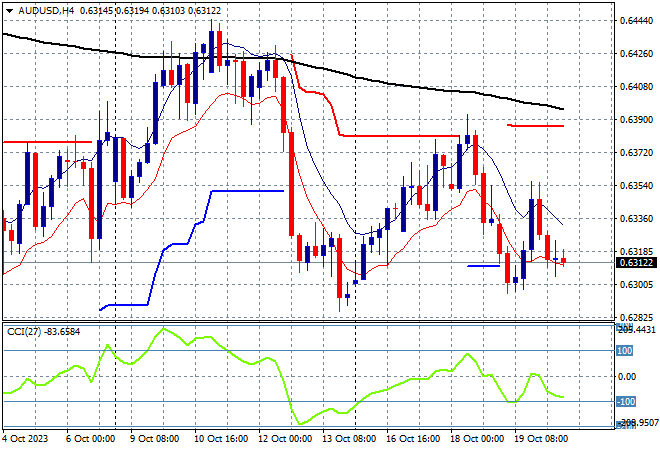

Asian share markets are trading lower across the board as risk aversion continues amid renewed focus on the Middle East with a jumble of safe haven buying in USD and selling off of bonds as 10 year Treasuries approach the 5% yield level. The Australian dollar dropped back to the 63 cent level despite higher commodity prices.

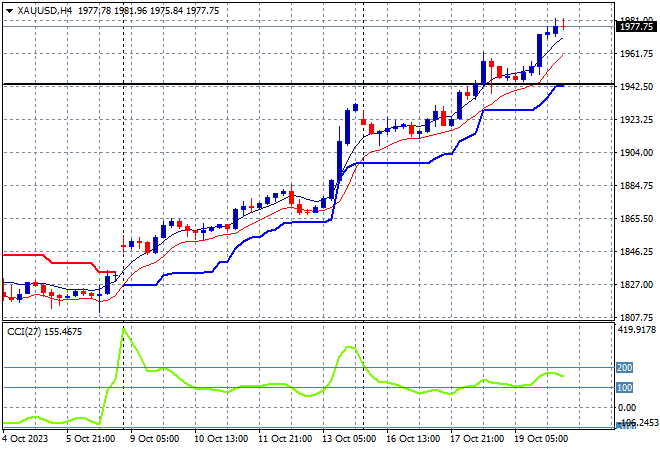

Oil prices are holding on to their recent breakout gains, with Brent crude consolidating above the $93USD per barrel level while gold is not giving back anything with what looks like a run to the $2000USD per ounce level at a new monthly high:

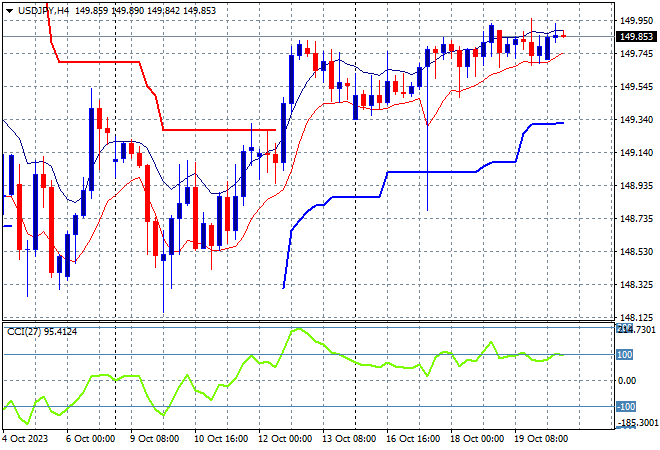

Mainland Chinese share markets have dropped back sharply with the Shanghai Composite down 0.8% going into the close at 2980 points while in Hong Kong the Hang Seng Index is off slightly less, finishing 0.5% lower at 17211 points. Japanese stock markets were able to put in mild scratch sessions with the Nikkei 225 closing just 0.2% lower at 31367 points. Trading in the USDJPY was somewhat muted but still holding just below the 150 level:

Australian stocks were again unable to escape the selling with the ASX200 closing 1.1% lower at 6900 points, completing the break below at 7000 points in the previous session while the Australian dollar fell back down to the 63 handle again, almost making a new weekly low in the process:

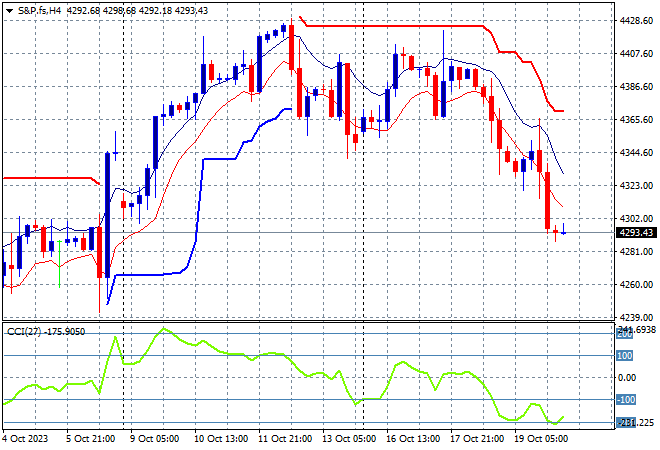

S&P and Eurostoxx futures are looking down going into the London open as the S&P500 four hourly chart shows support crumbling at the 4300 point level as short term momentum remains very negative:

The economic calendar finishes the trading week with UK retail sales and a view more Fed speeches.