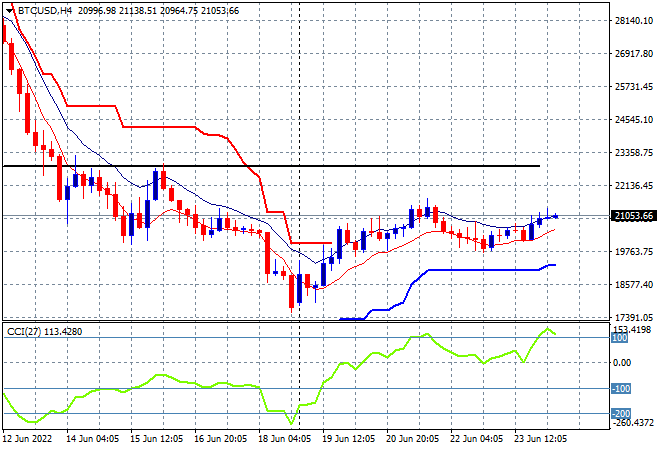

Some solid gains to finish the week on Asian share markets with risk sentiment firming following last night’s late rebound on Wall Street. The USD remains strong against most of the undollars, with the Australian dollar hovering around the 69 cent level. Oil prices are trying to stabilise but are ending up drifting sideways, with Brent crude just above the $110USD per barrel level while gold is still depressed at the $1824USD per ounce level. Interestingly, the four hourly chart of Bitcoin is looking very similar to that of the S&P500 (see bottom of report) – is this the actual bottom?

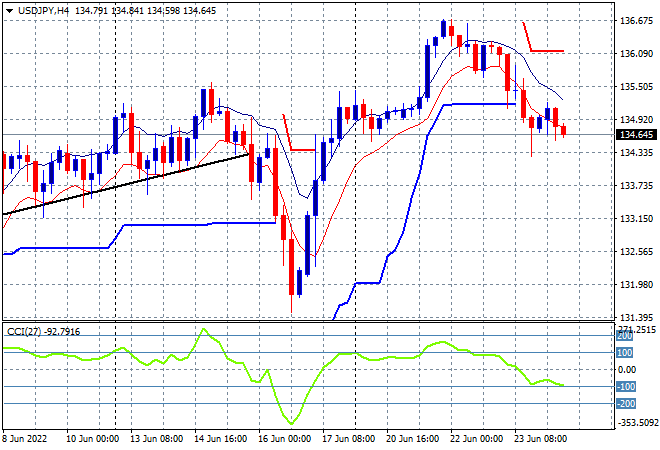

Mainland Chinese share markets are again accelerating into the close with the Shanghai Composite up more than 0.8% to 3347 points while the Hang Seng Index has gained nearly 1.6%, currently at 21641 points. Japanese stock markets however are playing catchup after their previous scratch sessions with the Nikkei 225 index about to close more than 1.2% higher at 26501 points while the USDJPY pair has continued its overnight drop, now below the 135 handle after failing to stabilise after its early week breakout:

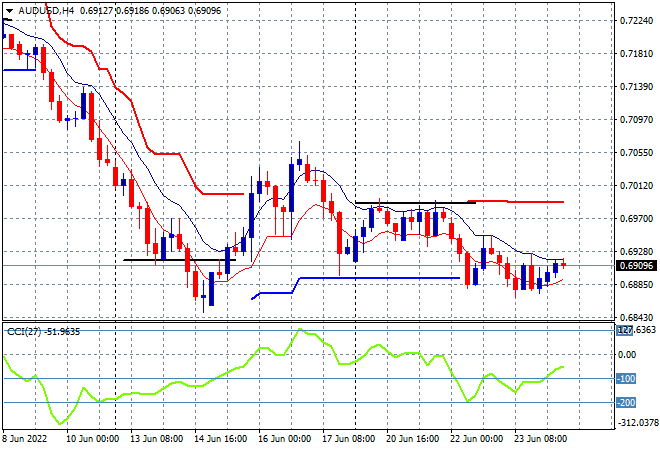

Australian stocks were able to put in modest gains, with the ASX200 about to finish nearly 0.8% higher at 6575 points. The Australian dollar is trying to find a bottom here, having been depressed below the 69 cent level against USD in the second half of the week:

Eurostoxx and Wall Street futures are pushing higher going into the European open, with the S&P500 four hourly futures chart showing price action no longer anchored above the 3700 point level as it now begins to threaten the May lows (lower horizontal black line) that have acted as firm resistance, with a bullish inverse head and shoulders pattern almost complete:

The economic calendar includes the closely watched German IFO survey, then the US Michigan consumer sentiment print.

Have a good weekend!