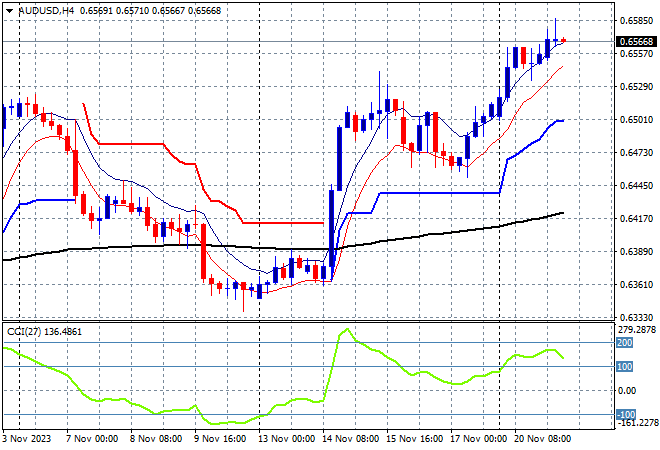

Asian share markets are mostly in a positive mood following a solid session on Wall Street overnight as King Dollar continues to retreat, making a new three month low versus the Chinese Yuan while the Australian dollar holds on to its new monthly high above the 65 cent level.

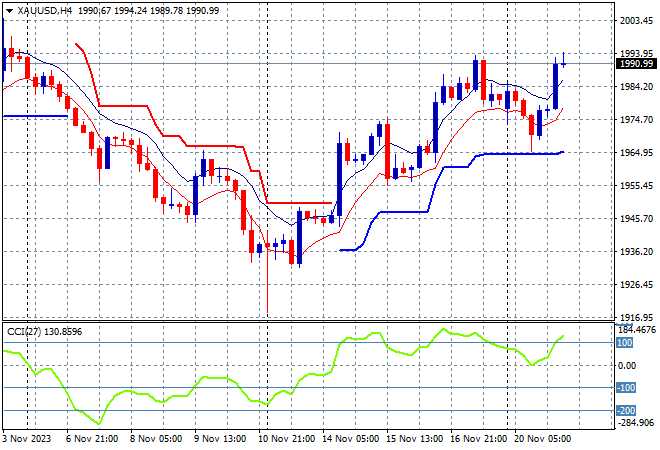

Oil prices are trying to stabilise, with Brent crude retracing slightly below the $82USD per barrel level while gold is consolidating at the $1990USD per ounce level, shoring up short term support:

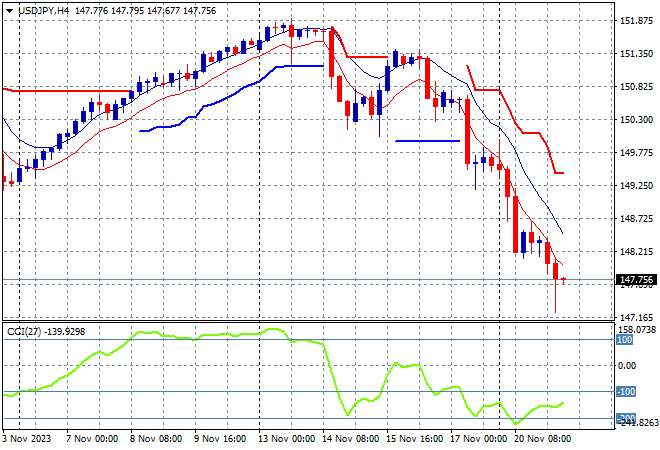

Mainland Chinese share markets were heading higher after the long lunch break but the Shanghai Composite has given up most of those gains to be flat at 3067 points while in Hong Kong the Hang Seng Index has held on with a 0.3% lift to 17835 points. Japanese stock markets continue to feel the weight of a stronger Yen with the Nikkei 225 losing another 0.2% to 33354 points while the USDJPY pair continues its breakdown to breach the 148 level:

Australian stocks were able to translate positive momentum into something substantial with the ASX200 closing 0.3% higher at 7078 points while the Australian dollar has held well above the mid 65 cent level at a new monthly high:

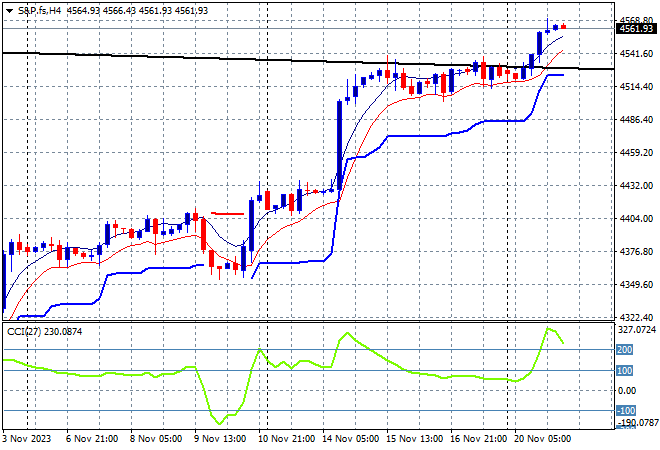

S&P and Eurostoxx futures are holding steady going into the London open as the S&P500 four hourly chart shows support firming at the 4500 point level as price action continues to move up a series of large steps following the recent rebound above the 4300 point level:

The economic calendar includes the latest Canadian inflation figures then the release of the recent FOMC meeting minutes.