The USD halted its two month rout with stock markets also putting on the brakes to the upside with Wall Street absorbed the latest FOMC minutes with some unease around the Fed’s direction on inflation. The Australian dollar fell back from its three month high but remains above the 65 cent level as Euro also fell back but is just holding on above the 1.09 handle.

US bond markets saw short term yields pull back on the minutes while 10 year Treasuries rose again through the 4.4% level. Oil prices continued their relatively minor bounceback as Brent crude pushed slightly above its monthly low at the $82USD per barrel level while gold rode alongside USD to break through the $2000USD per ounce level before consolidating slightly below this morning.

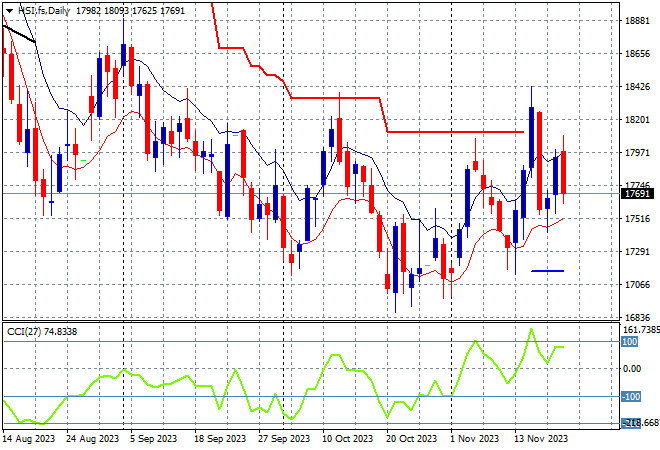

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were heading higher after the long lunch break but the Shanghai Composite gave up those gains to finish flat at 3067 points while in Hong Kong the Hang Seng Index also reversed later on to lose 0.3%, finishing at 17733 points.

The daily chart was showing a significant downtrend that had gone below the May/June lows with the 19000 point support level a distant memory as medium term price action remains stuck in the 17000 point range. Daily momentum readings are retracing back to positive settings despite Friday’s reversal with the potential for a fill in rally here towards the ATR resistance at the 18000 point level:

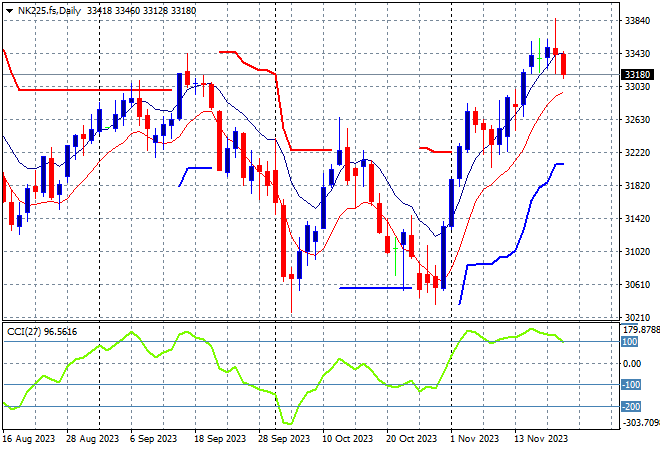

Japanese stock markets continue to feel the weight of a stronger Yen with the Nikkei 225 losing another 0.2% to 33354 points.

Trailing ATR daily support is a long way below the current bounce that has now exceeded the September highs at the 33000 point level with daily momentum still in the overbought zone but not over-extended. I’m watching correlations with Wall Street and Yen to see if there is more upside here:

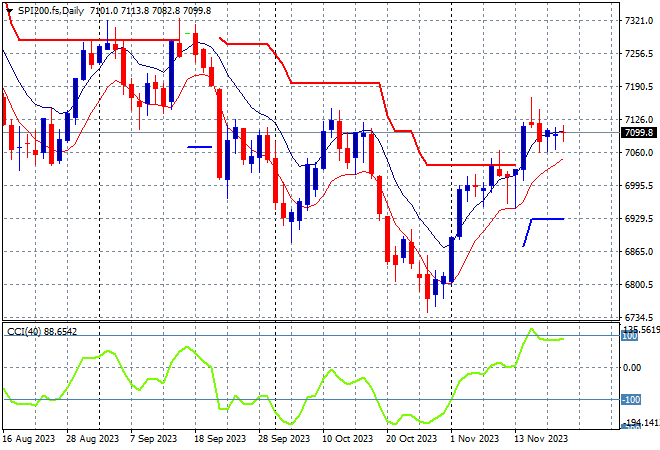

Australian stocks were able to translate positive momentum into something substantial with the ASX200 closing 0.3% higher at 7078 points.

SPI futures are slightly lower due to the pessimistic finish on Wall Street overnight so we should see the 7000 point level continue to firm as daily support this trading week. The daily chart is trying to look more optimistic here in the medium term with short term price action filling a hole against the tide, but sideways at best so far:

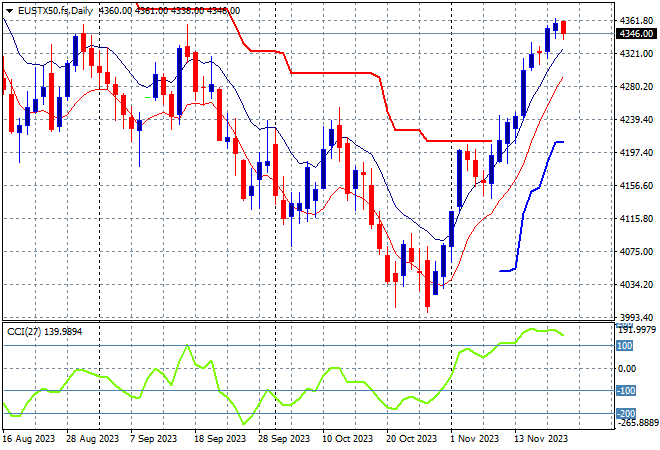

European markets were again unable to find more positive momentum following Friday’s session with the Eurostoxx 50 Index falling back 0.2% to finish at 4331 points.

The daily chart shows weekly resistance at the 4300 point resistance level nearly taken out with this large bounce setting up for further gains if that level is pushed aside proper. Support at the 4250 level should be quite firm on any pullback but I’m watching the much higher Euro possibly providing a headwind as the week progresses:

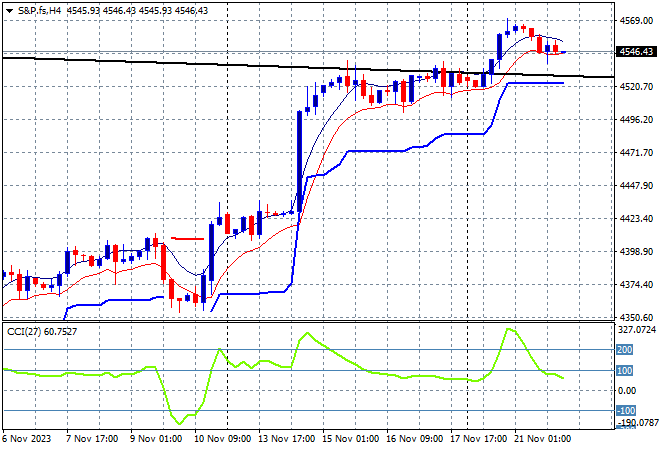

Wall Street was unable to follow through on its Monday gains as the NASDAQ finished 0.6% lower while the S&P500 managed to lose some 0.2% to finish at 4538 points in a lacklustre session.

Short term momentum was overextended as price action bounced strongly off the recent low at the 4100 point level for the potential for a retracement back to trailing ATR support on the four hourly chart building here. Watch the 4500 point level to hold though:

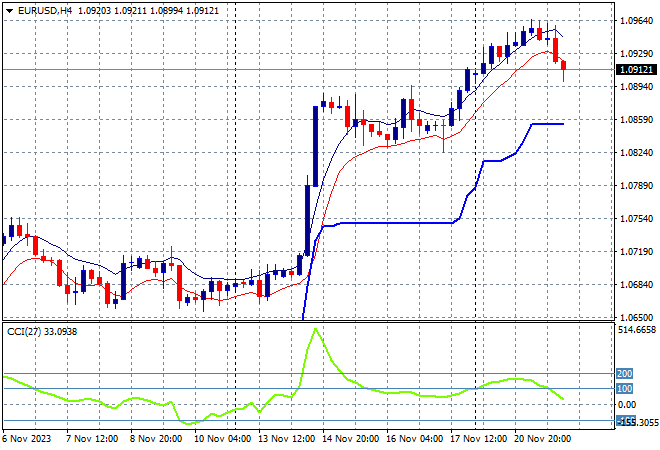

Currency markets were able to breathe a sigh of relief due to the FOMC minutes finally lifting USD out of its doldrums overnight, but it was a fairly mild result across the undollar complex with Euro just pulling back to its Monday morning starting point above the 1.09 handle.

The recent consolidation was after the union currency was able to fend off more Fedspeak in recent weeks and remain in a bullish, albeit neutral condition. Support at the recent weekly lows around the 1.06 level was not tested with new short term support upgraded to the 1.07 mid level at a minimum, but there could be a sharp short term reversal here to ATR support:

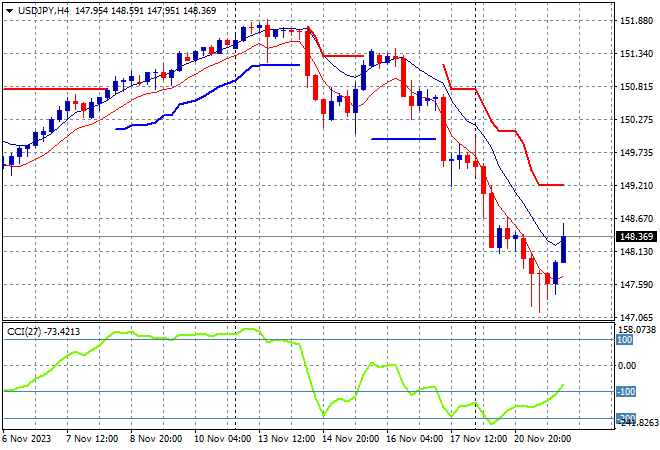

The USDJPY pair finally stopped falling with a decent bounce off the November lows to get back above the 148 handle overnight after decelerating prior to the release of the FOMC minutes.

