Asian share markets are starting to lift together – except local stocks – with Japanese markets playing catchup to the post NY rally in Chinese stocks while futures are looking promising for overnight markets. The USD is still pulling back against most of the major currency pairs, while the Australian dollar is pushing higher above the 65 cent level to remain at a two week high.

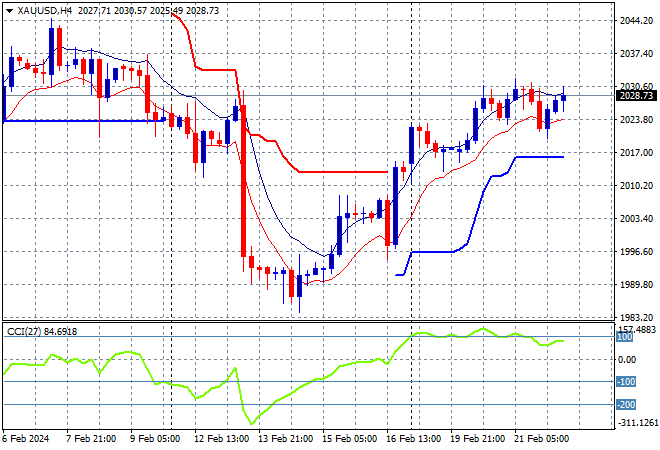

Oil prices are still on trend but are now struggling to hold on to their nascent gains from last week with Brent crude just above the $83USD per barrel level while gold wants to advance through the $2030USD per ounce level but is hitting short term resistance:

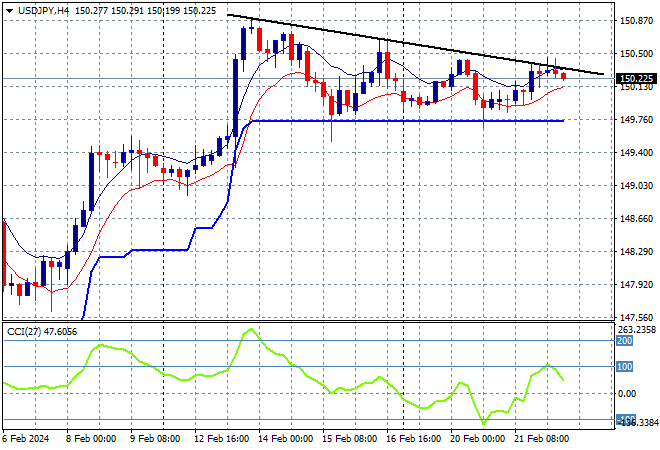

Mainland and offshore Chinese share markets are continuing their post break rally with the Shanghai Composite up 1.2% while the Hang Seng is up nearly 1% to 16651 points. Japanese stock markets are playing catchup with a big rally as the Nikkei 225 closes 2.2% higher at 39098 points while the USDJPY pair is hovering above the 150 handle:

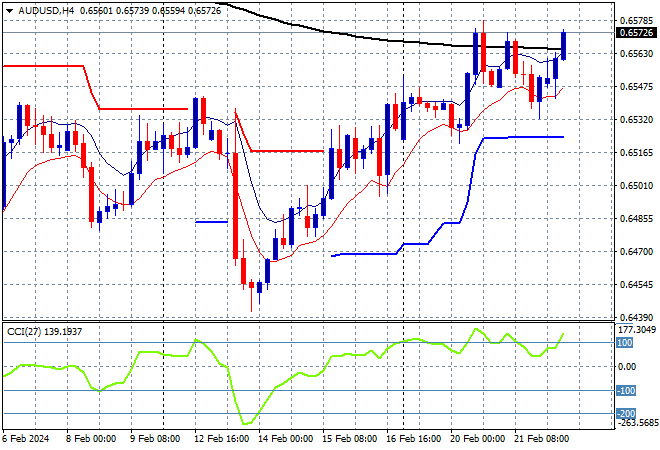

Australian stocks range are flat with the ASX200 closing just above the 7600 point level while the Australian dollar has pushed back to its recent high above the mid 65 cent level:

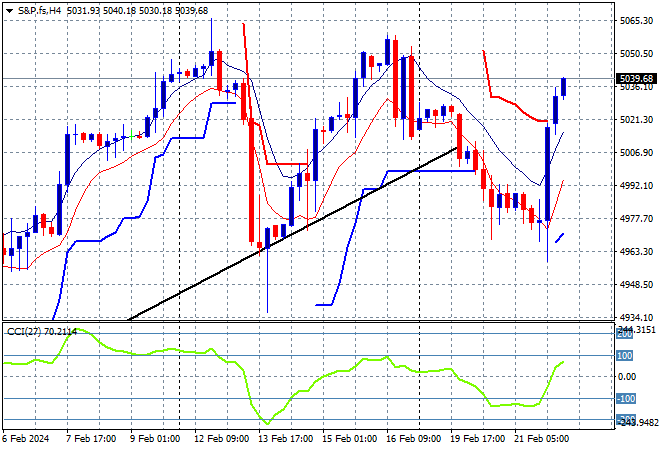

S&P and Eurostoxx futures are bouncing back sharply from their recent lows and looking a lot better going into the London session with the S&P500 four hourly chart showing price action wanting to really return above the 5000 point level:

The economic calendar includes a slew of manufacturing PMI prints, plus Euro core inflation and US initial jobless claims.