Asian share markets are in a very good mood after absorbing the overnight Federal Reserve meeting that saw the USD slump against the majors and keep equity risk afloat. Australian stocks got out of their funk while the Australian dollar is also looking boisterous despite the recent employment numbers, crossing back above the 65 handle.

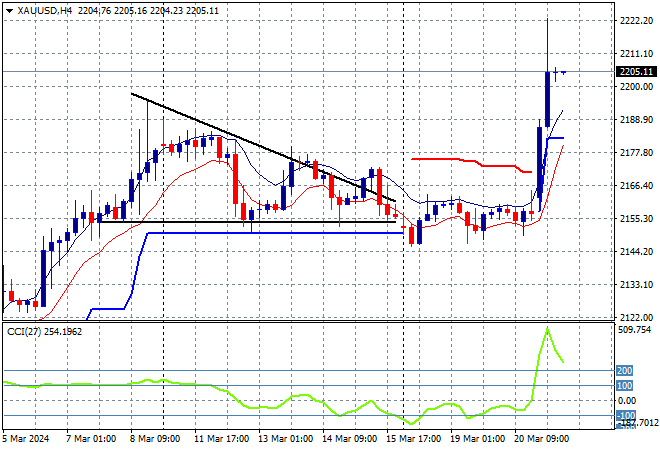

Oil prices are pausing their recent breakout as Brent crude remains well above weekly resistance at the $86USD per barrel level while gold has flared right through the $2200USD per ounce level:

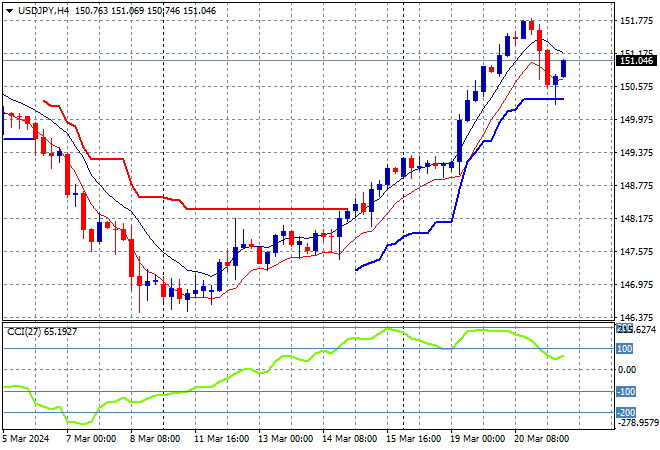

Mainland and offshore Chinese share markets are trying to get back on track with the Shanghai Composite closing dead flat while the Hang Seng is up more than 2% at 16909 points. Japanese stock markets were the big movers again with the Nikkei 225 also closing more than 2% higher at 40815 points while the USDJPY pair has bounced back slightly following the overnight mild reversal to be just above the 151 level:

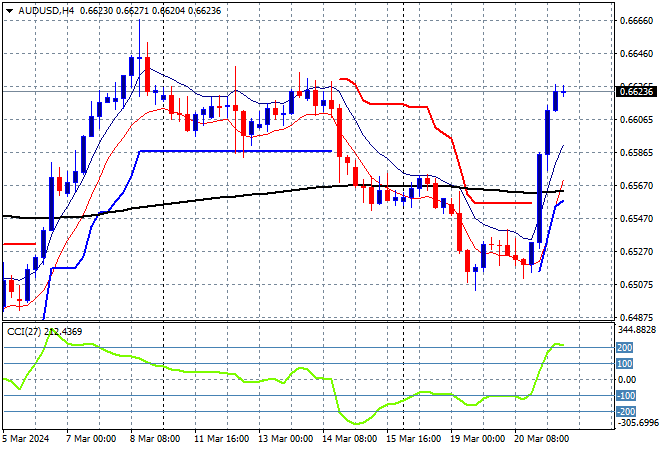

Australian stocks were the laggards again but its all relative as the ASX200 gained more than 1% to close at 7781 points while the Australian dollar is holding on with a small peekaboo above the 66 cent level after its overnight reversal due to the Fed:

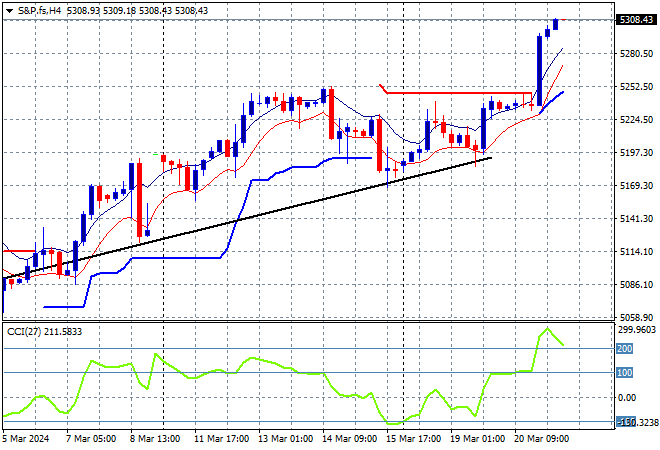

S&P and Eurostoxx futures are trying to extend their overnight gains as we head into the London session with the S&P500 four hourly chart showing price action trying to get above the 5300 point level with short term support shoring up:

The economic calendar will include some flash PMI prints in Europe but all eyes will now be on the Bank of England (BOE) after last night’s Fed meeting.