Four hourly momentum has punched its way out of nearly extreme oversold settings on the lower USD with price action suggesting a swing play here that could push towards the 149 level but I suspect we need another catalyst to get things moving:

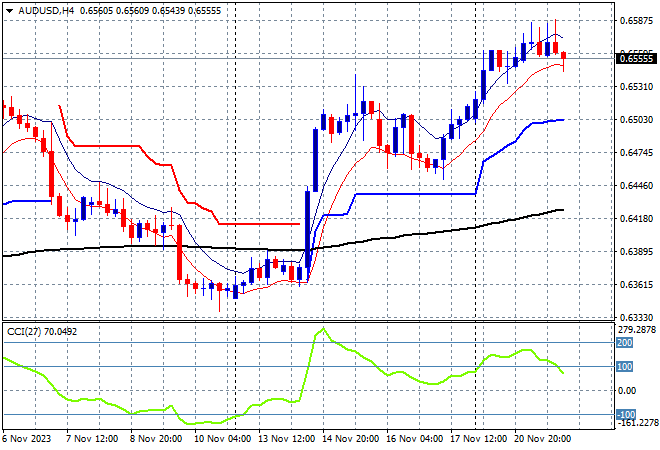

The Australian dollar was surprisingly resilient overnight with the USD not really pushing it around like other pairs with price action still stuck near the mid 65 cent level.

The Pacific Peso remains under medium and long term pressure but was able to test the mid 63 level following the RBA’s recent rate hike with momentum now overbought and looking very positive as we continue this new trading week, but watch for a potential pullback to the 65 handle proper:

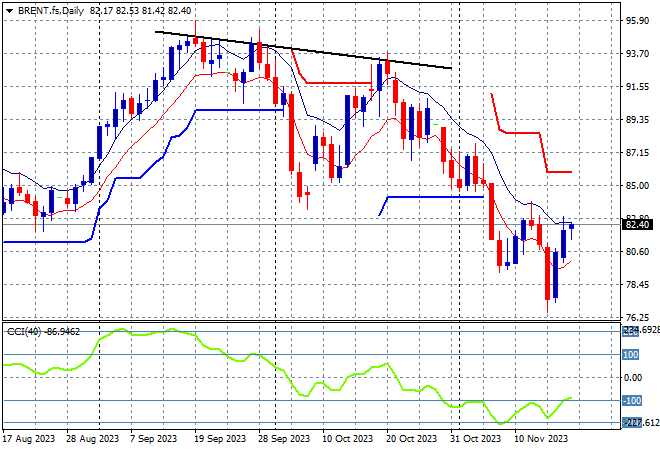

Oil markets remain in flux with the growing conflict in the Middle East and potential OPEC cuts adding to volatility with another small lift overnight with Brent crude pushing above the $82USD per barrel level.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout. Daily momentum is still in oversold settings with this failed test of support at the August level setting up for further falls below:

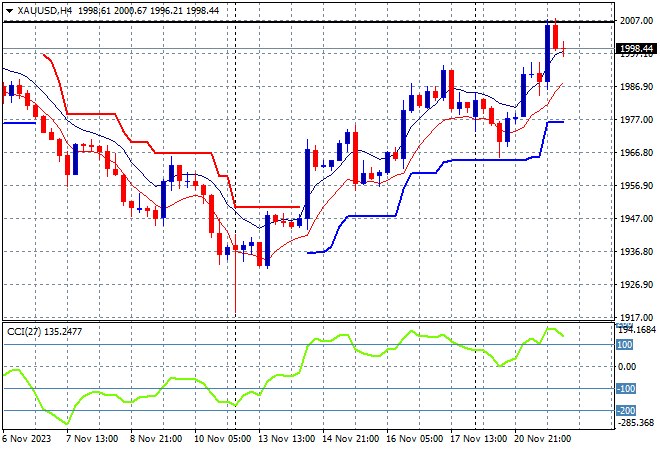

Gold was the surprise card overnight as it seems decoupled from USD correlation against other undollars, lifting back above the $2000USD per ounce level briefly where it sits this morning.

Daily support is building again here as the four hourly chart shows short term resistance (upper horizontal black line) the area to truly beat again: