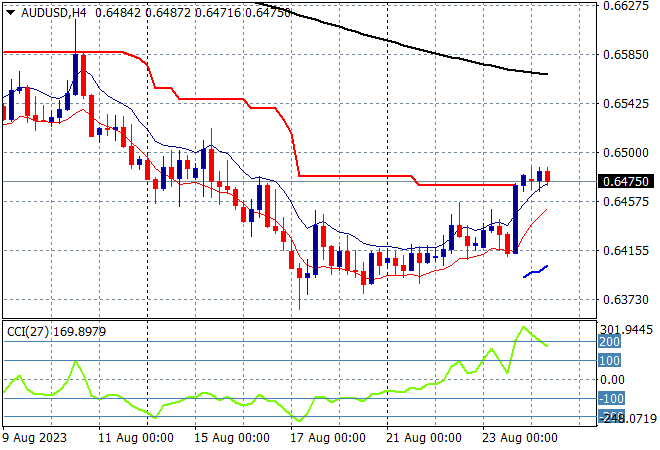

The central banker talkfest at Jackson Hole ramps up tonight and with the slightly weaker USD plus good tech stock earnings on Wall Street, the mid week bounce on risk markets continues. The USD is firming slightly going into the London session after the overnight volatility around the latest PMI prints but the Australian dollar is holding well above the 64 cent level.

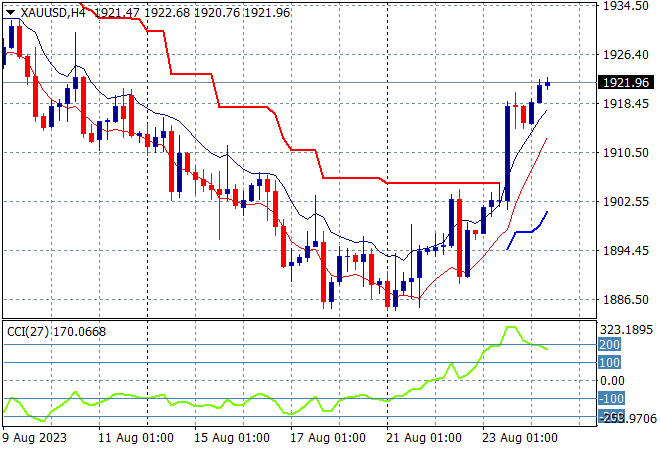

Oil prices are failing to bounce back after the recent modest selloff with Brent crude stuck below the $83USD per barrel level while gold is building on its recent relief, currently at the $1920USD per ounce level and still moving higher:

Mainland Chinese share markets are retracing slightly going into the close with the Shanghai Composite up only 0.2% at 3086 points while in Hong Kong the Hang Seng Index is breaking out signficantly, up more than 2% at 18237 points.

Japanese stock markets are putting in very good sessions playing catchup, with the Nikkei 225 lifting nearly 1% higher to 32287 points while the USDJPY is hovering around the 145 level after its breakdown overnight:

Australian stocks are having a somewhat solid session with the ASX200 closing nearly 0.5% higher at 7182 points while the Australian dollar is trying to hold above the 64 cent level after almost hitting the 65 cent level overnight:

Eurostoxx and S&P futures are building higher here with the former up nearly 0.8% playing catchup to the rise on Wall Street overnight. The S&P500 four hourly chart is showing a potential bottom brewing here with the return back to the previous support level just below the 4500 point area:

The economic calendar includes the latest speeches at the Jackson Hole conference, plus US durable goods and initial weekly jobless claims.