The latest Japanese CPI print was the highlight of the last trading session in Asia with a slightly softer than expected print still seeing Yen extend its losses to multi decade lows. Volatility is expected on Wall Street tonight due to timing issues with futures so watch out for a potentially mixed return over the weekend gap. The Australian dollar is still hovering just below the 67 cent level.

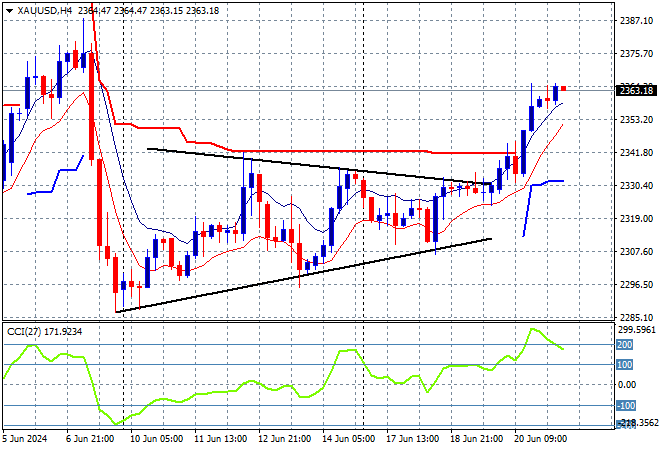

Oil prices are holding on to their recent gains with Brent crude well above the $85USD per barrel level while gold has held on to its breakout above resistance, currently beyond the $2360USD per ounce level:

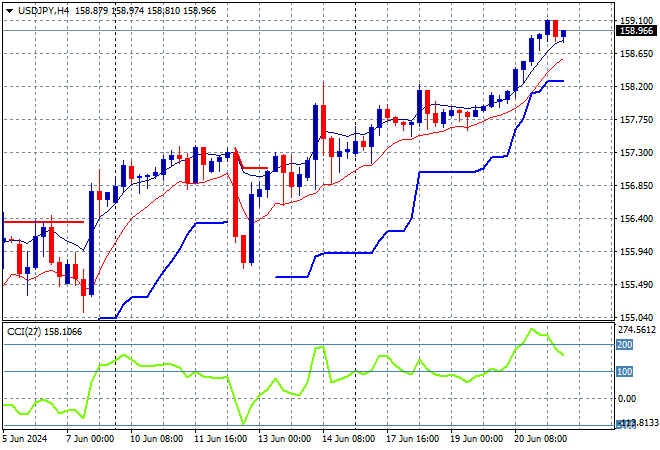

Mainland Chinese share markets are falling again with the Shanghai Composite down some 0.3% going into the close while the Hang Seng Index has given up a lot of its recent gains, down 1.6% to 18034 points. Meanwhile Japanese stock markets are failing to get out of their holding pattern with the Nikkei 225 down just 0.1% at 38596 points as the USDJPY pair consolidates above the 158 level after making another record high:

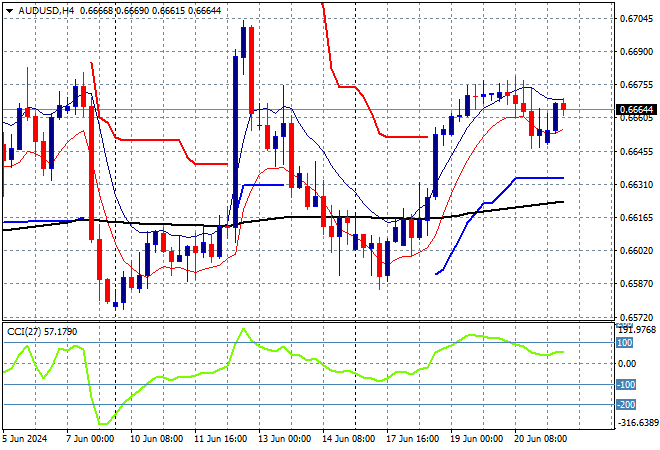

Australian stocks were the only ones to make any gains, with the ASX200 closing 0.3% higher to 7796 points while the Australian dollar has retreated ever so slightly to be just above the mid 66 cent level:

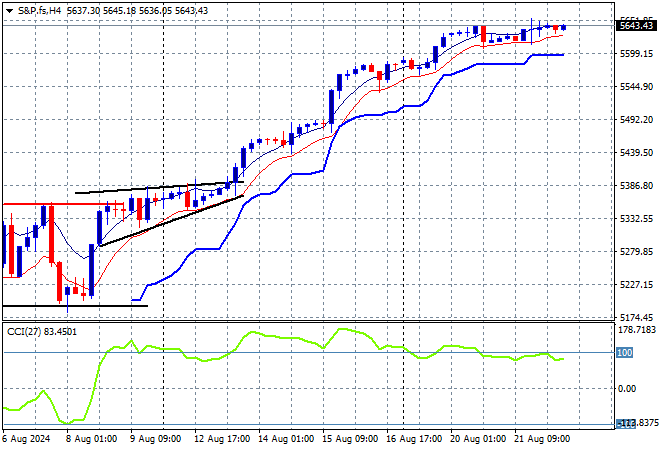

S&P and Eurostoxx futures are both down marginally as we head into the London session with the S&P500 four hourly chart showing price action holding after last nights pullback as the 5500 point level comes into play as support:

The economic calendar finishes the trading week with a slew of flash PMI surveys across Europe and the US tonight.