Market volatility is starting to spike around the reaction to the death of the Iranian president, with most European markets actually closed for a bank holiday adding to the potential slippage overnight. Asian stock markets were all positive however with commodities rising as well to new highs. Meanwhile the USD is continuing its retreat against the majors, with the Australian dollar matching its previous weekly high above the 67 cent level.

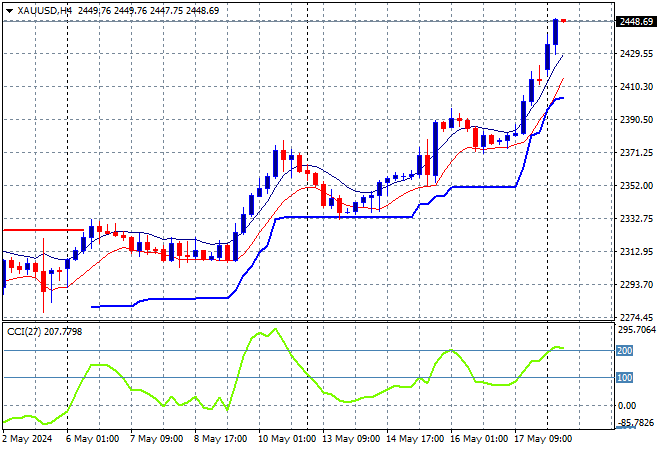

Oil prices are lifting strongly with Brent crude now above the $84USD per barrel level while gold is pushing to a new record high well above the $2450USD per ounce level this afternoon:

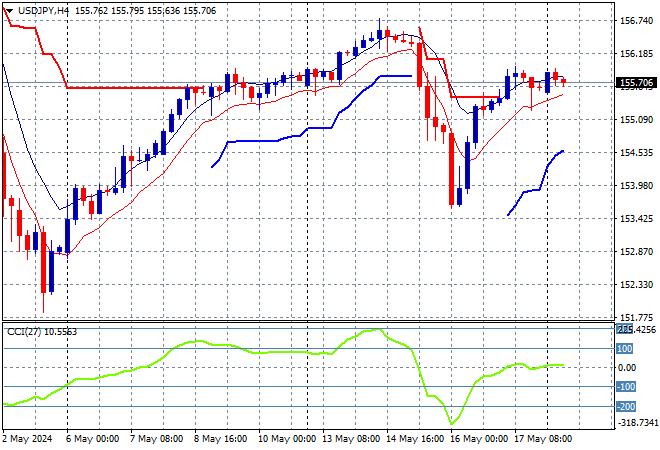

Mainland Chinese share markets have held on to their initial gains going into the close with the Shanghai Composite up 0.5% while the Hang Seng Index is up about the same to 19641 points. Meanwhile Japanese stock markets are doing even better with the Nikkei 225 up 0.6% to 39035 points with the USDJPY pair still trying to recover from its recent reversal as it steadies at the mid 155 level:

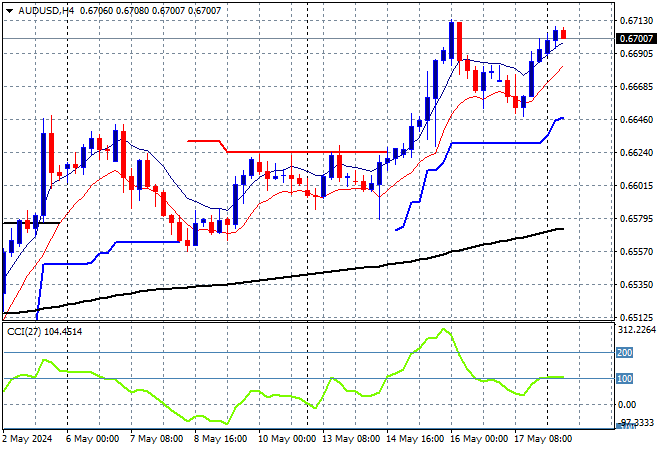

Australian stocks are doing well in line with the rest of the region with the ASX200 up 0.5% to 7862 points while the Australian dollar has returned to just above the 67 cent level:

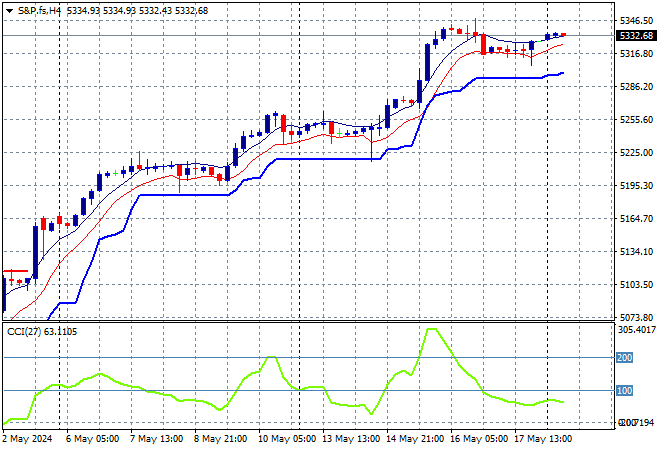

S&P and Eurostoxx futures are looking healthy as we head into the London session despite the latter closed for a holiday with the S&P500 four hourly chart showing price action still building slowly above the 5300 point level:

The economic calendar starts the trading week quietly with a few Treasury auctions and some Fed member speeches.