The USD is continuing to support risk markets with further slides overnight although European shares were sidelined as Wall Street finally managed better gains. The Australian dollar pushed through its previous monthly high at the 65 cent level as Euro continued its strong breakout above the 1.09 handle.

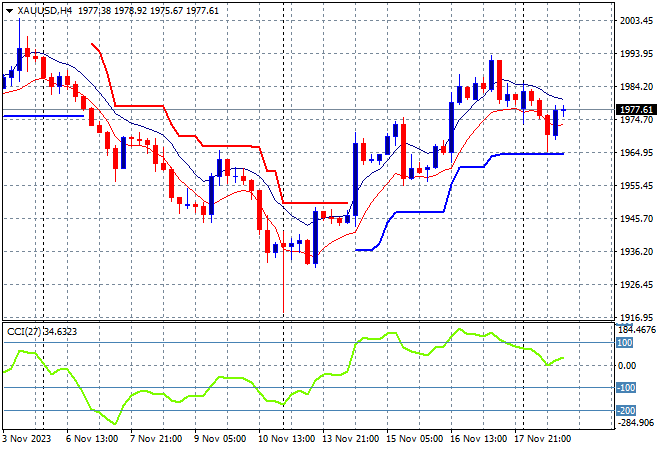

US bond markets saw yields range trading with 10 year Treasuries unchanged at the 4.4% level as oil prices continued their relatively minor bounceback as Brent crude pushed slightly above its monthly low at the $82USD per barrel level. Gold was the undollar standout, unable to hold on with a minor falls as it still fails to get back above the $2000USD per ounce level, consolidating around the $1980 level.

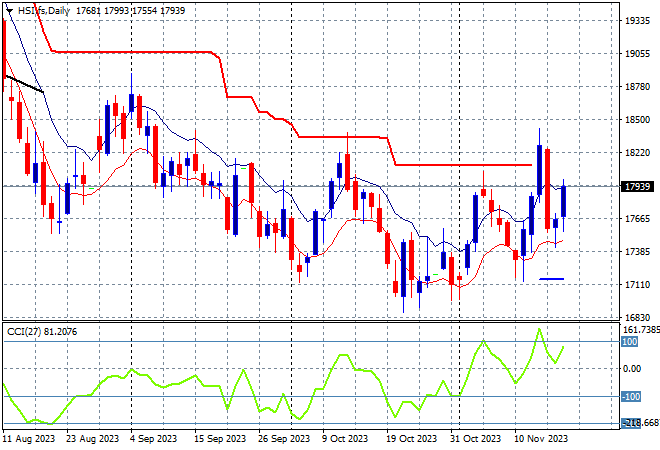

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets kept on to solid gains after the long lunch break with the Shanghai Composite up more than 0.4% to 3067 points while in Hong Kong the Hang Seng Index has reversed its Friday session slide, up more than 1.7% to 17778 points.

The daily chart was showing a significant downtrend that had gone below the May/June lows with the 19000 point support level a distant memory as medium term price action remains stuck in the 17000 point range. Daily momentum readings are retracing back to positive settings despite Friday’s reversal with the potential for a fill in rally here towards the ATR resistance at the 18000 point level:

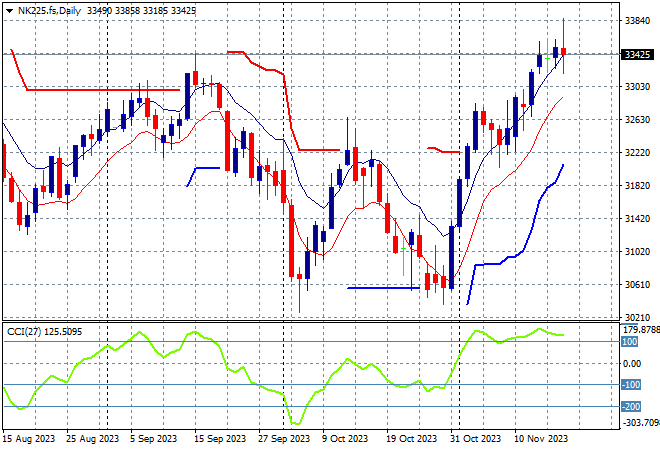

Japanese stock markets however had the worst sessions in the region with the Nikkei 225 losing more than 0.6% to 33338 points.

