Market volatility remains somewhat hesitant with the latest UK inflation figures combined with a jump in Japanese yields is seeing some shifting mood around the risk complex, despite record highs on Wall Street. The USD is continuing to firm after weeks of weakness, although the Kiwi did spike after today’s hawkish RBNZ minutes. The Australian dollar however hasn’t followed along and remains stuck at the 66 cent level.

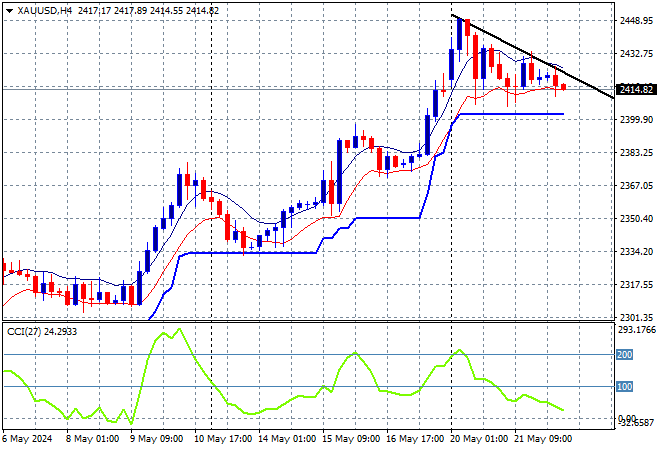

Oil prices are no longer stalling but starting to fall with Brent crude now the $82USD per barrel level while gold is steadying after hitting a new record high at the start of the week, currently just above short term support at the $2410USD per ounce level this afternoon:

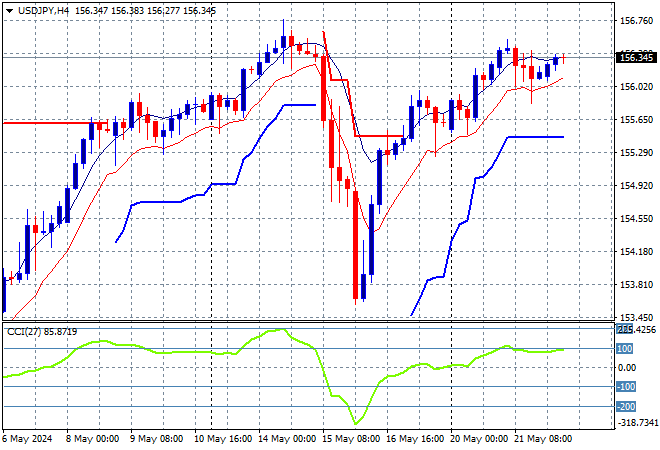

Mainland Chinese share markets are looking to put in a slightly positive session as they go into the close with the Shanghai Composite up by just 0.1% while the Hang Seng Index has risen just 0.3%, barely putting a dent in the previous session slump, currently at 19272 points. Meanwhile Japanese stock markets are doing the worst with the Nikkei 225 closing some 0.8% lower to 38646 points with the USDJPY pair still recovering from its recent reversal as it steadies above the 156 level:

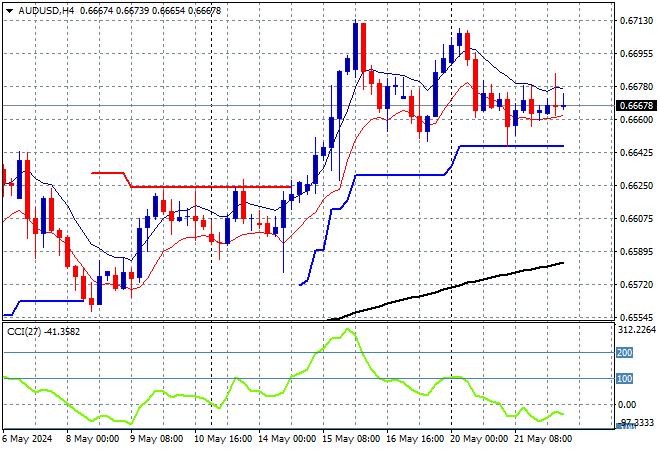

Australian stocks were unable to advance yet again, with the ASX200 falling about 0.1% to 7848 points while the Australian dollar is unchanged at the mid 66 cent level:

S&P and Eurostoxx futures are down and up respectively but only minor, with swings and roundabouts over the higher than expected UK inflation print as we head into the London session. The S&P500 four hourly chart still shows price action stalled out above the 5300 point level:

The economic calendar includes UK inflation and the latest US home sales data.