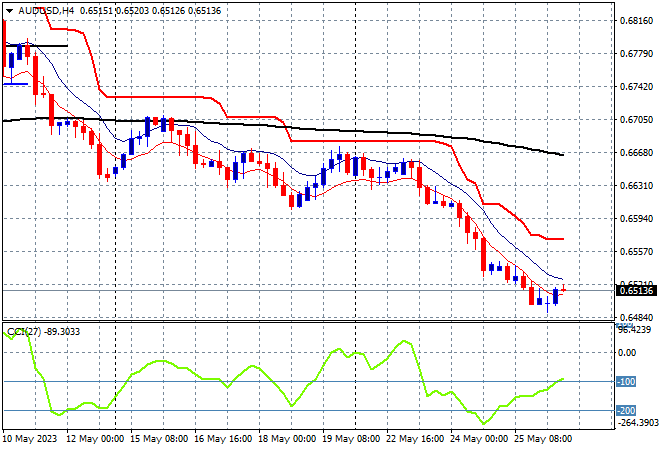

Asian markets are quite mixed again in the last trading session of the week with the US Congress debt ceiling negotiations dominating risk taking. The highest CPI reading in Tokyo for 40 years is keeping Japanese stocks flying higher and the Yen lower while the strong USD is keeping the Australian dollar at its new monthly low at the 65 cent level.

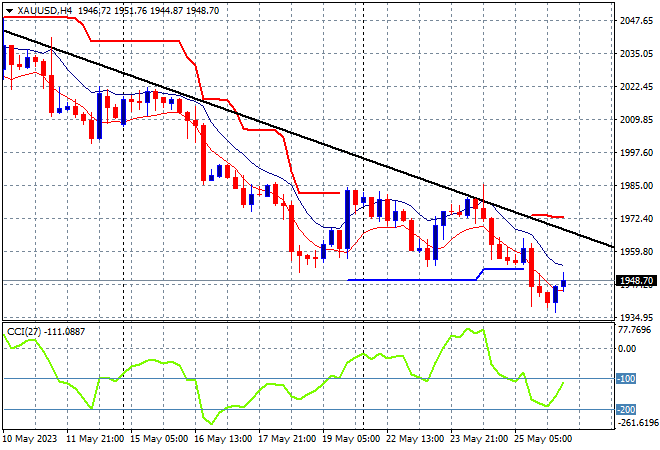

Oil prices look like finishing the week in a wash with Brent crude just above the $76USD per barrel level while gold has remained depressed, currently holding just below the $1950 level as the $2000USD per ounce level becomes a distant memory:

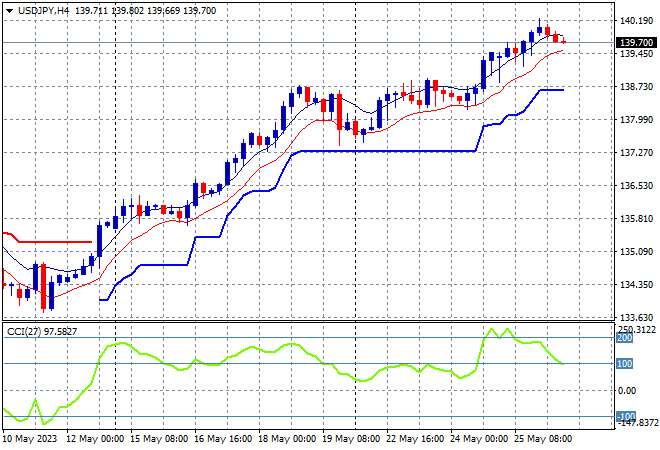

Mainland Chinese share markets are lifting going into the close with the Shanghai Composite up 0.3% to 3209 points while the Hang Seng Index is closed for a holiday. Japanese stock markets are putting in a strong finish with the Nikkei 225 closing 0.6% higher at 30989 points helped by a weaker Yen as the USDJPY pair slipped back below the 140 level:

Australian stocks are having a staid finish to the week with the ASX200 about to close just 0.2% higher at 7151 points. The Australian dollar is bouncing along at a new monthly low at just above the 65 cent level:

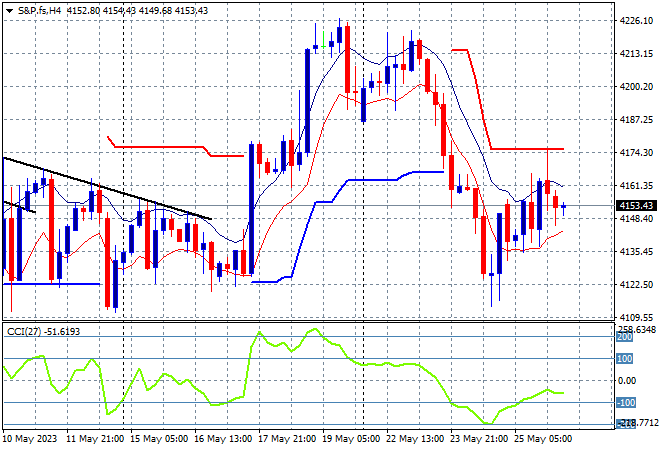

Eurostoxx and S&P futures are up slightly going into the London open with Wall Street still on tenterhooks with the lack of progress in debt ceiling negotiations. The S&P500 four hourly chart is showing the breakdown to the 4100 point level still has room to grow with short term momentum readings still quite negative:

The economic calendar finishes the trading week with US durable goods orders and the Michigan consumer sentiment survey.