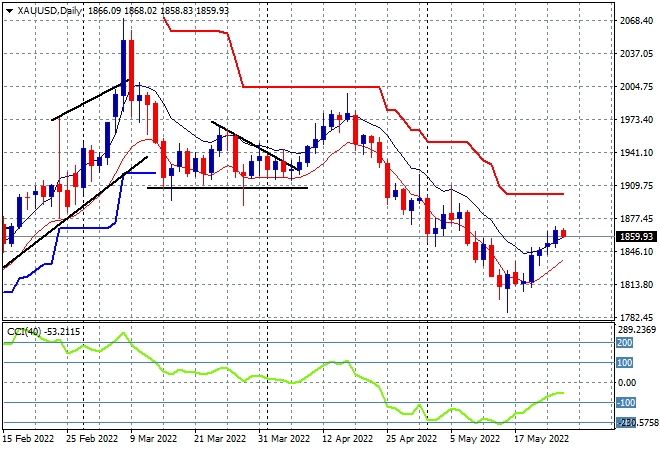

Asian share markets are rebounding somewhat outside of Japan with risk sentiment improving slightly on overnight volatility. The RBNZ surprised today with a 50bps rate rise, which sent AUD/NZD to a three week low as expectations firm for the RBA to play catchup. Other currency markets are seeing some firming in USD with Euro pulling back from its overnight surge while oil prices are slowly climbing again, with Brent crude now hovering just above the $114USD per barrel level. Meanwhile gold is treading water here just below the $1860USD per ounce level as its swing trade runs out of steam:

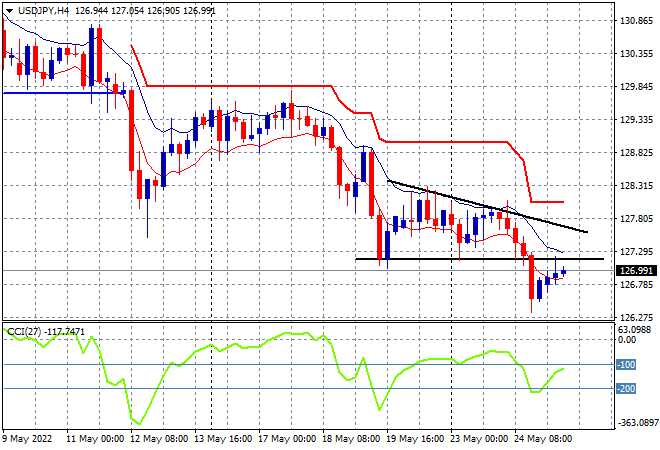

Mainland Chinese share markets have rebounded with the Shanghai Composite up 0.9% to 3098 points while the Hang Seng Index has treaded water, up only 0.1% to keep above the 20000 point level. Japanese stock markets remain on the downside however as the Nikkei 225 index lost nearly 0.4% to close at 26677 points while the USDJPY pair has tried to pare back its overnight losses, dicing with the 127 level as Yen defensive buying has not yet abated:

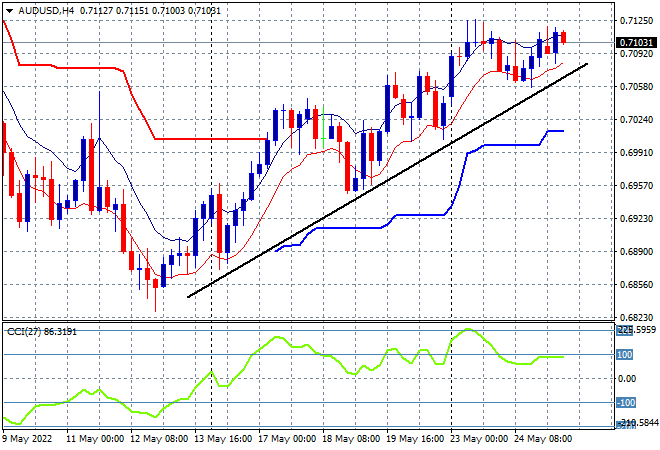

Australian stocks ended slightly higher with the ASX200 finishing up 0.3% at 7155 points, taking back the previous losses and keeping the key 7100 point support level intact for now. Meanwhile the Australian dollar has pulled back slightly below the 71 handle against USD after the RBNZ rate rise, still finding significant resistance at that level overnight, but four hourly momentum remains positive for now:

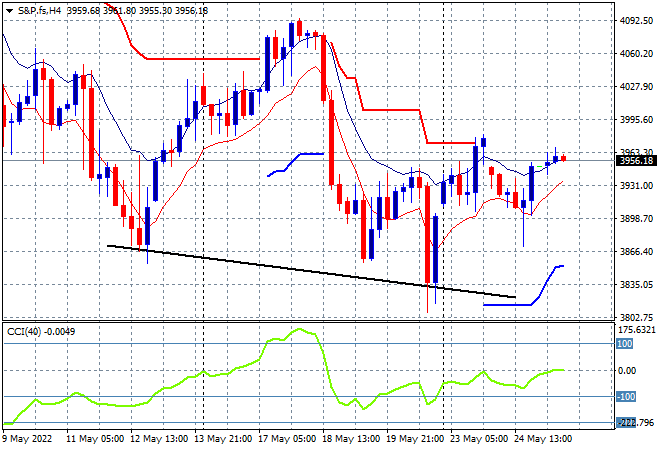

Eurostoxx and Wall Street futures are slowly rising as we head into the European open with the S&P500 four hourly chart showing price wanting to get back towards the key 4000 point level as intrasession volatility remains quite high:

The economic calendar includes the latest German GDP print and US durable goods orders.