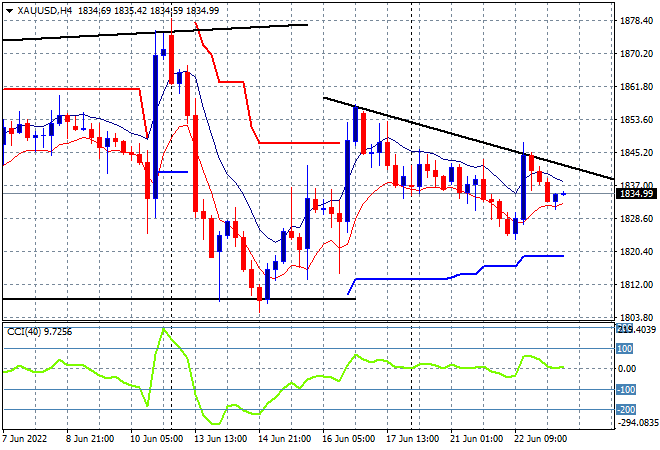

Share markets are once again bouncing back across Asia despite the overnight volatility on Wall Street as traders react to central bankers trying to backpedal, sidestep and generally stumble their way through this post COVID stagflation, of sorts. The USD remains strong against most of the undollars, with the Australian dollar once again pushed below the 69 cent level on “don’t be asking for more wage increases” Phil Lowe’s little chat today. Oil prices are drifting sideways, with Brent crude just above the $110USD per barrel level while gold is down a handful of dollars as it struggles at the $1834USD per ounce level:

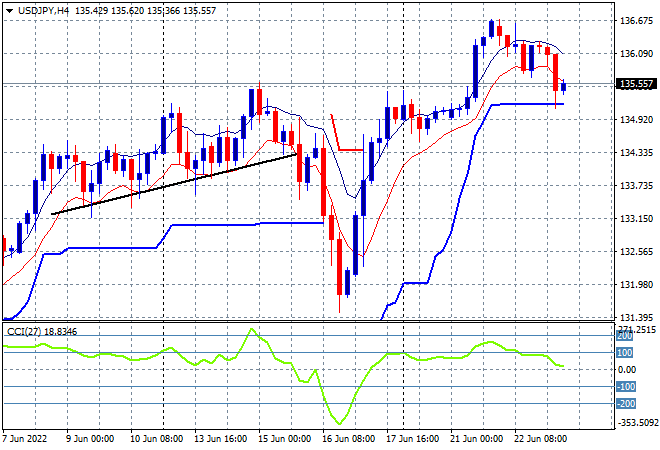

Mainland Chinese share markets are accelerating higher going into the close with the Shanghai Composite up more than 1.2% to 3307 points while the Hang Seng Index has gained nearly 2%, currently at 21396 points. Japanese stock markets however are putting in scratch sessions with the Nikkei 225 index closing just 0.1% higher at 26246 points while the USDJPY pair has dropped below the 136 handle after failing to stabilise after its early week breakout:

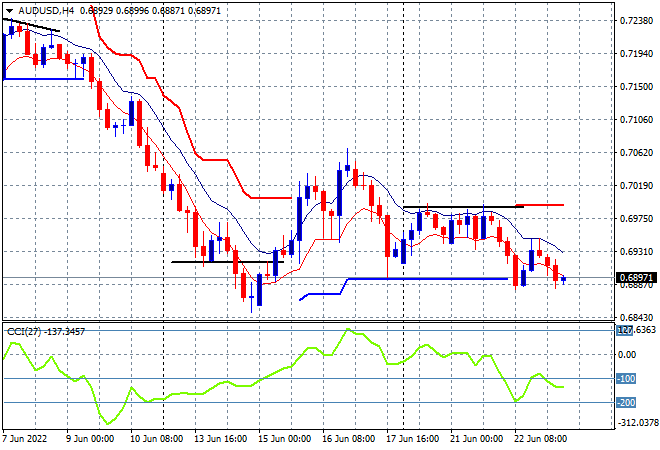

Australian stocks were able to put in modest gains, with the ASX200 finishing just 0.3% higher at 6528 points. The Australian dollar however has flopped again, now just below the 69 cent level against USD and on its way to the previous weekly low as the RBA loses control of the rudder (not having anyone in the crows nest and all the navigators down below playing poker) as four hourly momentum remains highly negative:

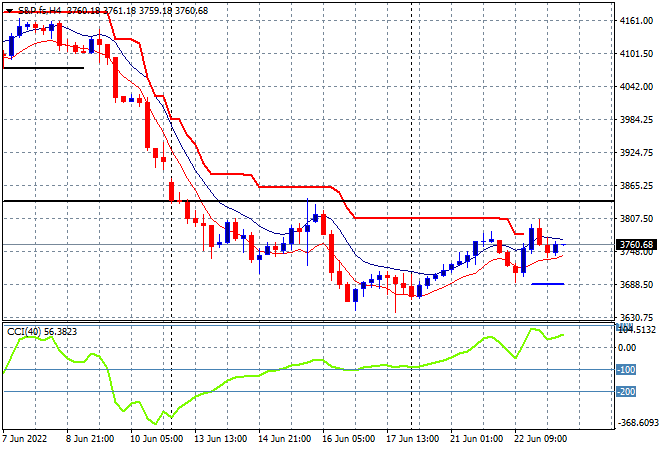

Eurostoxx and Wall Street futures are slowly drifting sideways going into the European open, with the S&P500 four hourly futures chart showing price action still anchored here above the 3700 point level as the May lows (lower horizontal black line) turn into firm resistance:

The economic calendar is packed tonight with a slew of flash PMI readings for Germany, UK, Europe and the US, plus weekly initial jobless claims and Fed Chair Powell’s testimony continues.