There wasn’t much economic data or other events to shake up Asian equities today as US politics continued to dominate risk taking, with Wall Street experiencing a buy the dip rally overnight, some of what spilled over locally but without a lot of confidence. The USD remains mixed against the majors as Yen appreciates while the Australian dollar continues to slide down in the wake of growth concerns in China.

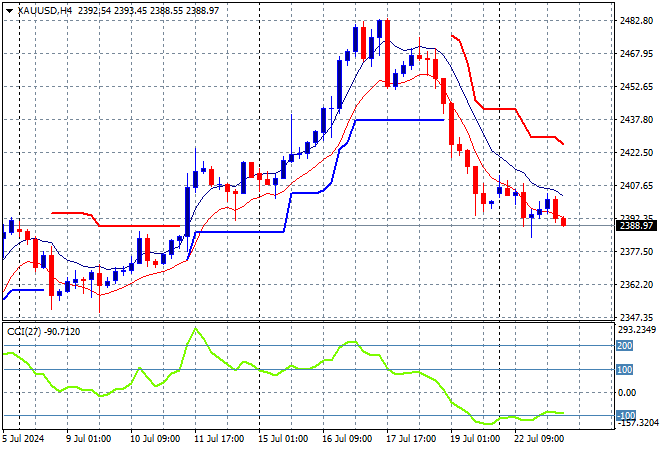

Oil prices are flat with Brent crude unable to push above the $83USD per barrel level while gold is slowly slipping once more after falling sharply on Friday, now well below the $2400USD per ounce level:

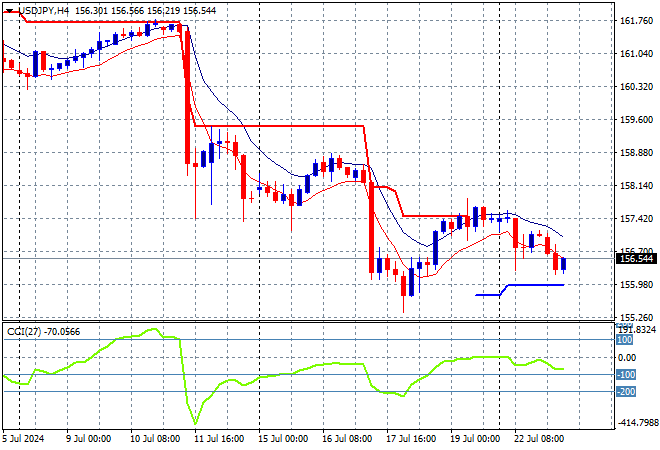

Mainland Chinese share markets are still going down with the Shanghai Composite losing more than 1% while the Hang Seng Index is falling again, off by only 0.5% to 17546 points. Meanwhile Japanese stock markets are stabilising somewhat despite an appreciating Yen with the Nikkei 225 flat at 39594 points as the USDJPY pair has continued its falls below the 157 level in afternoon trade:

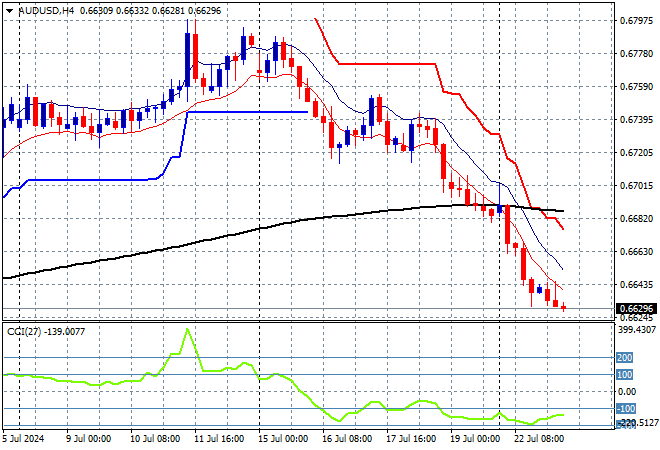

Australian stocks were able to claw back some of their recent losses with the ASX200 up 0.5% but still below the 8000 point level, closing at 7971 points while the Australian dollar continues its retreat below the 67 cent level next as momentum remains oversold:

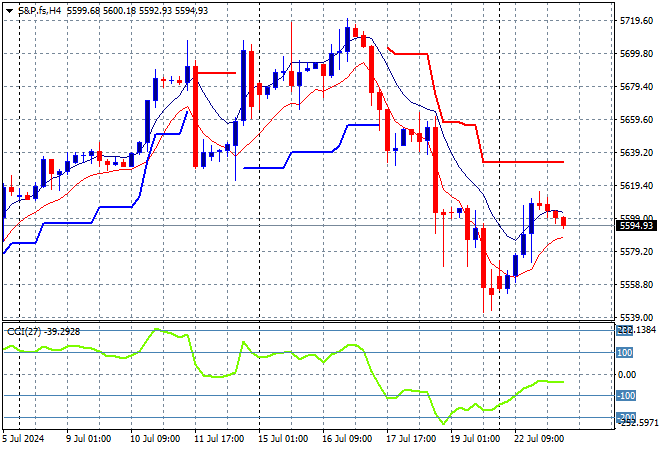

S&P and Eurostoxx futures are declining as we head into the London session with the S&P500 four hourly chart showing last night’s buy the dip action starting to fade as price remains below the previous point of control at the 5700 point level with volatility rising – watch out below as more political machinations turn the wheel:

The economic calendar is still relatively quiet with US existing home sales the only big release of note.