Asian share markets are in a fix with most resisting overnight positive risk sentiment with Chinese authorities trying to stop short selling while local stocks were staid after the Albo tax reversal. Wall Street is looking positive as it prepares for some substantial economic releases later in the week while the USD is strengthening against the major currencies with the Australian dollar unable to get back above the 66 cent level.

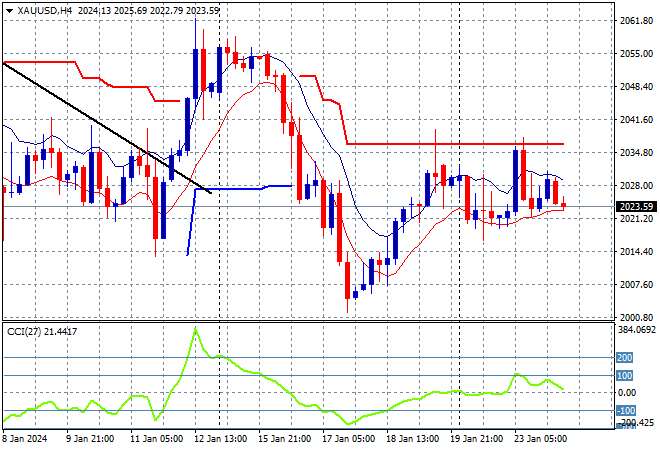

Oil prices are trying to get out of stall mode with Brent crude unable to lift through the $80USD per barrel level while gold is also in a little funk with the inability to get back to the start of week position at the $2020USD per ounce level:

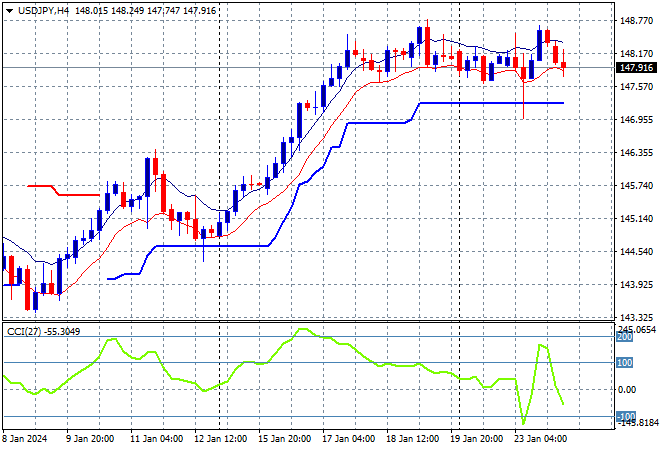

Mainland Chinese share markets are treading water as the Shanghai Composite looks set to put in a scratch session, down a handful of points to 2770 points while in Hong Kong the Hang Seng Index is trying to bounce back, currently up 0.4% to 15422 points. Japanese stock markets however are falling back after their recent big run up with the Nikkei 225 closing nearly 1% lower at 36145 points while the USDJPY pair has calmed down again following yesterday’s BOJ meeting with a steady hover below the 148 level:

Australian stocks were dead flat as the ASX200 closed at 7519 points, absorbing the impact of the latest tax cut news. Meanwhile the Australian dollar rolled back down to the mid 65 cent level as it fails to break free of overhead resistance:

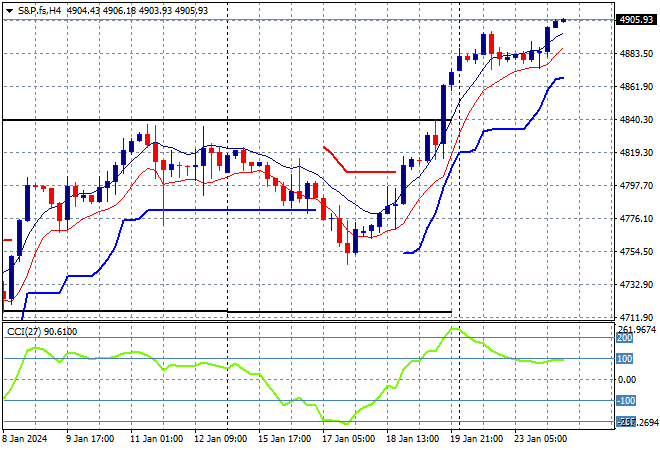

S&P and Eurostoxx futures are inching slightly higher going into the London session with the S&P500 four hourly chart showing a slight move higher with the 4900 point level now in sight:

The economic calendar ramps up tonight with a slew of flash manufacturing PMIs across Europe and the UK, followed by the Canadian central bank meeting.