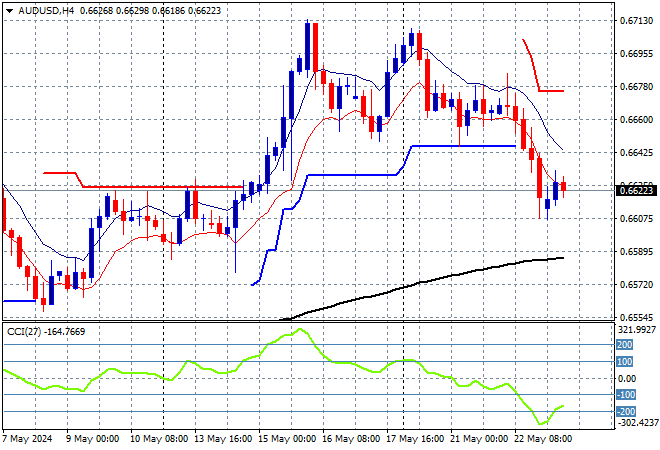

Market volatility remains somewhat high with tensions in the Taiwan Strait overshadowing last night’s FOMC minutes release, with Chinese stocks and their proxies like the ASX200 falling while a slightly weaker Yen is helping lift Japanese markets. More post close earnings on Wall Street is likely to lead to a positive open there tonight while the USD is continuing to firm after weeks of weakness, with the Australian dollar bouncing ever so slightly this afternoon but still dicing with the 66 cent level.

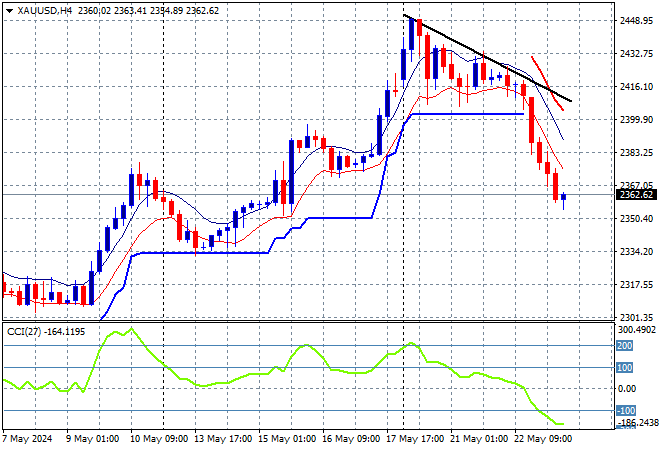

Oil prices are falling further with Brent crude below the $82USD per barrel level while gold is failing to steady after its own steep fall overnight, currently just above the $2360USD per ounce level this afternoon:

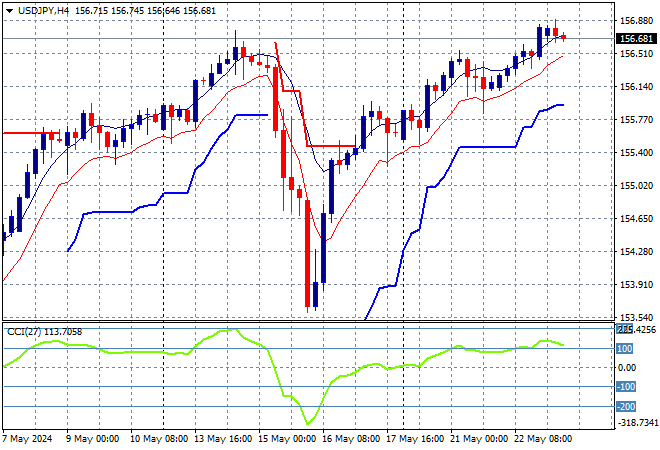

Mainland Chinese share markets are heading down fast as they go into the close with the Shanghai Composite losing more than 1.2% while the Hang Seng Index has lost over 1.7%, currently at 18867 points. Meanwhile Japanese stock markets are bucking the trend with the Nikkei 225 closing some 1.2% higher at 39103 points as the USDJPY pair retreats slightly below the 157 level:

Australian stocks were unable to advance yet again, with the ASX200 falling about 0.5% to 7811 points while the Australian dollar almost got through the 66 cent level before a late afternoon bounce:

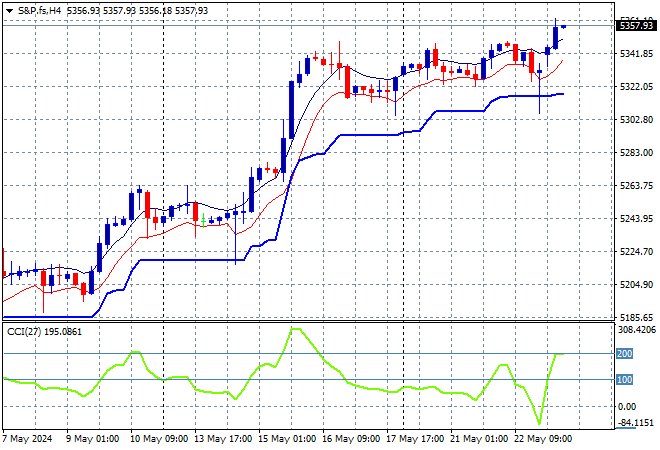

S&P and Eurostoxx futures are lifting despite the mixed returns here in Asia as we head into the London session. The S&P500 four hourly chart shows price action wanting to get out of its stall at the 5300 point level:

The economic calendar includes a slew of flash manufacturing and services PMIs across Europe and UK, then US initial jobless claims for the week.