Asian share markets are trading lower across the board with a few markets closed for holidays as focus on the potentially widening conflict in the Middle East continues to hurt equity markets the most, as safe haven buying in USD dissipates slightly. Nevertheless, the Australian dollar can’t get much above the 63 cent level despite higher commodity prices.

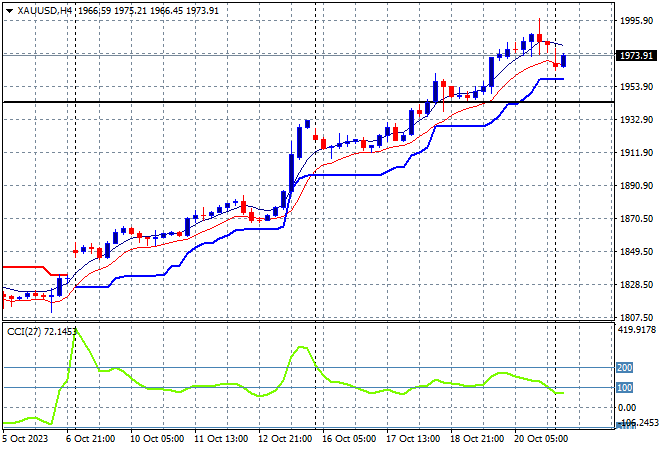

Oil prices have gapped lower over the weekend, with Brent crude consolidating around the $93USD per barrel level while gold is also slipping slightly, having made a new high at the $1980USD per ounce level, in what looks like a run to the $2000USD per ounce level that needs some steam taken out:

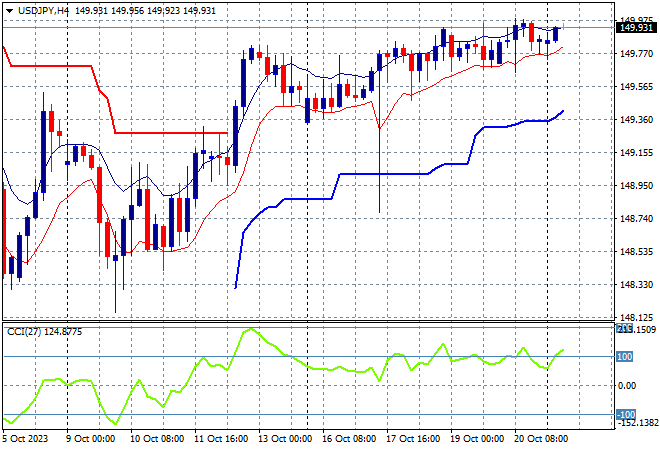

Mainland Chinese share markets have dropped back again with the Shanghai Composite down 0.8% going into the close at 2956 points while in Hong Kong the Hang Seng Index is having a market holiday, thankfully. Japanese stock markets are also losing ground with the Nikkei 225 closing some 0.5% lower at 31111 points. Trading in the USDJPY was again muted but still holding just below the 150 level:

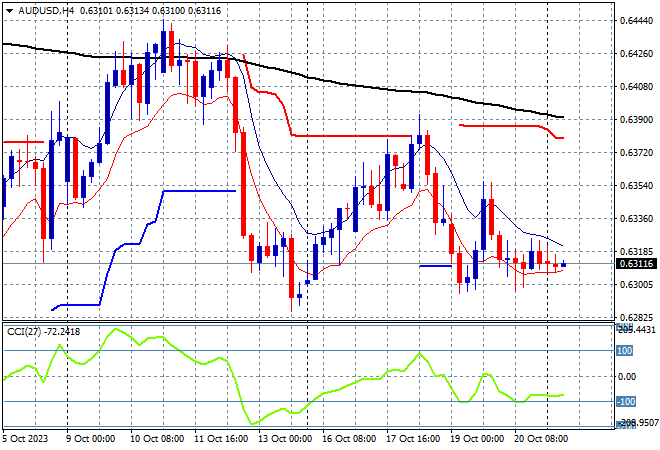

Australian stocks were unable to escape the weekend selling with the ASX200 closing nearly 1% lower at 6844 points, firming the break below at 7000 points from last trading week while the Australian dollar remains anchored at the 63 handle again, almost making a new weekly low in the process:

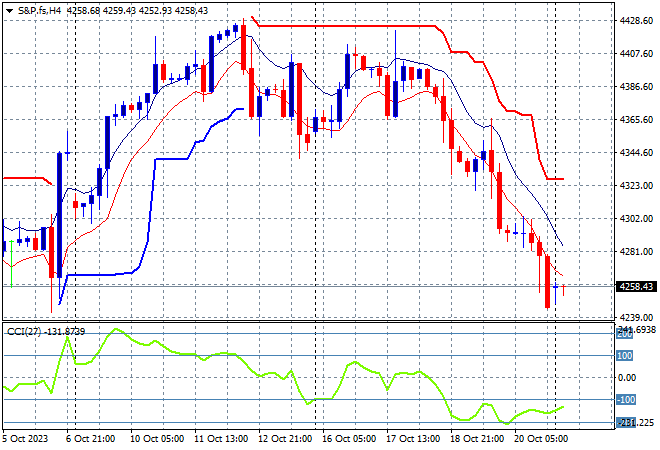

S&P and Eurostoxx futures are steady but precarious going into the London open as the S&P500 four hourly chart shows support crumbling at the 4300 point level as short term momentum remains very negative:

The economic calendar starts the trading week very quietly with a few Treasury auctions and European consumer confidence figures.