A minor taste of stability returned to risk markets here in Asia, although most share markets are still taking it tough after the mid week slump on Wall Street. Chinese shares remain depressed while local issues rallied hard into the weekend. The USD lost some ground against the majors after holding the high ground all week, but this could change tonight on the closely watched Core PCE figures that are due, with a light calendar in Europe. The Australian dollar was able to push itself off the floor after almost crossing the 65 cent level overnight.

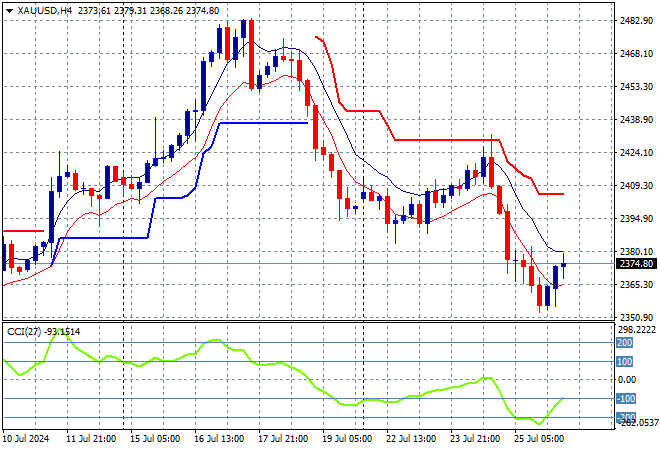

Oil prices are starting to slip again with Brent crude looking to cross below the $81USD per barrel level while gold has bounced back somewhat, currently at the $2370USD per ounce level:

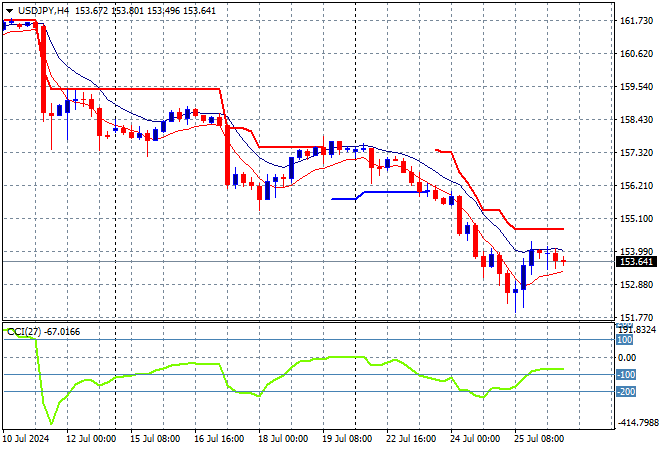

Mainland Chinese share markets are still going down with the Shanghai Composite losing more than 0.2% while the Hang Seng Index is going the other way, up nearly 0.3% to 17054 points. Meanwhile Japanese stock markets continue their terrible week with the Nikkei 225 down more than 0.5% to close at 37675 points as the USDJPY pair managed a small bounce but is losing momentum just above the mid 153 level in afternoon trade:

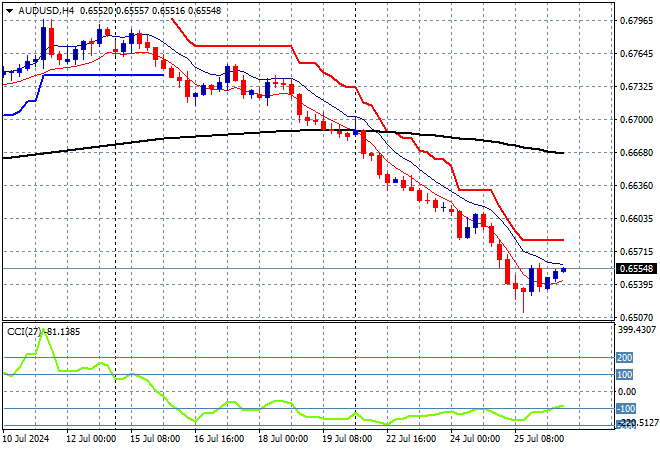

Australian stocks were the best in the region with the ASX200 closing 0.7% higher at 7921 points while the Australian dollar was able to pause its retreat, still well below the 66 cent level as momentum tries to get out of extreme oversold mode:

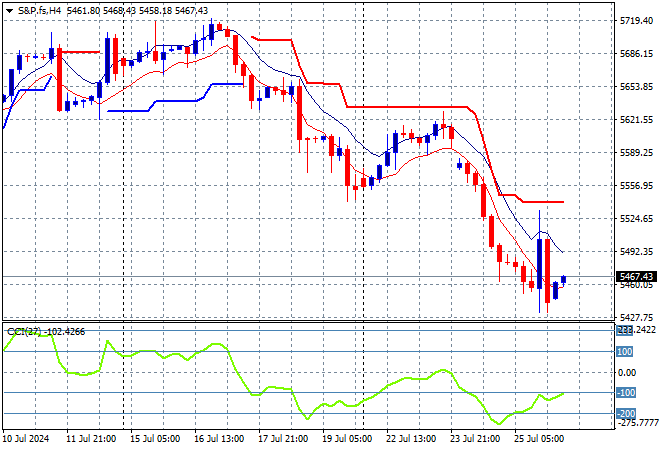

S&P and Eurostoxx futures are down slightly as we head into the London session with the S&P500 four hourly chart showing how a potential bottom at the 5400 point level but the next target is 5200 points if this dip isn’t turned around:

The economic calendar will focus squarely on the latest Core PCE (personal consumption expenditure) data tonight, with a brief preview in last night’s GDP print, plus the latest Michigan consumer sentiment figures.