US politics dominated the risk markets as a new trading week got underway as President Biden pulled out of the race, leaving convicted felon Trump the oldest presidential nominee in history. With Wall Street slowly increasing their bets that he was likely to win in November before the weekend news, markets are now quite unsettled although volatility is easing. Speaking of easing, the PBOC is letting loose with a series of easy policy decisions with rate cuts across the board. This hasn’t settled mainland markets with other Asian equities also under pressure.

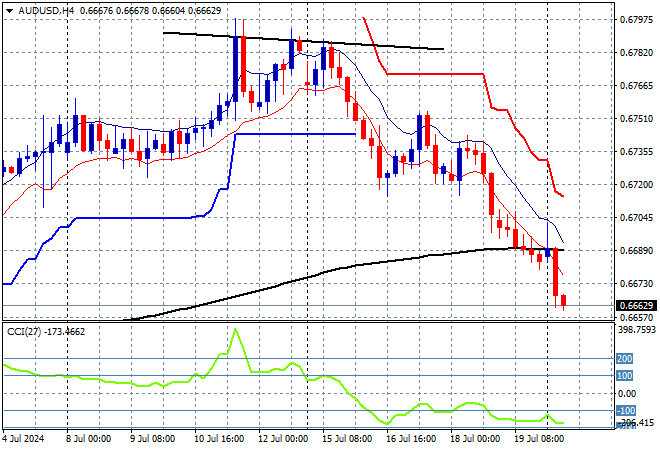

The USD lost significant ground against Yen but is still battering the Australian dollar into submission as it continues to fall below the 67 cent level.

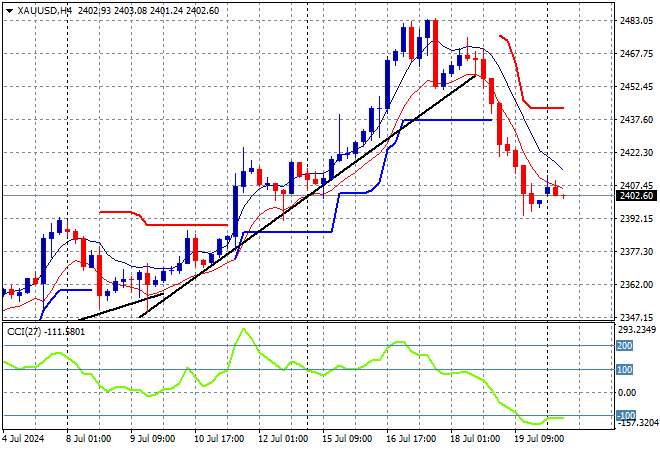

Oil prices are flat with Brent crude unable to push above the $83USD per barrel level while gold has steadied in the opening session after falling sharply on Friday, just hanging on above the $2400USD per ounce level:

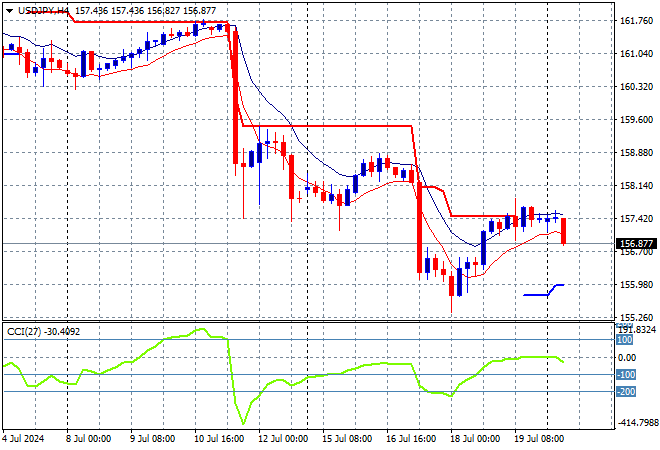

Mainland Chinese share markets are down with the Shanghai Composite off by nearly 1% while the Hang Seng Index is bouncing back after falling most of last week, now up 0.7% to 17554 points. Meanwhile Japanese stock markets are failing to stabilise as Yen appreciates with the Nikkei 225 moving more than 1.3% lower to 39534 points as the USDJPY pair has dropped sharply below the 157 level in afternoon trade:

Australian stocks were unable to claw back their recent losses with the ASX200 down 0.5% to remain below the 8000 point level, closing at 7931 points while the Australian dollar continues its retreat below the 67 cent level next as momentum remains oversold:

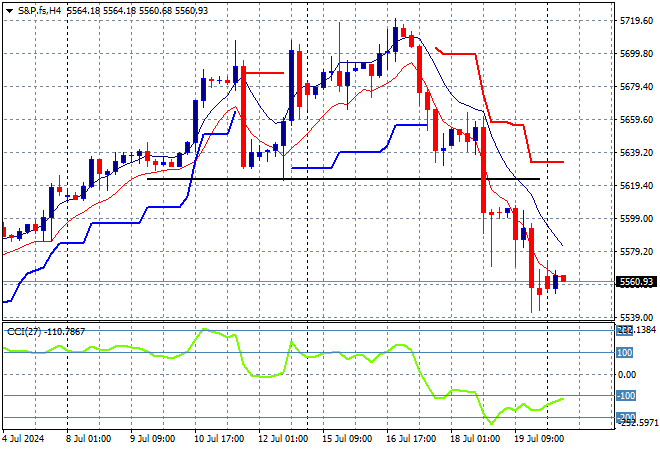

S&P and Eurostoxx futures are flat as we head into the London session with the S&P500 four hourly chart showing price action looking weak below the previous point of control at the 5700 point level with volatility rising – watch out below as more political machinations turn the wheel:

The economic calendar starts the week with an almost empty roster, as all eyes will be on US political turmoil tonight.