A steady session for Asian share markets as Wall Street braces for the latest consumer confidence numbers tonight after a major revision in last month’s NFP job print, with bets of a Fed rate rise tightening to a sooner possibility. Futures are a bit flat going into tonight’s session with the weak USD still on the backfoot versus Euro and other currencies with the Australian dollar looking a lot stronger as it stays above the 67 cent level.

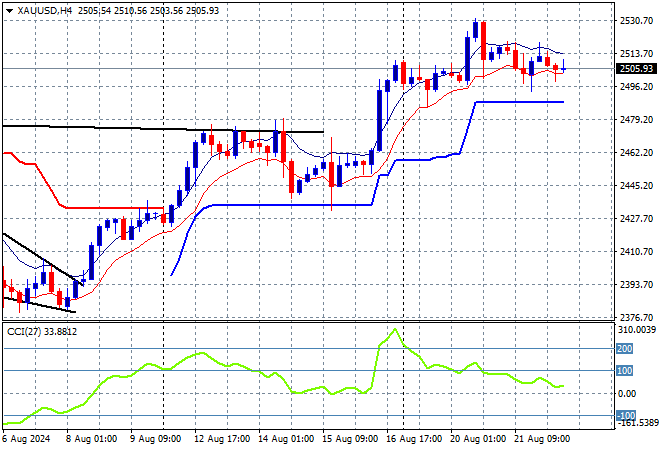

Oil prices are losing further short term momentum as Brent crude retreats below the $75USD per barrel level while gold is holding on to its breakout above the $2500USD per ounce level:

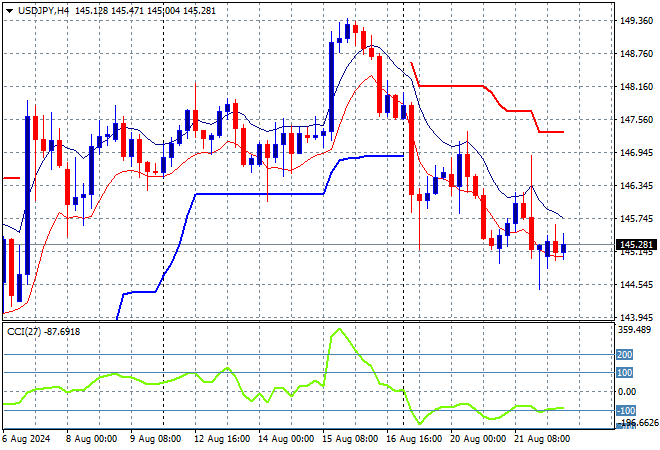

Mainland Chinese share markets pushed lower again with the Shanghai Composite down 0.3% while the Hang Seng Index had another boost out of the blue, closing more than 1.2% higher to 17602 points. Meanwhile Japanese stock markets are also lifting despite continued Yen volatility with the Nikkei 225 closing 0.8% higher to 38211 points while trading in USDPY has seen some stability but its all relative as it hovers near the 145 level:

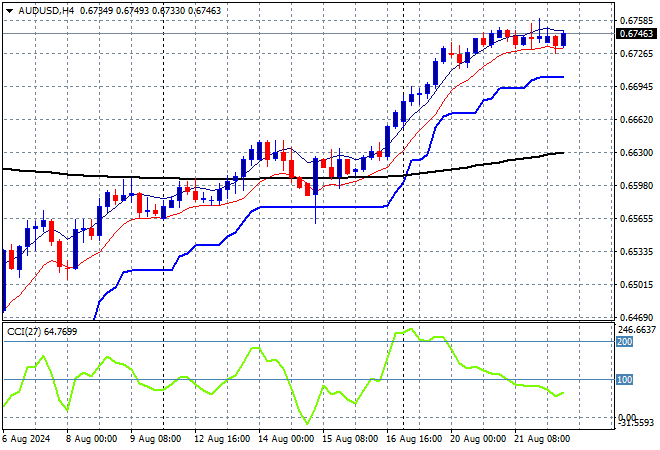

Australian stocks eked out another small gain with the ASX200 lifting 0.2% to extend above the 8000 point level while the Australian dollar was able to hold on to its move above the 67 cent level in a quiet session:

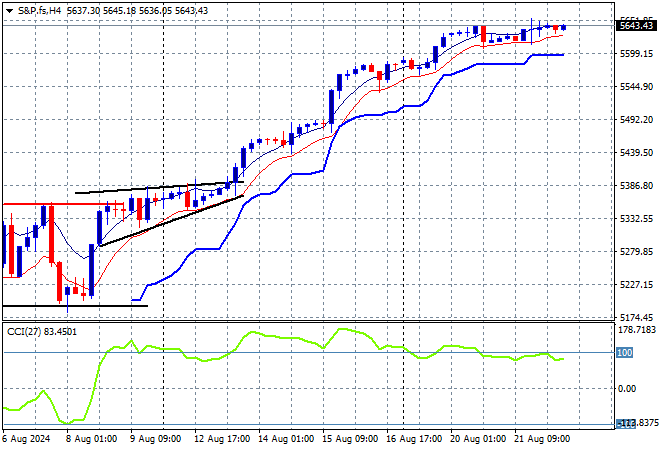

S&P and Eurostoxx futures are barely tracking higher going into the London session with the S&P500 four hourly chart showing momentum is starting to slow here:

The economic calendar will have a slew of flash manufacturing and services PMI surveys released across both sides of the Atlantic tonight, plus the latest ECB minutes and US flash consumer confidence numbers.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI