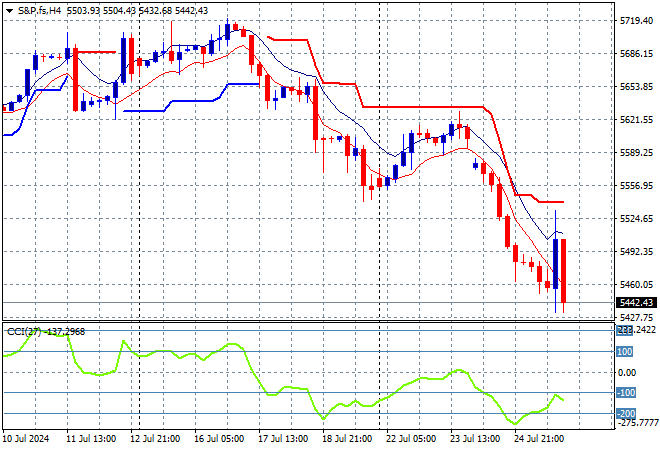

Wall Street is again getting torn by earnings with further losses on the NASDAQ, off by nearly 1% while the S&P500 didn’t do as bad as industrial stocks were better, but still closed more than 0.5% lower at 5399 points.

The four hourly chart showed resistance overhead that had been tested last Friday before an early week slump that has now been tested and broken through, helped alongside a previously soaring NASDAQ. Momentum was somewhat overbought but has retraced sharply and weekly support levels are now being threatened here:

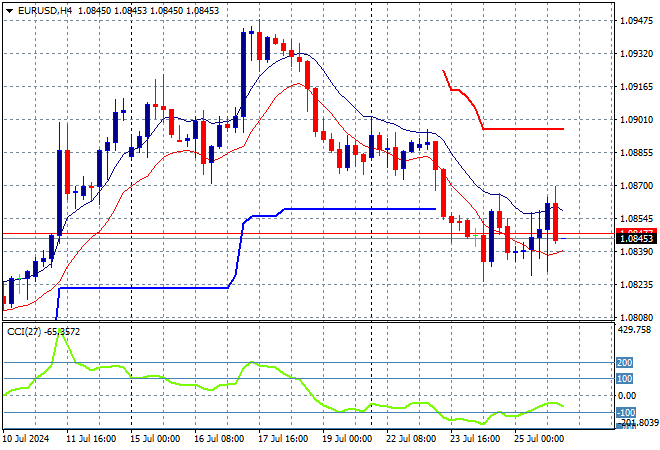

Currency markets are starting to moderate in volatility with all eyes on the Fed as the latest GDP and initial jobless claims were absorbed with the USD stabilising overnight against everything but Yen and the commodity currencies. Euro remained below the 1.09 handle but is firming at the mid 1.08 mid level.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier in the week with more momentum building to the upside with the 1.0750 mid level as support but there is too much pressure here from King Dollar so watch for a further retracement as ATR support at the mid 1.08 handle has been taken out:

The USDJPY short term chart still looks like tumbling down a series of steps here with Yen much higher again overnight although the pair bounced back to the 154 level as it failed to get back into positive short term momentum territory.

This volatility speaks volumes as it once pushed aside the 158 level as longer term resistance, but then was unable to breach the 162 level as it looks like the BOJ intervention finally worked on the ever weakening Yen. With this short term bounce failing to get past short term resistance, more steps down are inevitable:

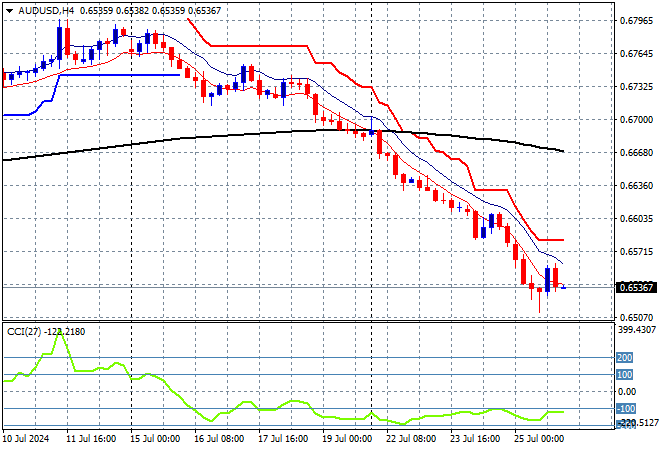

The Australian dollar continued to struggle with another straight down decline overnight, this time almost moving below the 65 handle as the combo of a stronger USD overall and macro concerns re China and iron ore take a toll.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This looks dire with medium term support now broken:

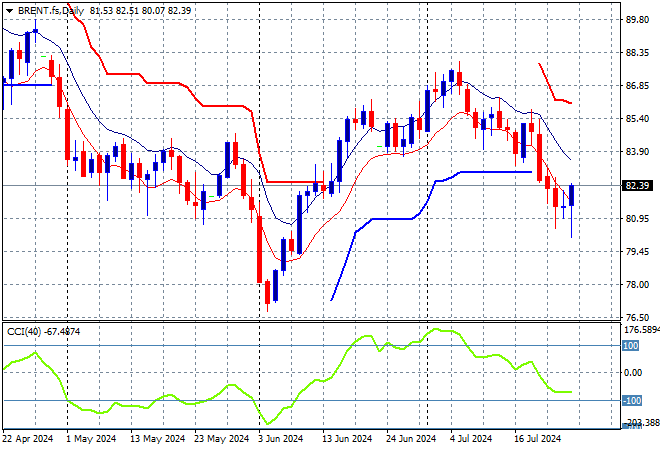

Oil markets are failing to stabilise after have a solid run in the latter half of June with Brent crude just holding on overnight, moving back above the $82USD per barrel level.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support has now been broken with short term momentum now retracing into negative mode – watch out below:

Gold failed to hold on to its recent breakout as the slow slide back under the weight of King Dollar turned into a reversal overnight with a return below the $2400USD per ounce level.

While it was the biggest casualty of the reaction to the US jobs report, the shiny metal was able to clock up some gains before this reversal, almost hitting the $2500USD per ounce level. The longer term support at the $2300 level remains key but the much stronger USD is very quickly turning the tide: