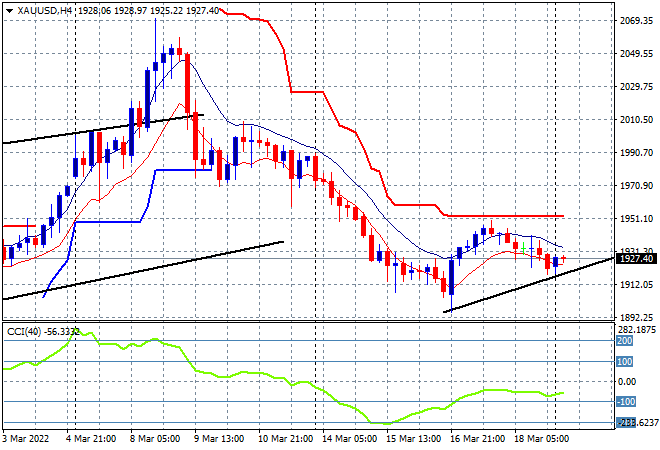

Asian stock markets are starting the trading week in mixed fashion, unable to gain traction after some strong moves on Friday night on Wall Street that did lift risk sentiment somewhat. The USD is remaining strong against most of the majors, particularly Yen although Aussie is treading water as commodity prices come back. Oil prices are on the rise again with both WTI and Brent crude advancing well past the $100USD per barrel levels as gold can’t seem to make headway here as it continues to deflect off of short term resistance at the $1950USD per ounce level:

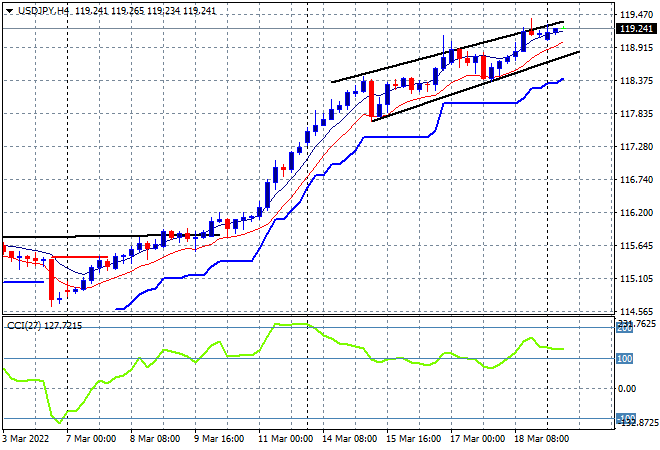

Mainland Chinese shares are again pausing their sharp bounceback with the Shanghai Composite currently down 0.7% to be just above 3200 points while the Hang Seng Index is off a similar amount, down 0.5% at 21306 points. Japanese stock markets are closed for yet another holiday as the USDJPY pair remains on track in a tighter flag pattern, keeping above the 119 handle:

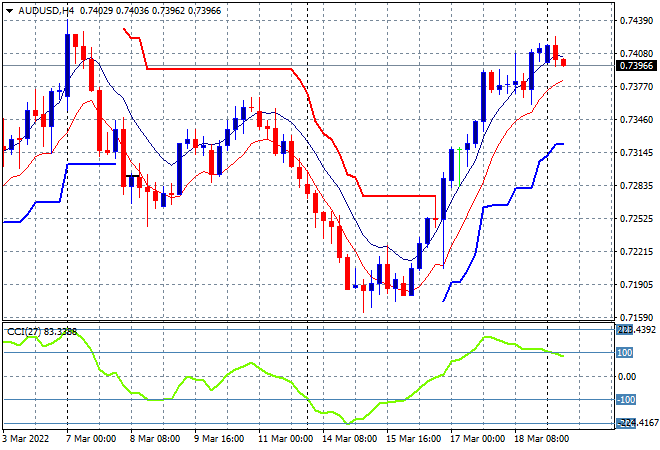

Australian stocks were looking good to start with but have died off in the close, with the ASX200 down 0.2% to 72 78points. Meanwhile the Australian dollar is treading water after briefly touching the 74 handle on Friday night, sitting here just under the previous weekly high:

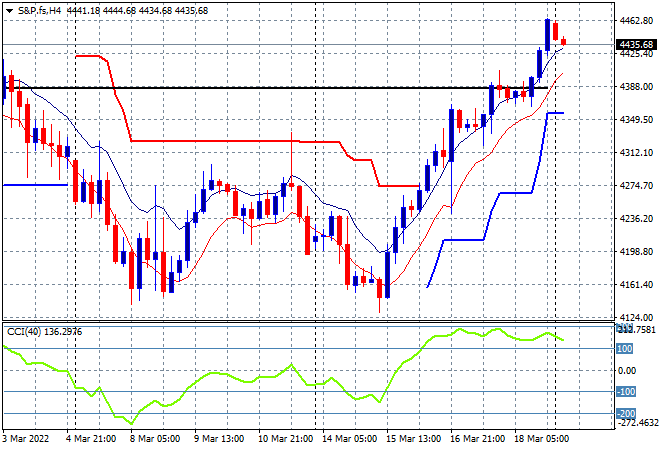

Eurostoxx and Wall Street futures have pulled back slightly with the S&P500 four hourly chart showing some heat taken out following Friday night’s surge. Resistance here at the 4400 point level has been taken out however, so it should act as short term support going forward:

The economic calendar starts the week with two speeches to watch out for – ECB President Lagarde and Fed Chair Powell.