Trailing ATR daily support is a long way below the current bounce that has now exceeded the September highs at the 33000 point level with daily momentum also in the overbought zone but not over-extended. I’m watching correlations with Wall Street and Yen to see if there is more upside here:

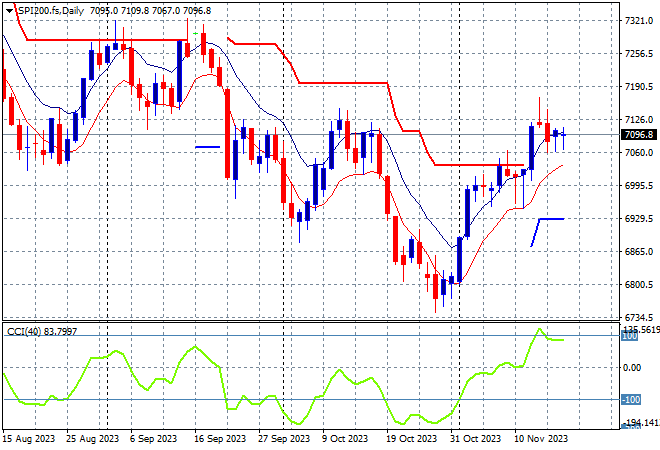

Australian stocks weren’t able to translate positive momentum into anything substantial with the ASX200 closing just 0.1% higher at 7058 points.

SPI futures remain optimistic with a 0.3% gain expected on the open because of the better finish on Wall Street so we should see the 7000 point level firm as daily support this trading week. The daily chart is trying to look more optimistic here in the medium term with short term price action filling a hole against the tide:

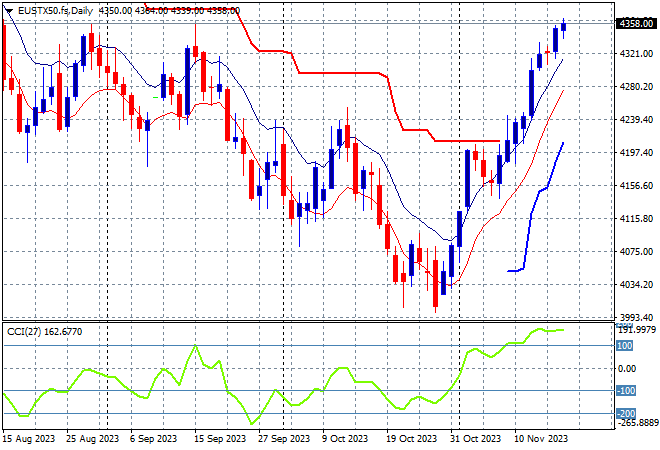

European markets were unable to find more positive momentum following Friday’s session with the Eurostoxx 50 Index putting in a scratch result to finish just 0.1% higher at 4342 points.

The daily chart shows weekly resistance at the 4300 point resistance level nearly taken out with this large bounce setting up for further gains if that level is pushed aside proper. Support at the 4250 level should be quite firm on any pullback but I’m watching the much higher Euro possibly providing a headwind as the week progresses:

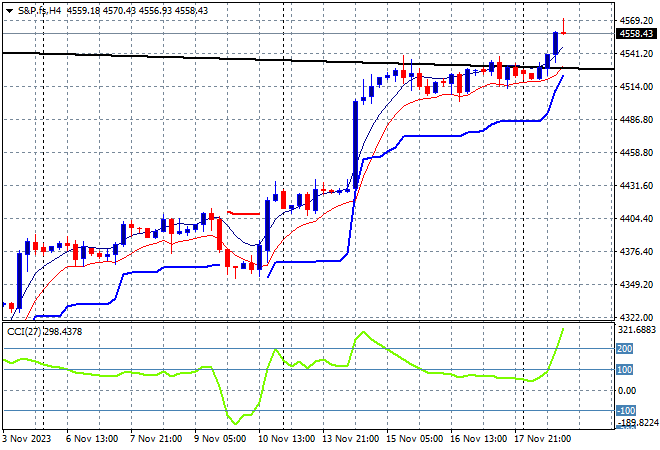

Wall Street however overshadowed with big gains across the board as the NASDAQ finished more than 1% higher while the S&P500 lifted 0.7% to finish at 4546 points.

Short term momentum is now really getting overextended after last week’s rally as price action bounced strongly off the recent low at the 4100 point level. There is not much potential for a retracement back to trailing ATR support on the four hourly chart back down to the 4360 point level to take some heat out of this:

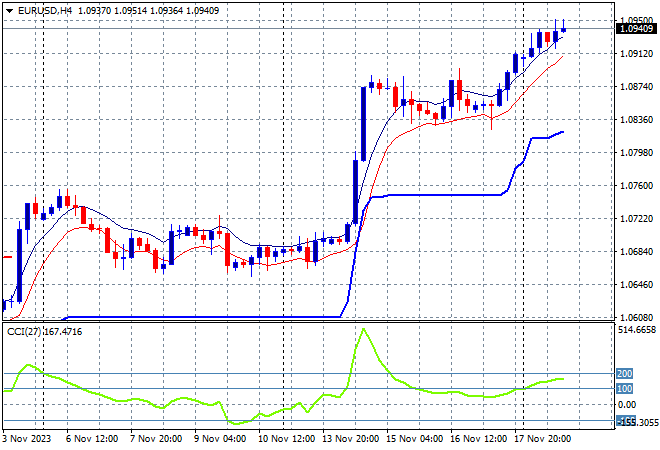

Currency markets continue to push back against USD in the wake of the previous CPI print, with King Dollar back at its September low on the DXY as Euro maintains its level above previous short term resistance at the 1.09 handle that broke on Friday night.

