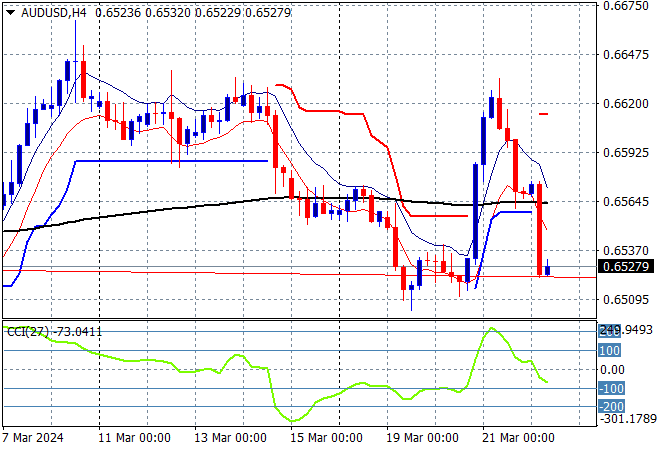

An uneasy final session for Asian share markets after what was a solid overnight showing on Wall Street with the higher USD still weighing on sentiment. The Australian dollar has reversed course fully after looking boisterous previously, now back down towards the 65 handle.

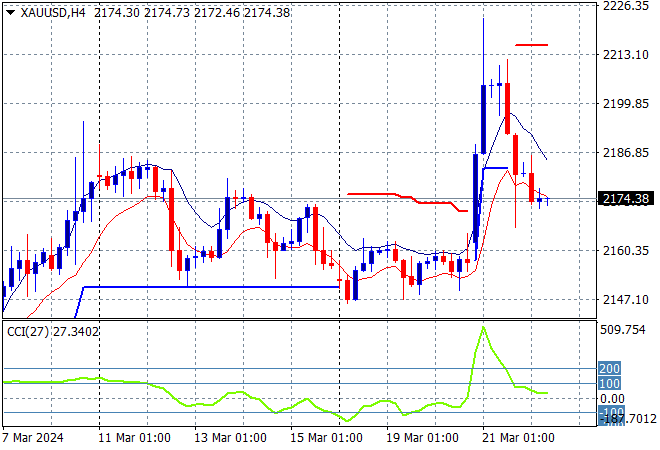

Oil prices are pausing their recent breakout as Brent crude remains well above weekly resistance at the $85USD per barrel level while gold has dissipated somewhat after surging through the $2200USD per ounce level, currently just below $2180:

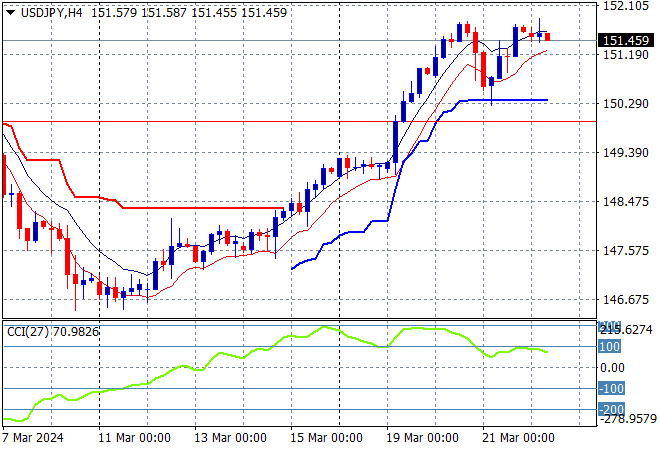

Mainland and offshore Chinese share markets are breaking down after failing to get back on track with the Shanghai Composite off by more than 0.7% while the Hang Seng is down more than 2% at 16418 points. Japanese stock markets were the only bright note in the region, with the Nikkei 225 closing 0.4% higher at 40981 points while the USDJPY pair has steadied after the overnight mild reversal to be just below the mid 151 level:

Australian stocks were the laggards again with a poor showing by the ASX200 which closed 0.1% lower at 7770 points while the Australian dollar is barely holding on above the 65 cent level after the overnight volatility surrounding the SNB and BOE meetings:

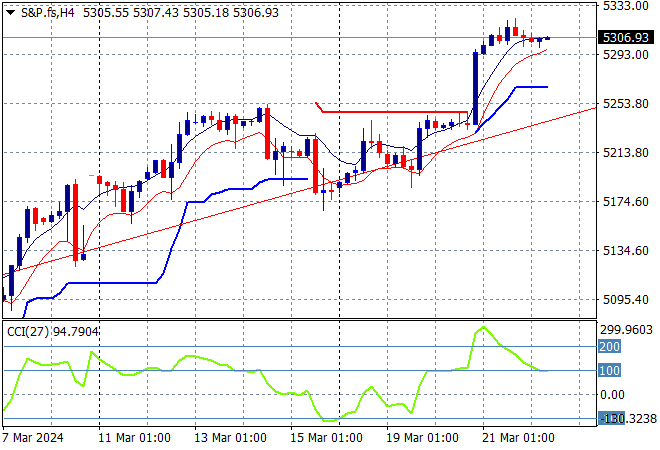

S&P and Eurostoxx futures are trying to extend their overnight gains as we head into the London session with the S&P500 four hourly chart showing price action trying to get above the 5300 point level with short term support shoring up:

The economic calendar finishes the trading week with a few Fed speeches and not much else.