Last night saw a return to strength for USD on the back of a firming US PMI survey, while Eurozone data disappointed. Wall Street lifted slightly alongside European shares while the Euro was pushed down from its recent two week high as the Australian dollar continues to float sideways around the mid 63 cent level.

US bond markets pulled back with 10 year Treasury yields down to the 4.8% level while oil prices had a sharp reversal on European lack of demand, with Brent crude losing nearly 5% to the $88USD per barrel level. Gold consolidated slightly but remains anchored near the $1980USD per ounce level.

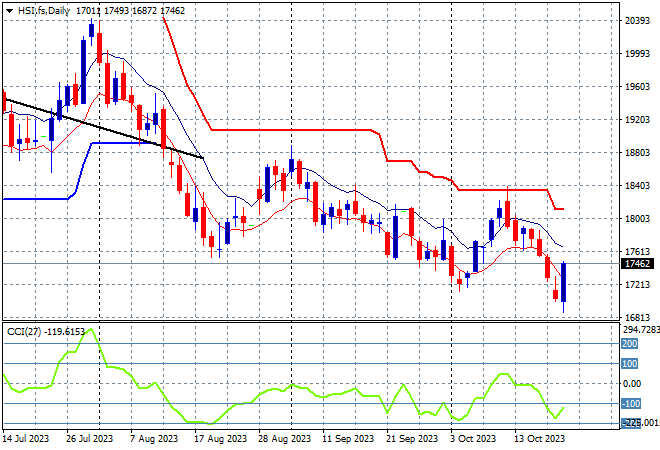

Looking at share markets in Asia from yesterday’s session mainland Chinese share markets finally lifted with the Shanghai Composite closing 0.8% higher at 2962 points while in Hong Kong the Hang Seng Index returned from a market holiday, but still lost 1% to finish at 16991 points.

The daily chart is still showing a significant downtrend that has gone below the May/June lows with the 19000 point support level a distant memory as medium term price action stays well below the dominant downtrend (sloping higher black line) following the previous month long consolidation. Daily momentum readings are stuck in oversold mode and price is now well below recent support levels, so watch out below:

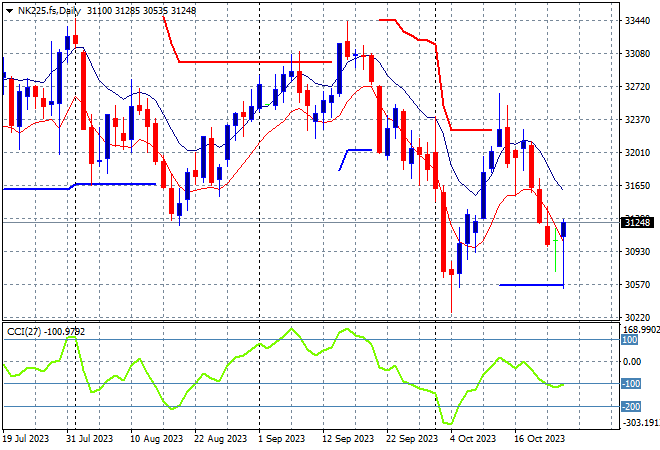

Japanese stock markets were able to stabilise slightly with the Nikkei 225 closing some 0.2% higher at 31062 points.

Trailing ATR daily resistance was coming under threat in a very fast bounceback and while daily momentum retraced back from oversold settings as price action is following Chinese markets with a typical dead cat bounce pattern forming here. Futures are indicating another move higher on the open but I’m still watching for a return to the previous monthly low at 30000 points proper:

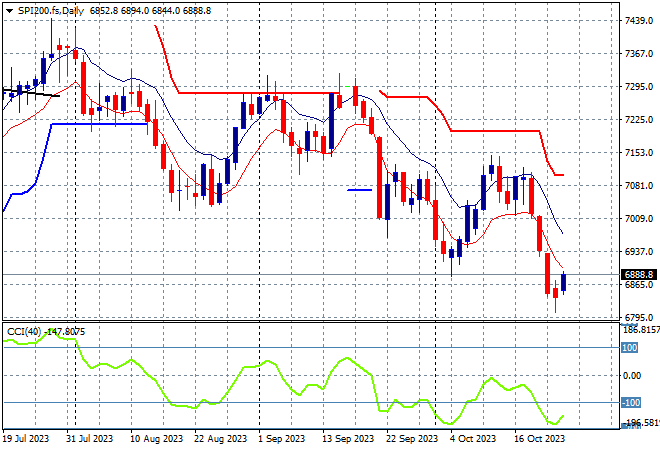

Australian stocks also put in a very mild uplift with the ASX200 closing 0.2% higher at 6856 points, still unable to get back above the 7000 point level that was broken last trading week.

With some relief across the risk complex, SPI futures are indicating a 0.3% rise on the open this morning with the 7000 point level still firming strongly as short term resistance. The daily chart is not looking optimistic here with medium term price action continuing to move sideways at best:

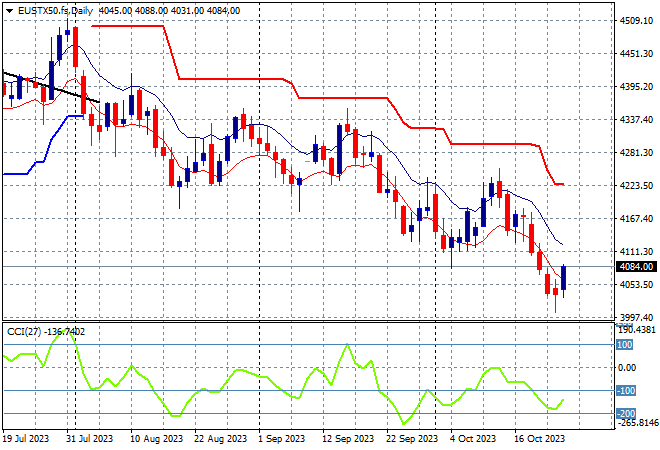

European markets tried to re-engage to the upside in the wake of the disappointing PMI data with the Eurostoxx 50 Index eventually gaining 0.5% to finish at 4065 points.

The daily chart shows an overall decline with weekly support at 4100 points no longer defended, as weekly resistance firms at the 4300 point resistance level. There were signs the previous little bounce was running out of steam as daily momentum remained neutral at best, with a return to oversold settings now setting up further downside:

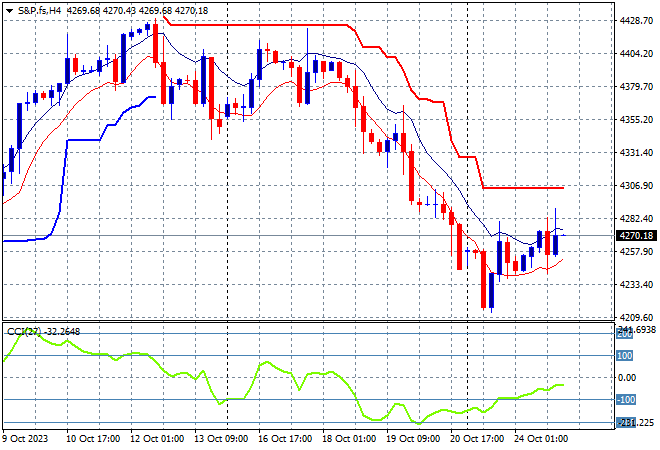

Wall Street was much better overall with the NASDAQ up nearly 1% while the S&P500 rebounded to finish 0.7% higher at 4247 points.

The four hourly chart showed support building at the 4340 point area with upside resistance still quite firm at last week’s high at the 4430 level before this selloff. Short term momentum is getting out of oversold territory as price action firms near a new monthly low, with building signs of a potential swing trade here so watch the high moving average level:

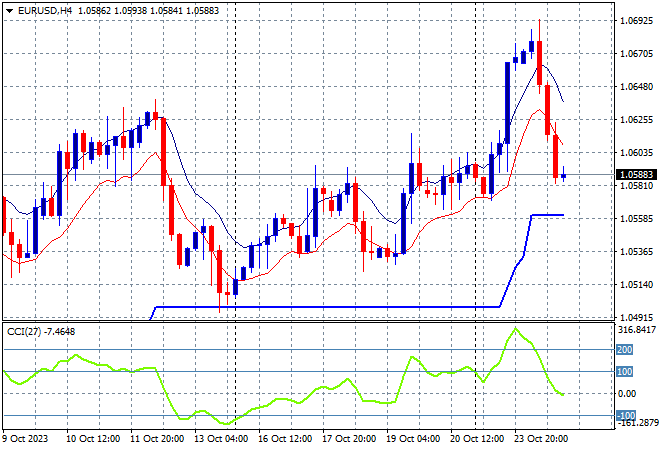

Currency markets reversed strongly on the PMI prints and Eurozone banking survey data which took all the wind out of the Euro’s sails as King Dollar returned to its throne, pushing Euro back below thee 1.06 handle.

On the four hourly chart the union currency had finally broke through short/medium term resistance at the 1.06 handle at the start of the week, pushing short term momentum to extremely overbought levels. Support at the recent weekly lows around the 1.05 level was very firm before this move which makes for a new two week high, but this pullback is not unexpected:

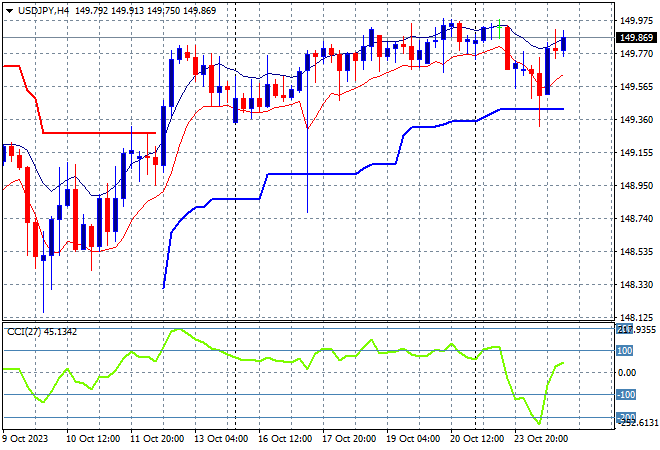

The USDJPY pair is just holding on here despite the return of USD strength to remain above the 149 level but failing to build further through the 150 handle to push for a new weekly high, after a brief pull back to trailing ATR support.

Four hourly momentum shows a reversal of overbought settings as the potential for a proper test of support at the 149 level but Yen buying is not yet evident:

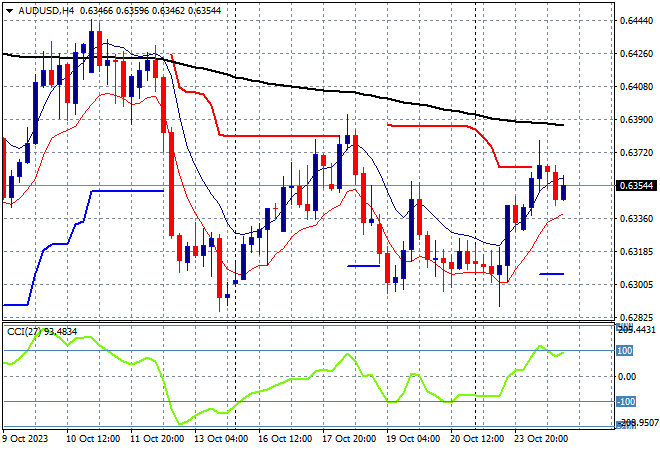

The Australian dollar had been dragged back to the 63 handle but found some life on the back of a weaker USD, almost lifting through the 64 cent level but finding resistance yet again.

The Pacific Peso remains under medium and long term pressure with price action just not being translated into anything sustainable as the four hourly chart shows momentum returning to positive settings but nothing exciting as yet:

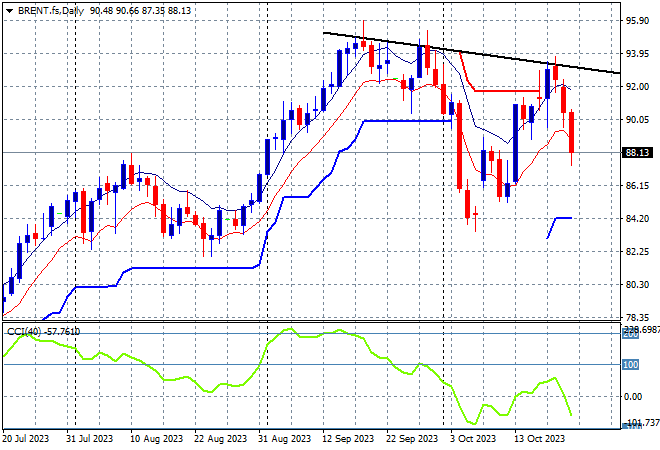

Oil markets are failing to shake off recent volatility with a big stumble overnight, losing nearly 5% in a one way selloff as Brent crude was pushed right down to the $88USD per barrel level, after a series of lower daily highs since the mid September levels.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout. Daily momentum is now back to negative settings with a retest of support at the August level, so watch for a possible slump to the $84 zone soon:

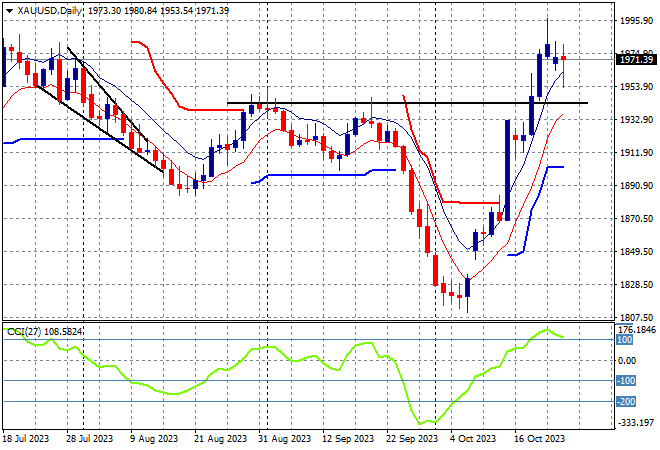

Gold remains the best undollar by holding on to its position overnight after being extremely overbought from the weekend as it leads the undollars, holding at the new monthly high at the $1970USD per ounce level.

The daily chart shows quite a steep uptrend since the previous weekend gap higher as momentum remained very positive in the short term, trying to get back up to the $2000 level. This new breakout puts in a new monthly high with daily momentum now looking overbought and ripe for a pullback back to retest the $1900 level again, but so far no change as it builds above the $1970 level: