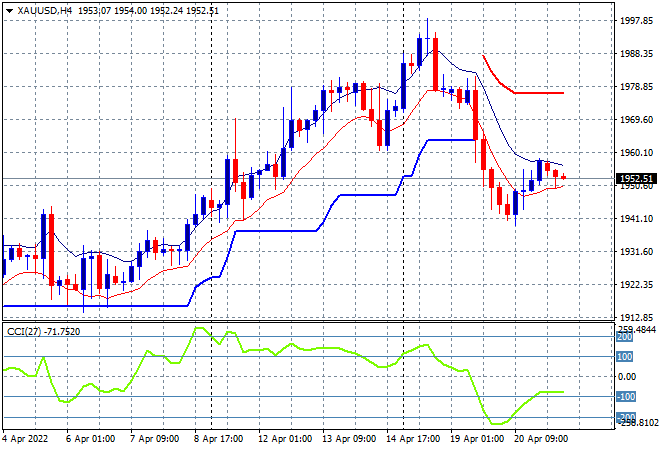

Its another diversion in risk taking today with Asian stock markets going bullish and bearish in nearly equal fashion. Mainland and offshore Chinese markets are selling off sharply once again, while Japanese bourses are lifting as Yen remains weak against USD. The Australian dollar has paused its bounce back, running out of puff above the 74 cent level versus USD, while oil markets are trying to stabilise again after the recent overnight 5% drop with Brent crude just below the $110USD per barrel level. Gold is also struggling following the recent profit taking selloff, somewhat stable at the $1950USD per ounce level but daily momentum is about to turn negative:

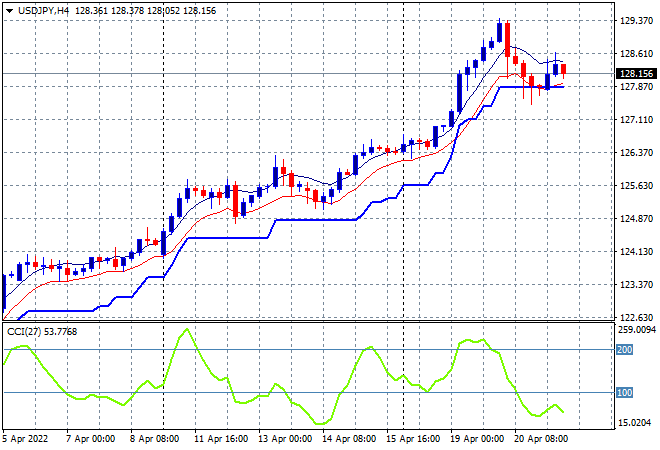

Mainland Chinese share markets are selling off sharply in the wake of COVID tensions, with the Shanghai Composite closing some 2% lower at 3087 points while the Hang Seng Index has followed suit, down 1.8% to 20570 points. Japanese stock markets continue to bounce higher, with the Nikkei 225 closing 1.2% higher at 27553 points while the USDJPY pair has settled down finally, still holding just above the 128 handle as price action hovers at trailing short term ATR support:

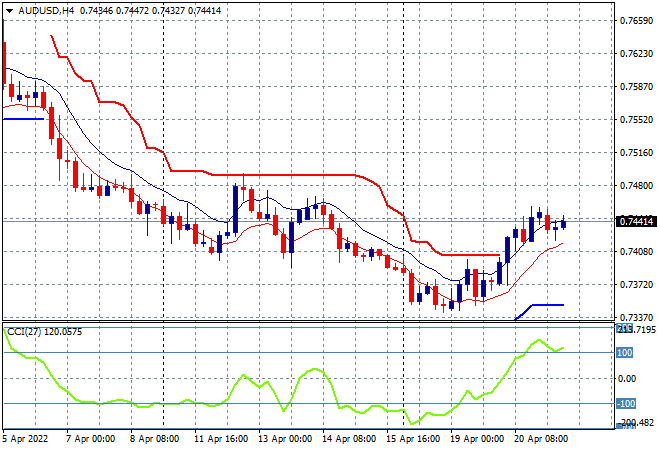

Australian stocks had a solid session with the ASX200 breaking through the 7600 point barrier to close 0.5% higher at 7604 points. Meanwhile the Australian dollar has not followed through on its recent bounceback, stalled above the 74 handle as a classic swing long play for now runs out of puff:

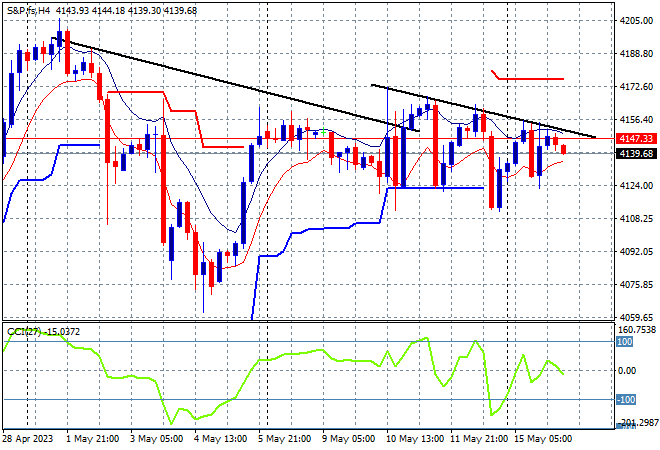

Eurostoxx and Wall Street futures are again just holding on to their overnight finishing points with the S&P500 four hourly chart still sniffing for a continuation of the breakout above ATR overhead resistance as momentum stays overbought with price action just above last week’s intrasession high:

The economic calendar finally ramps up tonight with the latest Euro core inflation print, some BOE speeches and then US initial jobless claims with a couple speeches by Fed Chair Powell in the mix.