With Wall Street returning from its mid week holiday tonight, risk taking has reduced across most markets with Asian stocks mixed or lower across the region. Local stocks are just holding on to their post RBA hold gains with the Australian dollar still hovering just below the 67 cent level.

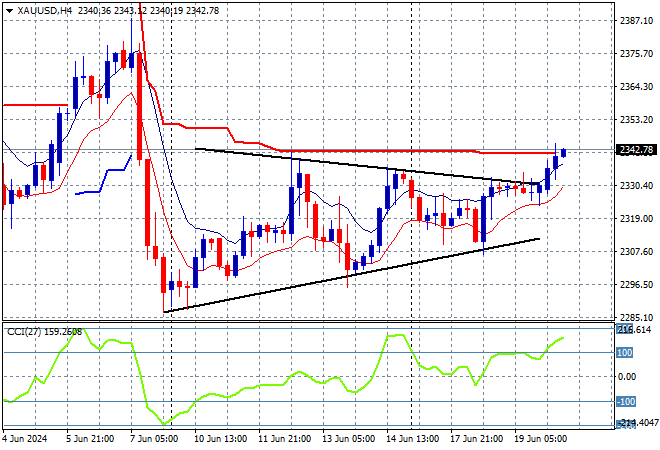

Oil prices are holding on to their recent gains with Brent crude just above the $85USD per barrel level while gold has finally lifted above its recent resistance level to break out above the $2340USD per ounce level:

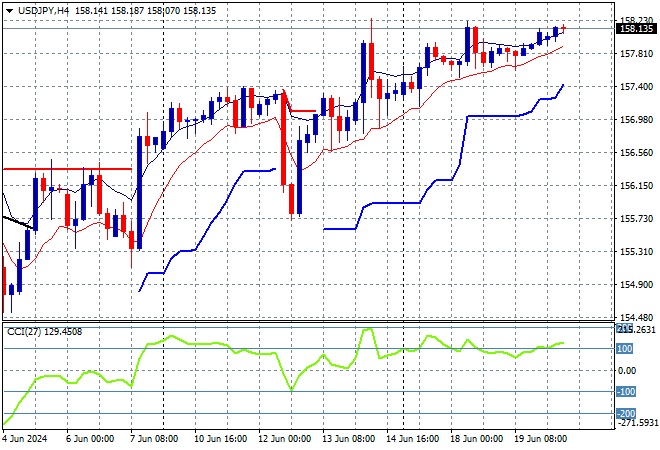

Mainland Chinese share markets are falling again with the Shanghai Composite down some 0.4% going into the close while the Hang Seng Index has given up some of its recent gains, down 0.6% in afternoon trade, currently at 18319 points. Meanwhile Japanese stock markets are failing to get out of their holding pattern with the Nikkei 225 up just 0.1% at 38633 points as the USDJPY pair is now above the 158 level after recently matching its previous weekly high:

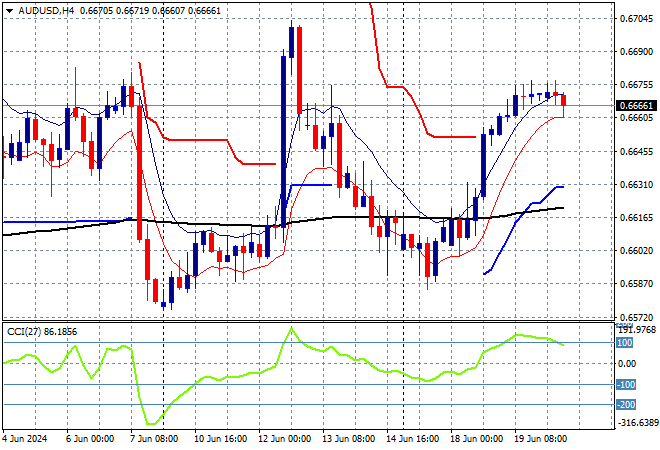

Australian stocks were unable to make any gains, with the ASX200 closing flat at 7769 points while the Australian dollar has retreated ever so slightly to be just above the mid 66 cent:

S&P and Eurostoxx futures are both up marginally as we head into the London session with the S&P500 four hourly chart showing price action holding after last nights breakout with yet another step up higher forming:

The economic calendar tonight includes the latest BOE interest rate meeting, then US building permits.