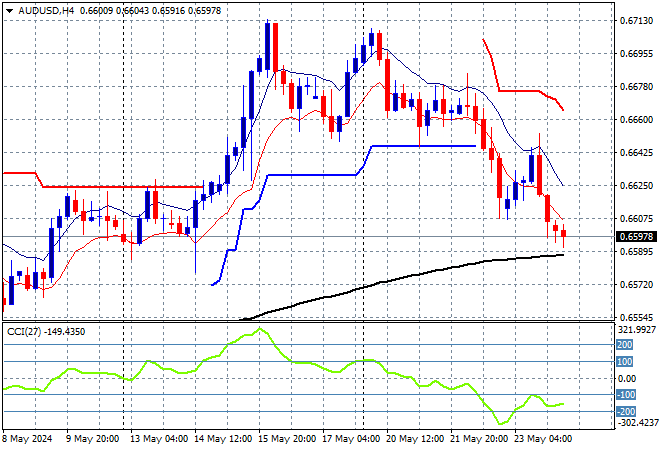

Asian stocks are in retreat as market volatility spikes further higher on the back of too-good economic reports and concerns interest rates will remain where they are for longer. Continued tensions in the Taiwan Strait are not helping either with the USD becoming a safe haven bid with the Australian dollar finally breaking below the 66 cent level.

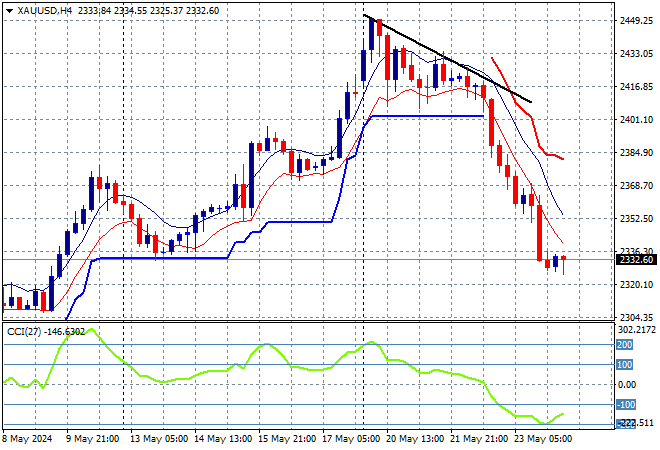

Oil prices are falling again with Brent crude just above the $81USD per barrel level while gold is trying hard to steady after its own steep falls, currently holding just above the $2320USD per ounce level this afternoon:

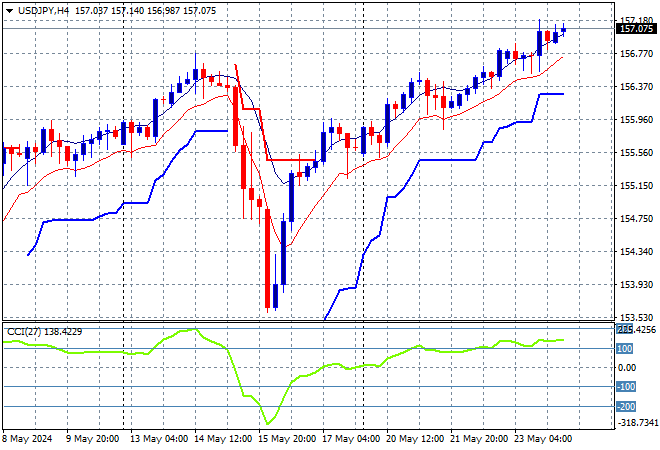

Mainland Chinese share markets are trying to hold after some poor recent sessions with the Shanghai Composite off by 0.2% or so while the Hang Seng Index is down more than 1%, currently at 18629 points. Meanwhile Japanese stock markets are feeling the heat as well with the Nikkei 225 down more than 1.2% at 38636 points as the USDJPY pair pulls slightly above the 157 level:

Australian stocks are playing the same tune with the same amplitude, with the ASX200 down nearly 1.2% to 7721 points while the Australian dollar almost held but couldn’t manage to fall through the 66 cent level:

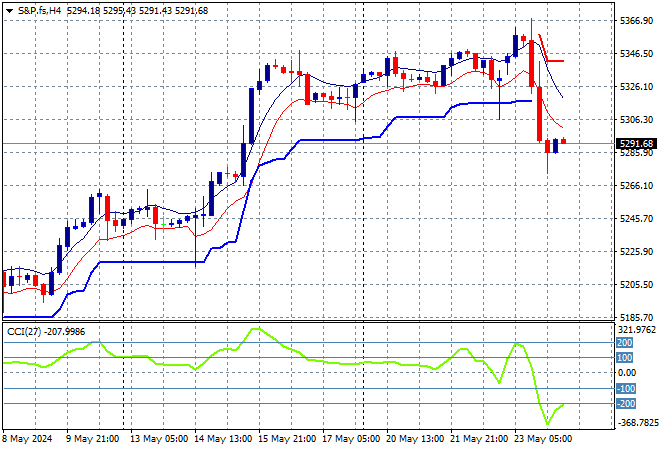

S&P and Eurostoxx futures are both down marginally given the poor returns here in Asia as we head into the London session. The S&P500 four hourly chart shows price action decidedly below the 5300 point level with the potential for a correction building:

The economic calendar concludes the trading week with the latest German GDP print, followed by US durable goods orders.