Wall Street tumbled on the latest initial jobless claims numbers and fears that inflationary based rate hikes may not yet be over as everyone awaits Fed Chair Powell’s speech at the Jackson Hole conference tonight. The USD remained stronger against most majors with both Euro and Pound Sterling hitting new weekly lows while the Australian dollar pulled back to the low 64 cent level again.

US bond markets saw a small lift across the yield curve with the 10 year Treasury back up to the 4.24% level while oil prices moderated again with Brent crude just above the $83USD per barrel level as OPEC considers more production cuts. Gold held on to its recent gains just above the $1915USD per ounce level.

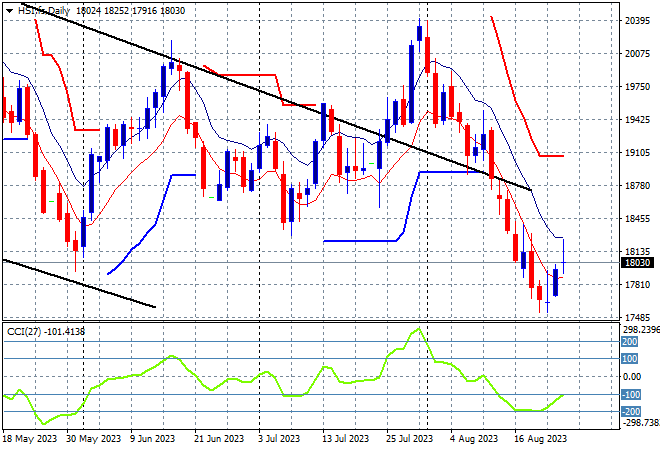

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets were able to put on positive results but fittered away most of these gains into the close with the Shanghai Composite up just 0.1% at 3086 points while in Hong Kong the Hang Seng Index made a significant breakout, closing up more than 2% at 18237 points.

The daily chart is now showing a near complete selloff that has gone below the May/June lows with the 19000 point support level a distant memory as price action stays well below the dominant downtrend (sloping higher black line) following the previous month long consolidation. Daily momentum readings remain fully oversold as confidence disappears so watch for this rollover to possibly hit the 17000 point level next:

Japanese stock markets were able to put in very good sessions, with the Nikkei 225 lifting nearly 1% higher to 32287 points.

Trailing ATR daily support had been paused for sometime now as the market went sideways after a big lift recently, with a welcome consolidation above that level but that has now turned into a proper dip. Daily momentum broke into the oversold levels but has now retraced as price action bounced back from the support zone with the potential for a swing building here:

Australian stocks are having a somewhat solid session with the ASX200 closing nearly 0.5% higher at 7182 points.

SPI futures are down more than 1.3% this morning given the big reversal on Wall Street overnight, with the 7300 point level remaining strong as short term resistance. Medium term price action is now moving sideways with the short term pattern looking like decelerating here:

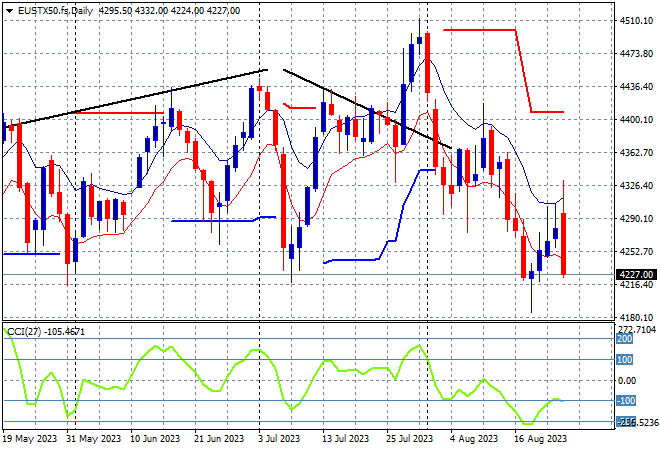

European markets pulled back their recent gains after first playing a positive catchup as the Eurostoxx 50 Index closed some 0.8% lower at 4232 points.

While the daily chart shows weekly support at 4200 points barely defended, weekly resistance at the 4400 point resistance level has now pushed the point of control well below the 4300 point level. There are signs of stability returning here as daily momentum tries to get out of oversold mode but I remain cautious:

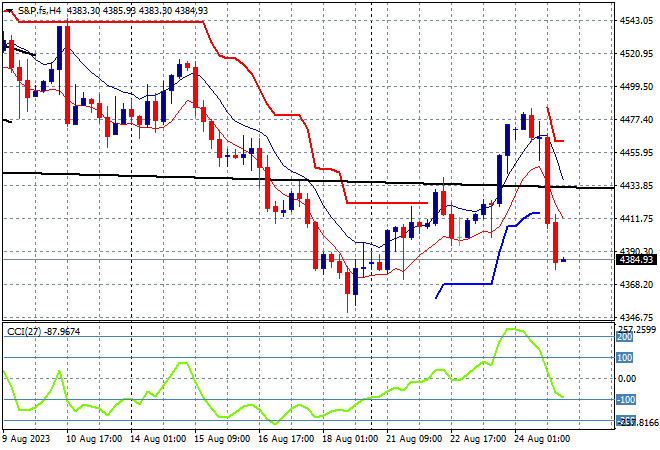

Wall Street slumped, taking back its recent big bounce with falls across the three bourses with the NASDAQ leading the way, down nearly 2% while the S&P500 fell back more than 1.3% to finish at 4376 points.

The four hourly chart is still showing price action well below the previous downtrend channel but short term ATR resistance has been definitively breached with this breakout. Recent deceleration had turned into a short term bottom here with a move above the 4400 point level but this still could prove risky going into the Jackson Hole meeting:

Currency markets tried to hold on to their recent gains versus USD with the release of the global PMI’s adding to the volatility as Euro flopped below the 1.08 handle for a new weekly low before rebounding to finish the session unchanged.

The union currency really needed to have a strong return above trailing ATR resistance just below the 1.10 handle in recent weeks but failed despite a mid week rally to decline back to the previous weekly lows just above the mid 1.09 level. Short term momentum is no longer oversold but price action remains below the August lows:

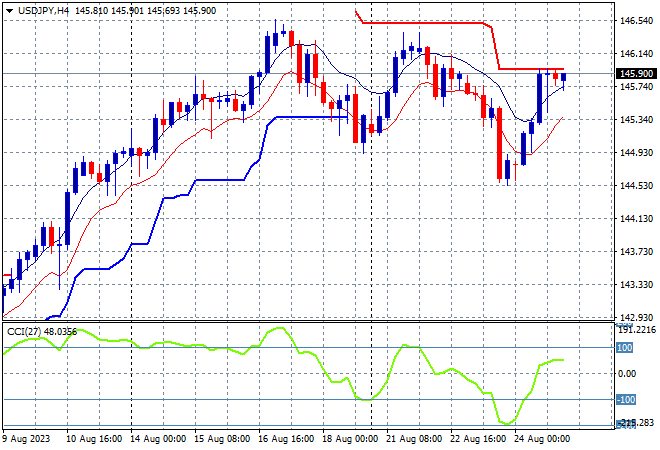

The USDJPY pair is no longer on a technical uptrend, with the overnight breakdown presaged by the start of week price action that had not been able to get above the previous high at the 146 level. Last night the pair broke well below the 145 level to unwind the last two weeks of upside action.

Four hourly momentum had retraced following the recent bounceback with a move back to neutral settings that looked like just taking some heat out of the two week uptrend. The 146 level then turned into short term resistance here as short term price action slid further down and now we are at a new weekly low:

The Australian dollar had been under the pump against King Dollar for sometime here although a possible bottom was brewing here at the 64 handle given no new session lows since Friday, with a fairly solid breakout almost above the 65 level overnight.

Four hourly momentum has switched to overbought mode in this move having built up all week but can the Pacific Peso keep on to these gains or will this be a swing move higher only?

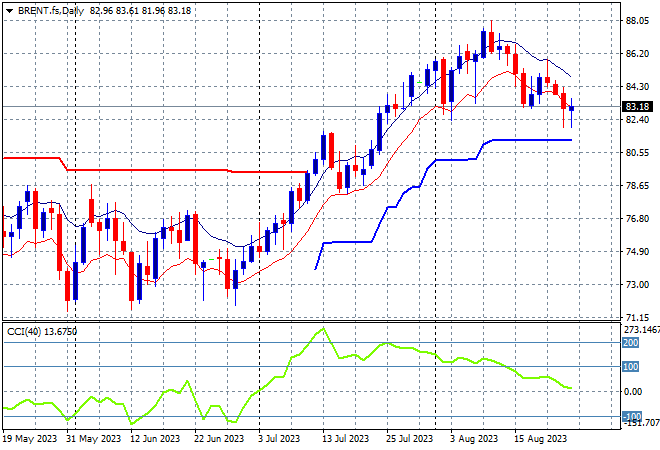

Oil markets had been relatively quiet with some moderation recently with the potential for a top forming as Brent crude lost more ground overnight to retrace further below the $85USD per barrel level, just holding on to its three month high and current uptrend.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now putting aside resistance at the $80 level. Daily momentum has retraced below previously overbought readings with price action rolling over – watch short term support at $80 to hold:

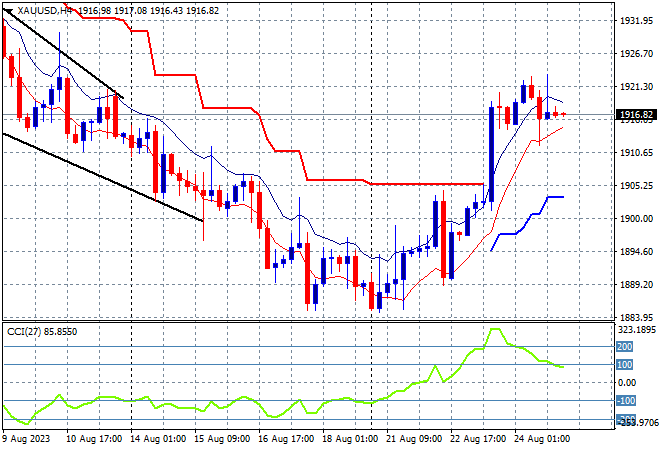

Gold was able to put in a second positive session to finally close above the key $1900USD per ounce level overnight.

The four hourly chart shows the attempt at getting back up to the psychologically important $2000USD per ounce level has been over for sometime now as the recent oscillations turn into a proper unwinding here below $1900. With the downtrend entrenched the potential for a reversal is building in the short term with four hourly momentum now extremely overbought as priece action bursts through trailing ATR resistance: