Asian stock markets are mixed yet again as local stocks went flat on the stronger than expected employment numbers while Yuan soared higher on PBOC macroprudential moves, sending mainland stocks lower. The USD lagged a little against against most of the majors after last night’s Eurozone and Brexitland inflation print sent Euro lower while the Australian dollar pushed back above the 68 cent level on the strong unemployment print.

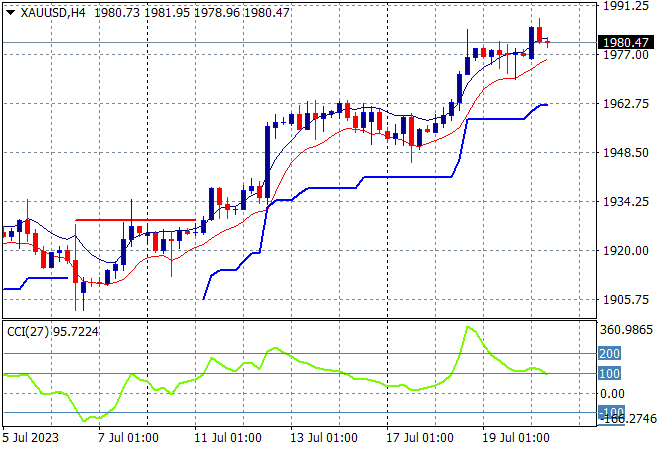

Oil prices are not moving any higher with resistance starting to build with Brent crude just above the $79USD per barrel level while gold is in still inflating, pushing above the $1980USD per ounce level:

Mainland Chinese share markets are still in deflation mode with the Shanghai Composite about to finish some 0.6% lower at 3171 points while in Hong Kong the Hang Seng Index is trying to rebound after its recent selling, up 0.3% to 19016 points.

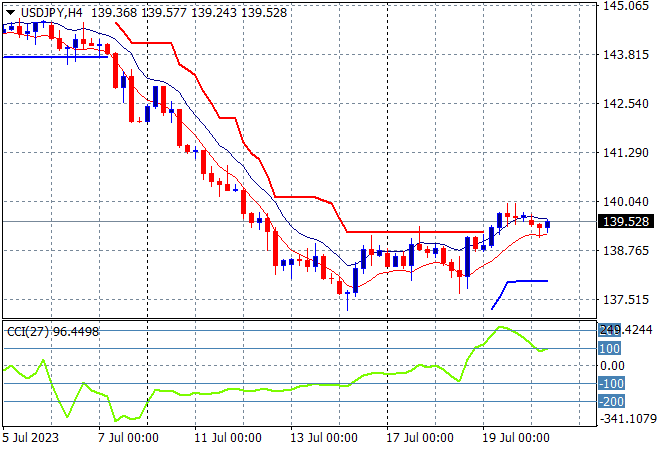

Japanese stock markets however are going the other way with the Nikkei 225 closing more than 1% lower at 32492 points while the USDJPY pair was trying to convert its recent breakout above the 139 level into something more sustainable but is holding the line here:

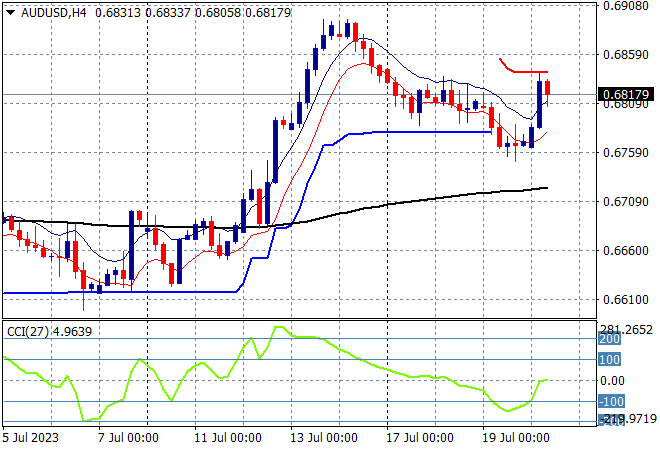

Australian stocks are putting a flat session given the upside employment figure surprise with the ASX200 closing where it started at 7325 points. The Australian dollar jumped on the solid numberwang print to burst through the 68 handle, restoring all of this week’s lost ground in one session – but can it keep it going into tonight’s session:

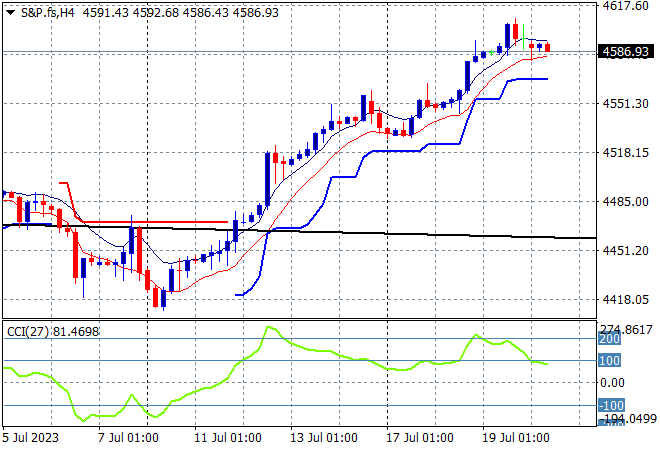

Eurostoxx and S&P futures are down 0.1 to 0.2% respectively as the S&P500 four hourly chart still shows price action wanting to extend above the 4500 point level which had been staunch resistance before the series of soft CPI and PPI inflation prints last week:

The economic calendar will only be looking at US initial jobless claims tonight.