Sentiment remained buoyed over the weekend gap on overnight markets with Wall Street pushing slightly higher while European shares played catchup. The divergence in fortunes here in Asia is likely to continue with Chinese shares in near nosedives while local bourses follow the overnight lead. USD regained some strength in the absence of economic releases on the calendar as Euro dipped below the 1.09 handle while the Australian dollar is dicing with the 65 cent level.

10 year Treasury yields were down about 5 points but remain well above the 4% level with chances of a March rate cut starting to firm while oil prices were able to lift slightly as Brent crude headed above the $79USD per barrel level. Gold also bounced back after recently almost breaking below the $2000USD per ounce level but is still under the thumb of King dollar.

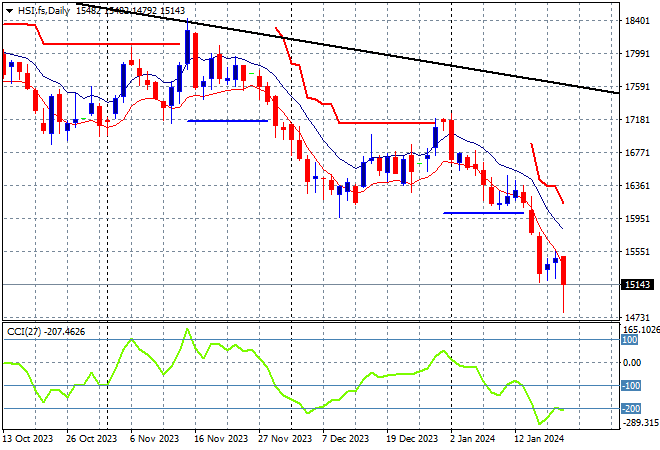

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets are pulling back sharply again as the Shanghai Composite falls nearly 3% to 2756 points while in Hong Kong the Hang Seng Index is having an equally rough day, down 2.7% to 14886 points.

The daily chart amply shows the significant downtrend from the start of 2023 with the 19000 point support level a distant memory as medium term price action remained stuck in the 17000 point range before this new losing streak. Daily momentum readings are still in oversold settings as price action returns to the October lows, with little chance of stabilising here:

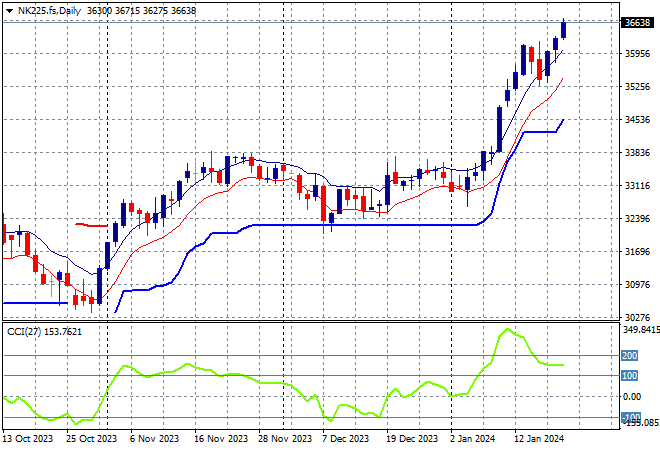

Japanese stock markets however went the other way with the Nikkei 225 up more than 1.6% to 36546 points.

Trailing ATR daily support was being threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum remaining extremely overbought. Correlations with a stronger Yen are breaking down here with a selloff back to ATR support at 32000 points unlikely as the November highs are wiped out in this breakout but I’m cautious of a strong pullback here on any volatility:

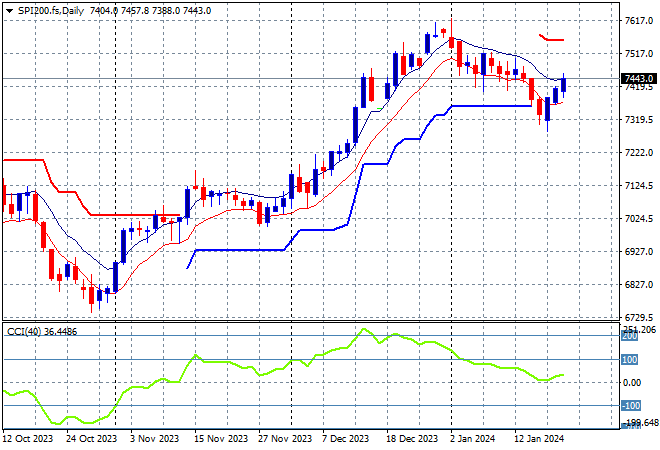

Australian stocks got some positive momentum, with the ASX200 lifting more than 0.7% to extend above the 7400 point level, closing at 7476 points.

SPI futures are flat despite some small gains on Wall Street overnight. The daily chart is still looking somewhat mixed here despite the medium term uptrend with short term price action however still suggesting a possible reversal underway as daily momentum starts to wane and resistance at the 7600 point level builds. Watch for any continued dip below the low moving average and conversely with a breakout above the high moving average:

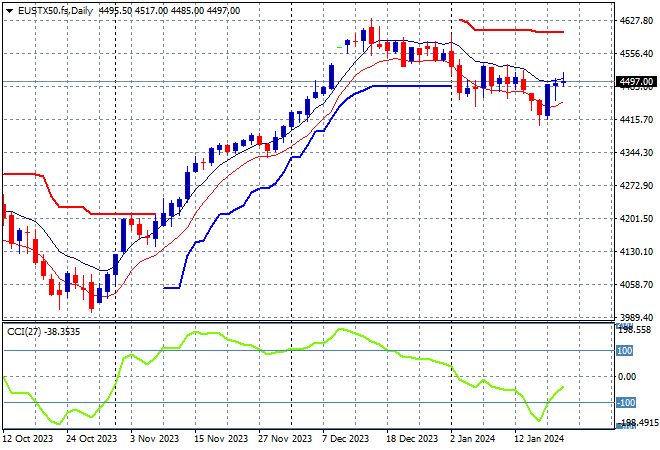

European markets were much more confident after the weekend gap with some solid gains across the continent as the Eurostoxx 50 Index finished 0.7% higher at 4480 points.

The daily chart shows price action meandering and not yet making a solid attempt at breaching the early December 4600 point highs as overall momentum remains somewhat negative. Futures are indicating a staid session for tonight:

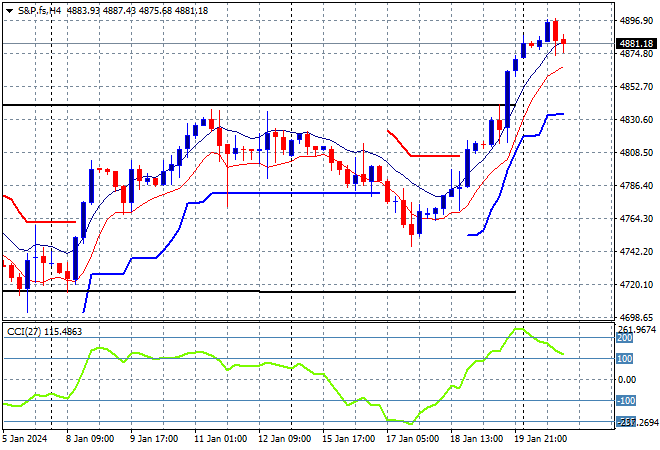

Wall Street was able to again rally across all the main markets but only with subdued sessions with the NASDAQ pushing just 0.3% higher while the S&P500 gained 0.2% to close at 4850 points.

Short term momentum is slightly retraced from extended overbought territory on the four hourly chart, with this solid breakout taking out trailing ATR resistance and the weekly highs overhead. Overall support has been strong at the 4700 point level proper but with those December highs as very strong resistance now breached we could see a swift run up to 5000 points:

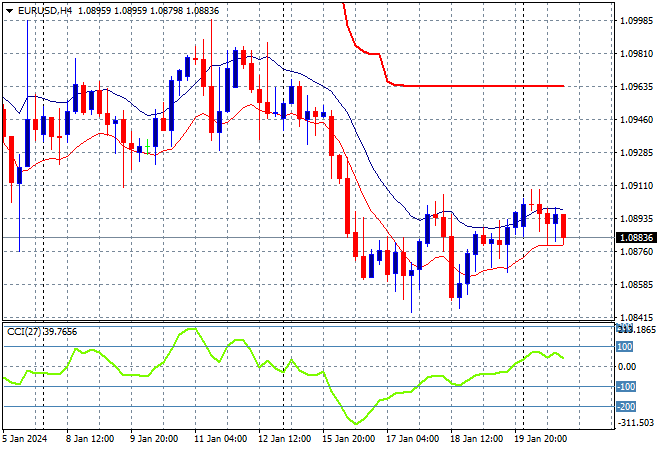

Currency markets were somewhat subdued as King Dollar regained some lost momentum against some of the majors with Euro again pulling back below the 1.09 handle proper.

The union currency had been still looking weak here after tracking sideways for nearly three weeks as short term momentum switched to negative as price action remains contained well below trailing ATR resistance. After being considerably oversold there is potential building for a swing trade higher here, but watch for a break below the low moving average:

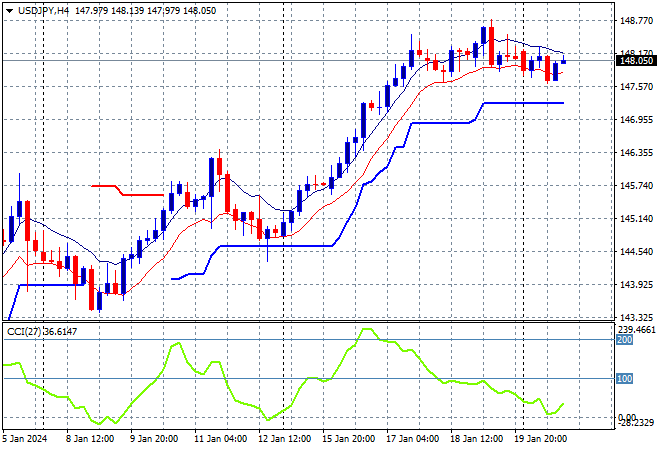

The USDJPY pair remains in a sideways bullish/consolidating mood after its recent big surge with the 148 level still proving strong short term support but also possibly building as resistance.

Four hourly momentum has calmly retraced from being extremely overbought and price firms here with support building at the 147 handle below. A welcome pause as there is potential for more upside here:

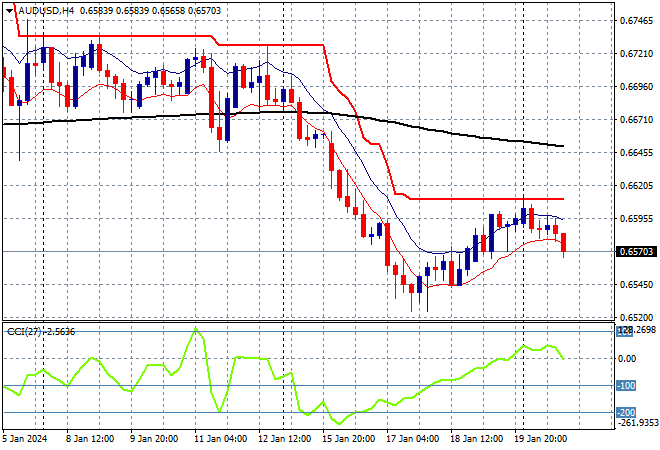

The Australian dollar is still the weakest undollar as traders await the February RBA meeting with a mild rollover overnight sending it back below the 66 level with short term resistance just too strong for now.

The Aussie has been under medium and long term pressure for sometime with the latest rally just a relief valve being let off with short term momentum returning to oversold territory as traders still have another month for the RBA to come back from holidays. As I said previously, if you’d turn this chart upside down and you’d be bullish – but watch trailing ATR resistance in the short term:

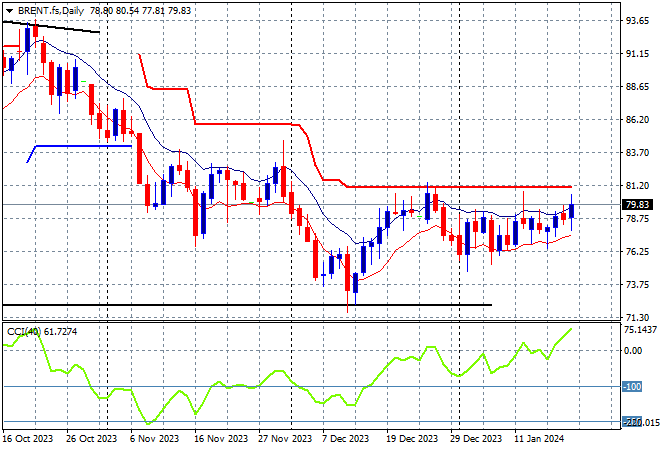

Oil markets saw another mild uptick that could be the start of a potential breakout given the recent amount of low volatility with Brent crude breaching the $79USD per barrel level overnight as tensions mount.

While still well contained below the key $80USD resistance level, daily momentum is now out of negative settings and setting up for a potential swing higher so watch carefully for a breakout soon:

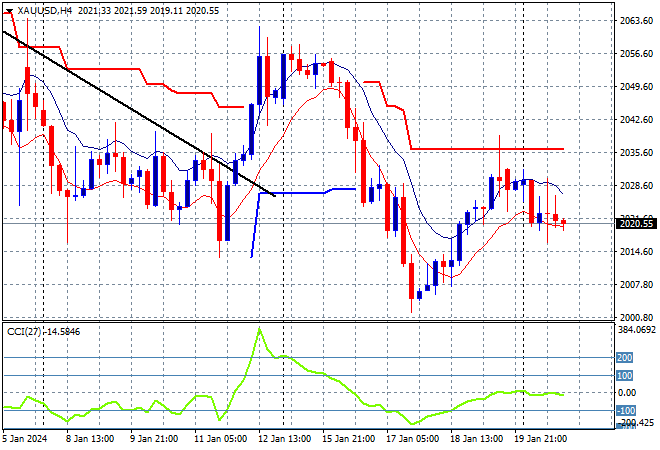

Gold looks weak after the weekend gap with the early Asian session sending it back to the $2020USD per ounce level where it stayed overnight, unable to restore the small rally from mid last week.

While a good start, this bounceback is not yet enough to get back above the dominant downtrend with support at the $2040 level still hovering overhead as resistance. Watch for a potential return to the previous lows just above the $2000USD per ounce level next: