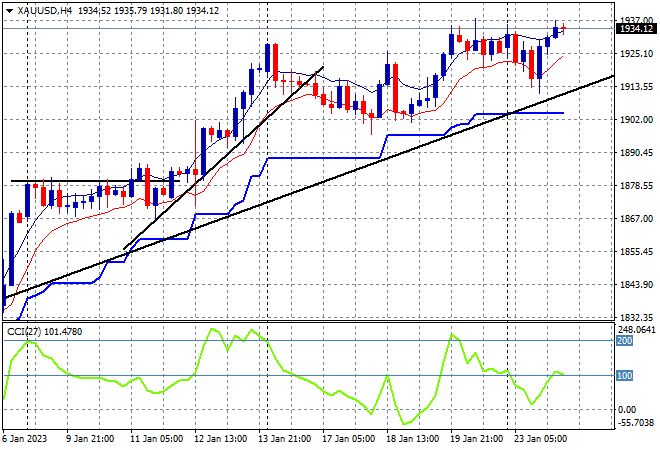

Asian stock markets are all advancing, making good on the solid start to the new trading week absent Chinese markets which remain closed. Wall Street is behind the big lift in risk sentiment with another surge overnight lead by tech stocks and heightened anticipation that the Fed will finally stop hiking rates. Currency markets are in the main going against King Dollar with Euro holding above the 1.09 handle while the Australian dollar is staying firmly above the 70 cent level. Meanwhile oil prices are edging slightly higher with Brent crude just above the $88USD per barrel level at its new weekly high while gold is wanting to advance again, now lifting above the $1930USD per ounce level:

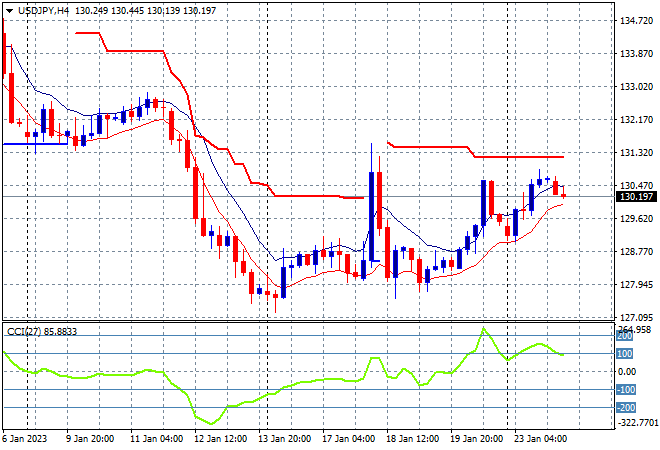

Mainland and offshore Chinese share markets are closed for Lunar New Year holidays this week. Japanese stock markets are doing the heavy lifting again with the Nikkei 225 closing 1.5% higher to 27322 points with the USDJPY pair pulling back slightly and remaining somewhat depressed just above the 130 handle after failing to make the nascent breakout overnight stick:

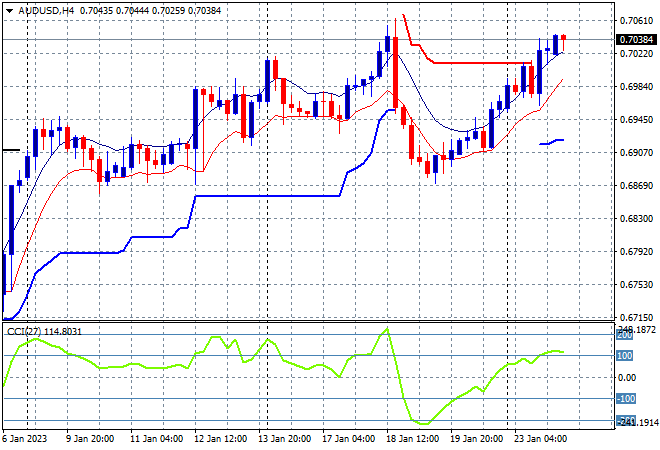

Australian stocks were able to finally advance after a false start to the trading week with the ASX200 finishing 0.4% higher at 7490 points. The Australian dollar kept above the 70 cent level and is now dicing with last week’s intrasession high was momentum gets slightly overbought:

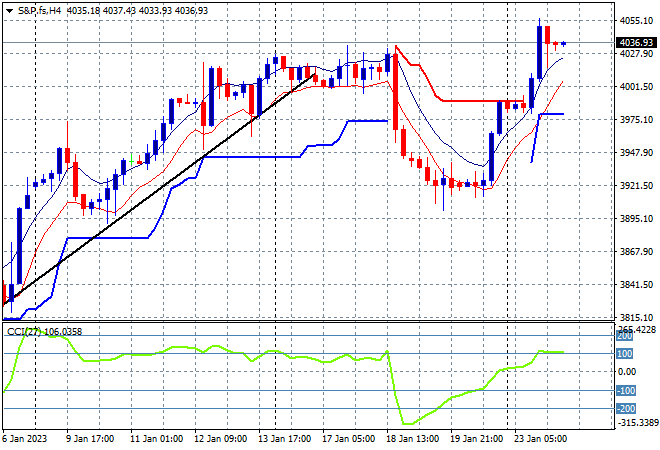

Eurostoxx 50 and US futures are drifting higher as the S&P500 four hourly chart shows price action wanting to hold above the psychologically important 4000 point zone after its breakout overnight as tech stocks lead the way. Short term momentum is now back to overbought readings with resistance almost cleared here:

The economic calendar includes the latest German consumer confidence and a slew of flash services and manufacturing PMI prints for Europe and the US.