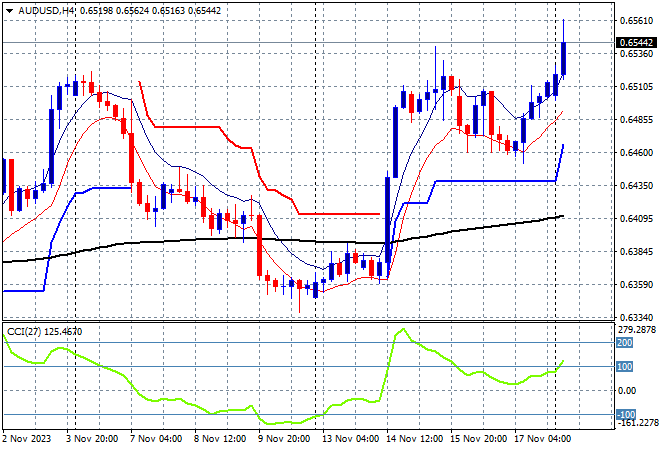

Asian share markets are mostly in a positive mood despite a wobbly Wall Street on Friday night as King Dollar continues to retreat, making a new three month low versus the Chinese Yuan while the Australian dollar puts in a new monthly high above the 65 cent level.

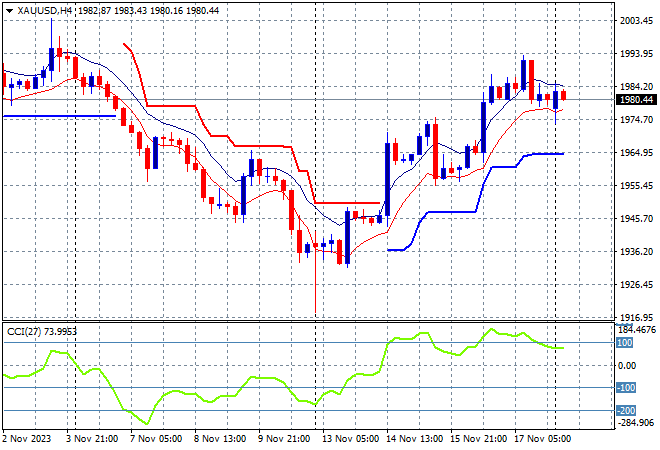

Oil prices are trying to stabilise, with Brent crude climbing slightly above the $80USD per barrel level while gold is consolidating at the $1980USD per ounce level, shoring up short term support:

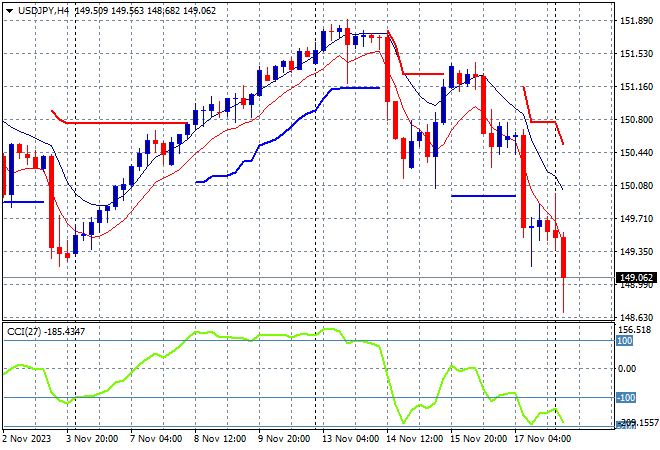

Mainland Chinese share markets are heading higher after the long lunch break with the Shanghai Composite up more than 0.4% to 3067 points while in Hong Kong the Hang Seng Index has reversed its Friday session slide, up more than 1.7% to 17758 points. Japanese stock markets however had the worst sessions with the Nikkei 225 losing more than 0.3% to 33473 points while the USDJPY pair continues its breakdown to almost breach the 149 level:

Australian stocks weren’t able to translate positive momentum into anything substantial with the ASX200 closing just 0.1% higher at 7058 points while the Australian dollar has spiked well above the 65 cent level to make a new monthly high:

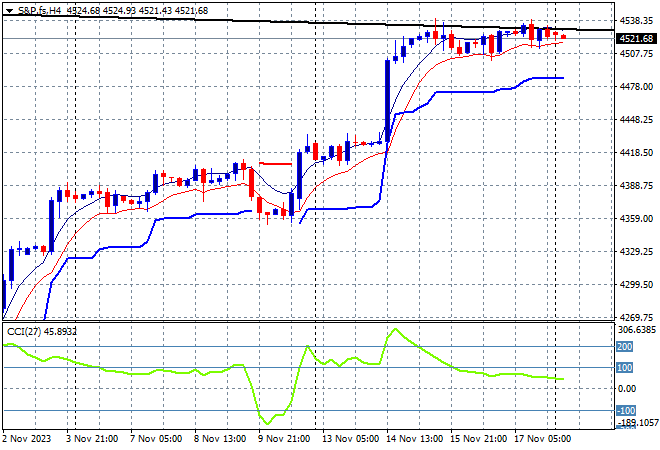

S&P and Eurostoxx futures are holding steady going into the London open as the S&P500 four hourly chart shows support firming at the 4500 point level as price action continues to move up a series of large steps following the recent rebound above the 4300 point level:

The economic calendar includes a few Treasury auctions and not much else to start the trading week quietly.