The current consolidation was after the union currency was able to fend off more Fedspeak in recent weeks and remain in a bullish, albeit neutral condition. Support at the recent weekly lows around the 1.06 level was not tested with new short term support upgraded to the 1.07 mid level at a minimum:

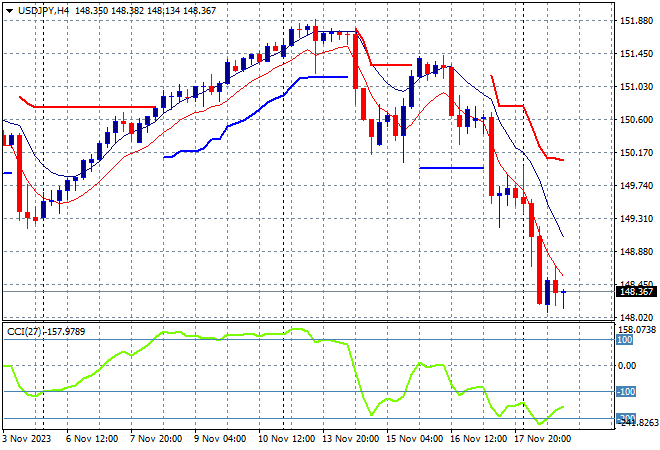

The USDJPY pair continues to fall, surpassing the start of November lows with a drop below the 149 handle overnight and brief consolidation this morning after the NY session.

Four hourly momentum has reverted to nearly extreme oversold settings on the lower USD with price action suggesting a possible pause here but that is being kind as the floodgates seemed to be open on increased volatility. Watch out for a test of the 148 handle next:

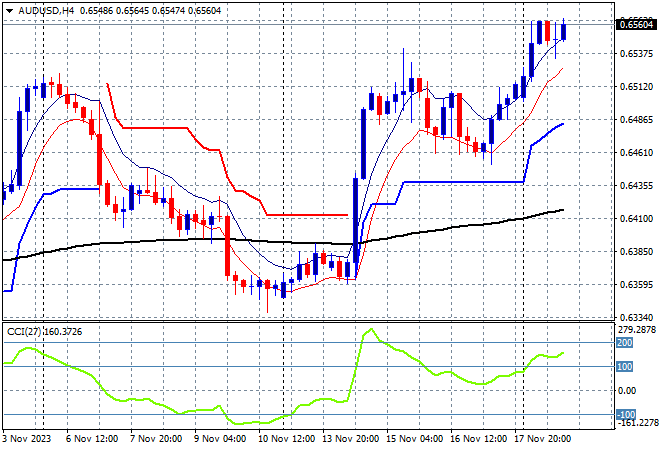

The Australian dollar continues to take advantage of the weaker USD with a strong breakthrough of weekly highs overnight, bursting through the mid week sneaky peek as it goes past the mid 65 cent level.

The Pacific Peso remains under medium and long term pressure but was able to test the mid 63 level following the RBA’s recent rate hike with momentum now overbought and looking very positive as we continue this new trading week, but watch for a potential pullback to the 65 handle proper:

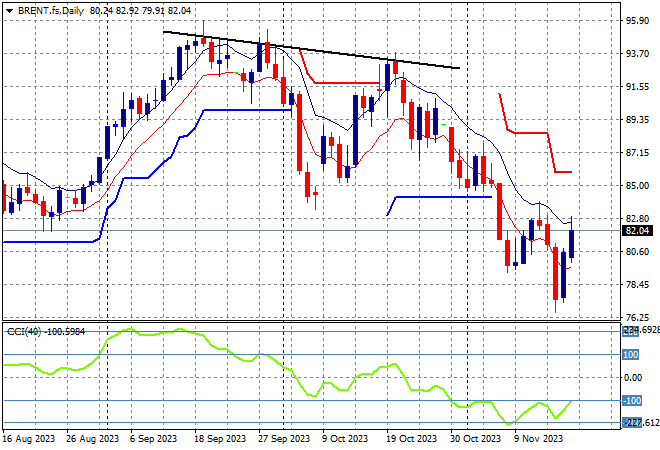

Oil markets remain in flux with the growing conflict in the Middle East and potential OPEC cuts adding to volatility with a small follow through of the rebound on Friday night with Brent crude up to just above the $82USD per barrel level.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout. Daily momentum is still in oversold settings with this failed test of support at the August level setting up for further falls below:

Gold pulled back slightly overnight despite the weaker USD across the undollar complex with the shiny metal retracing back below the $1980USD per ounce level.

Daily support is building again here as the four hourly chart shows short term resistance still looming at the $2000 level again: