Asian stock markets are seeing a boost as Chinese equities get support from new stimulus packages and more PBOC support of the Yuan. Australian stocks are following in kind with the Australian dollar also seeing a mild lift this afternoon while other major currencies remain in hesitation mode waiting for the triple whammy FOMC/BOE/BOJ meetings.

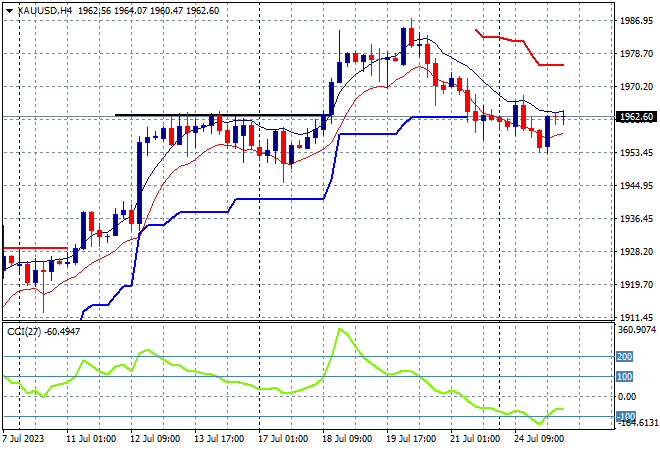

Oil prices are holding on to their recent gains as Brent crude pushes up towards the $83USD per barrel level while gold is holding on to its Friday night dip, steady here at the $1960USD per ounce level:

Mainland Chinese share markets are zooming higher with the Shanghai Composite about to finish 2% higher at 3229 points while in Hong Kong the Hang Seng Index has nearly doubled that, up more than 3.9% to burst through the 19000 point level, currently at 19339.

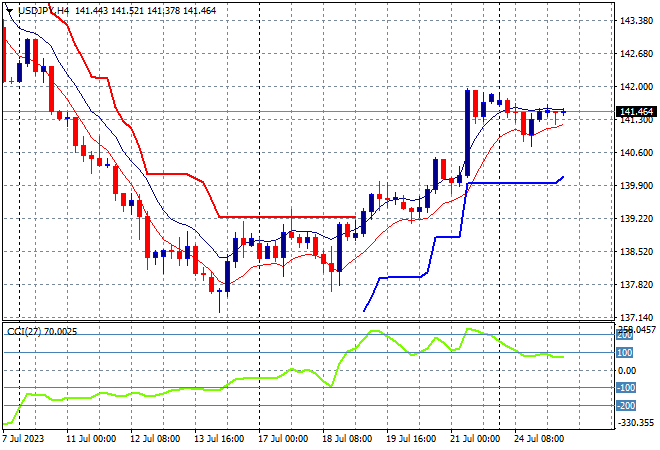

Japanese stock markets however are finishing flat with the Nikkei 225 closing at 32682 points while the USDJPY pair is also basically unchanged, still unable to convert its recent breakout above the 141 level into something more sustainable:

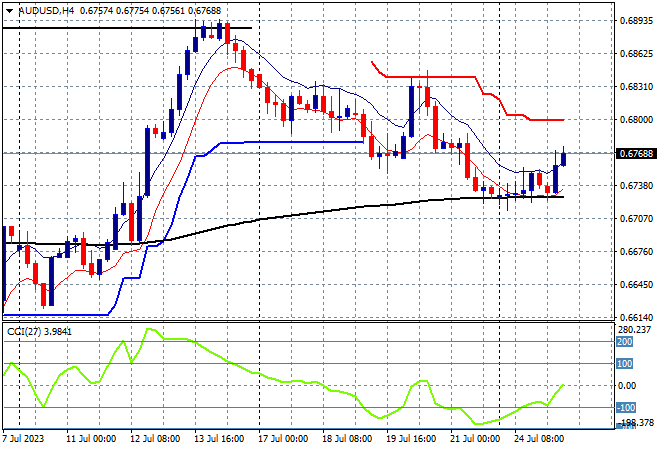

Australian stocks are putting in a better session in sympathy with Chinese stocks, with the ASX200 closing 0.5% higher at 7333 points. The Australian dollar is also lifting out of its doldrums above the 67 handle on the potentially “good” CPI print tomorrow as support builds here:

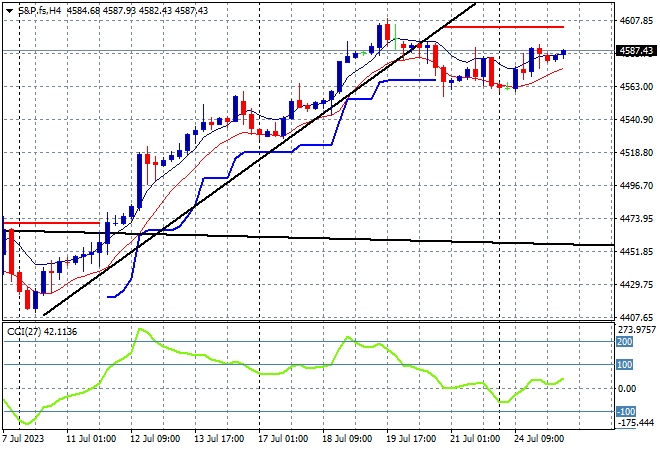

Eurostoxx and S&P futures are down 0.1% despite the good mood here in Asia with the S&P500 four hourly chart still showing price action below the recent uptrend that failed to extend successfully above the 4600 point level which continues as staunch resistance:

The economic calendar will first focus squarely on the German IFO business survey, then US house prices followed by US consumer confidence numbers for July.