The latest Bank of Japan meeting came and went without much flourish as Chinese stocks try to get off the floor having fell to a four year low yesterday amid upbeat momentum on other risk markets. Wall Street looks solid as it prepares for some substantial economic releases later in the week while the USD is weakening slightly against the major currencies with the Australian dollar wanting to break free above the 66 cent level.

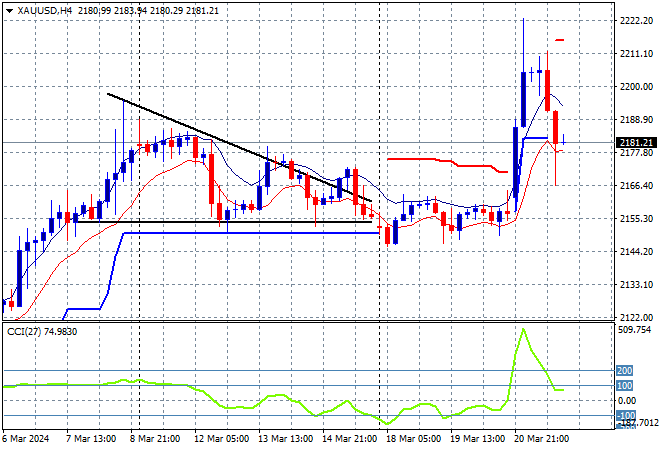

Oil prices are trying to get out of stall mode with Brent crude lifting through the $80USD per barrel level while gold has also found a little upside this afternoon with a small surge up to the $2030USD per ounce level:

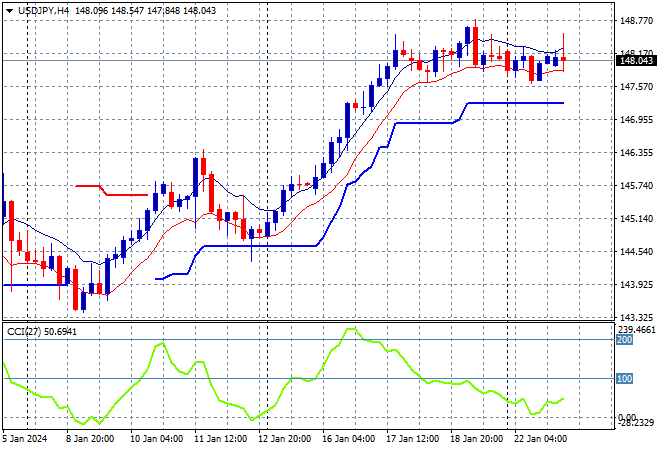

Mainland Chinese share markets are trying to not fall back again as the Shanghai Composite looks set to put in a scratch session, up a handful of points to 2756 points while in Hong Kong the Hang Seng Index is taking back its previous bad day, up 2.7% to 15369 points. Japanese stock markets however are more sedate with the Nikkei 225 closing nearly dead flat at 36595 points while the USDJPY pair has calmed down again following the BOJ meeting with a steady hover near the 148 level:

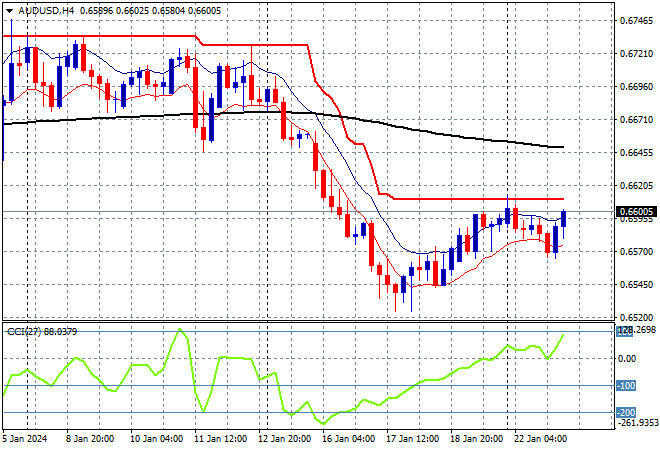

Australian stocks put in a solid session with momentum building as the ASX200 lifted more than 0.5% to breakthrough the 7500 point level, closing at 7514 points. Meanwhile the Australian dollar is itching to get back above the 66 cent level as it too builds more momentum as it tries to break free of overhead resistance:

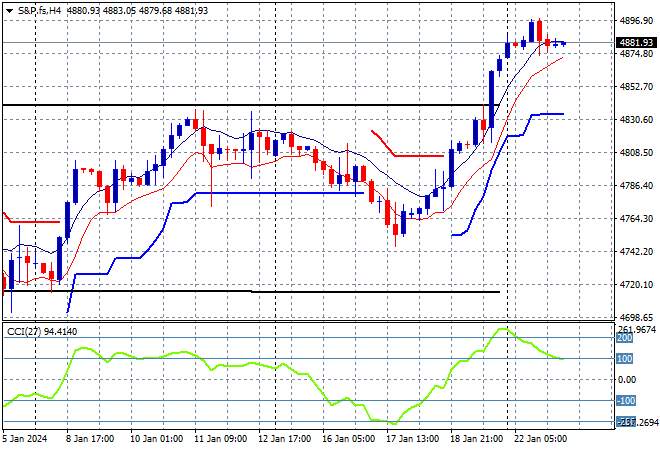

S&P and Eurostoxx futures are relatively calm going into the London session with the S&P500 four hourly chart showing a probable hold at or above last night’s slight move higher with the 4900 point level now in sight:

The economic calendar is still quiet but will ramp up soon, with Euro consumer confidence and some private oil inventory data from the US.