A very mixed start to the new trading week here in Asia after an equally hesitant performance on Wall Street from Friday night in the absence of any economic events. The USD remains quite strong against all the majors, save Swiss Franc with the Australian dollar barely holding on just above the 66 cent level.

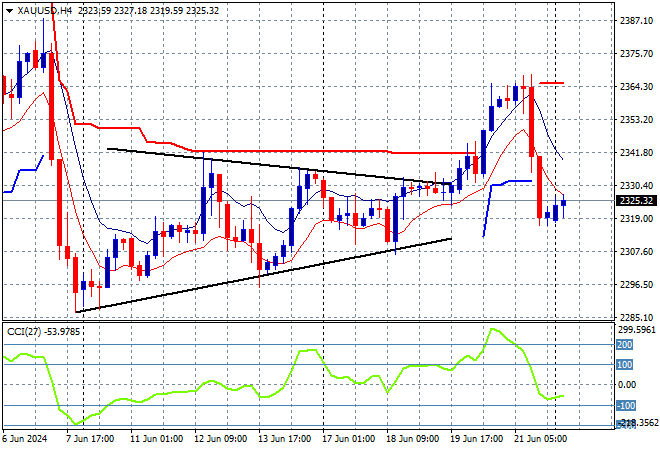

Oil prices have gapped lower alongside other commodities over the weekend with Brent crude looking to start above the $84USD per barrel level while gold continues to struggling following its recent reversal, still stuck just above the $2300USD per ounce level:

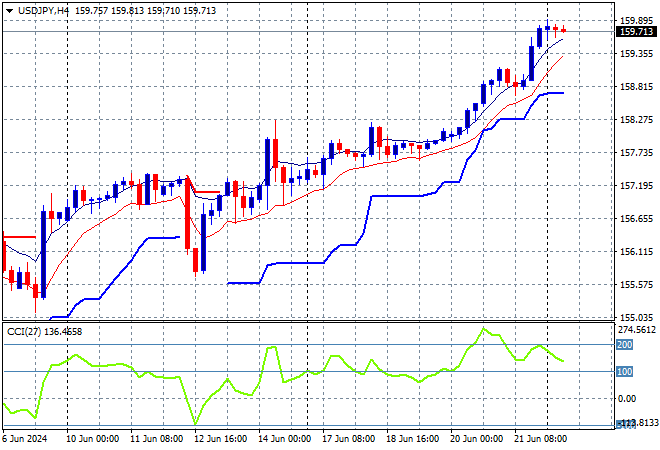

Mainland Chinese share markets are falling again with the Shanghai Composite down some 0.7% going into the close to stay well below the 3000 point barrier while the Hang Seng Index is down nearly 1% to 17869 points. Meanwhile Japanese stock markets are liking the lower Yen with the Nikkei 225 up 0.6% to 38859 points as the USDJPY pair consolidates above the 159 level after making another record high:

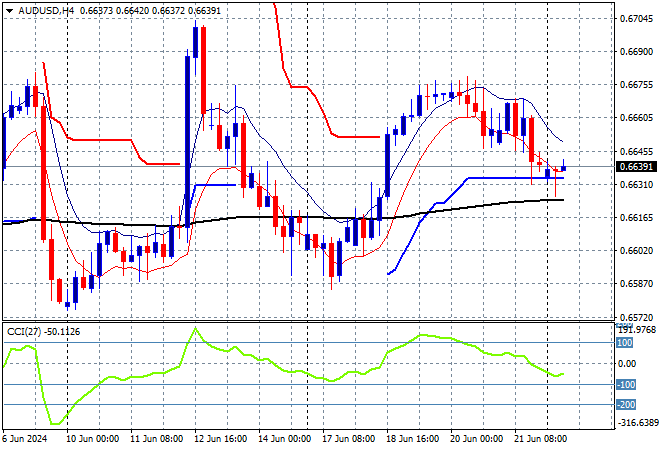

Australian stocks are playing catchup with the risk off mood, giving back their Friday gains as the ASX200 heads nearly 0.9% lower to 7733 points while the Australian dollar has retreated slightly above the low 66 cent level:

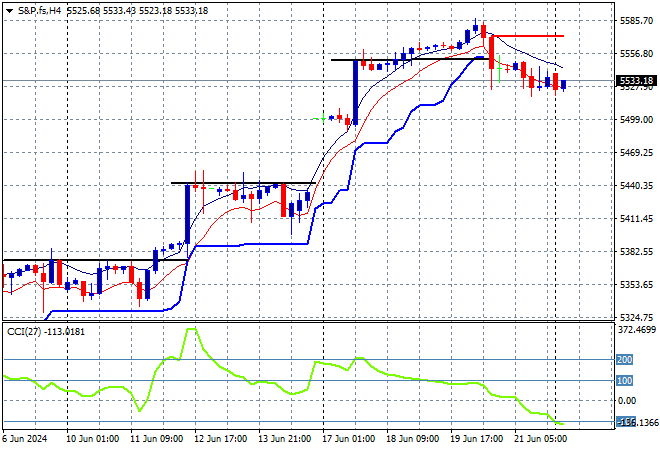

S&P and Eurostoxx futures are both down marginally as we head into the London session with the S&P500 four hourly chart showing price action holding above the 5500 point level which must hold as support:

The economic calendar starts the trading week with the latest German IFO survey and a few Treasury auctions.