Asian share markets are in caution mode as they await the reopening of Wall Street tonight with mild losses across the region. The USD is slowly fighting back against some of the major currency pairs, while the Australian dollar is pulling back to the 65 cent level on the absorption of the latest RBA minutes.

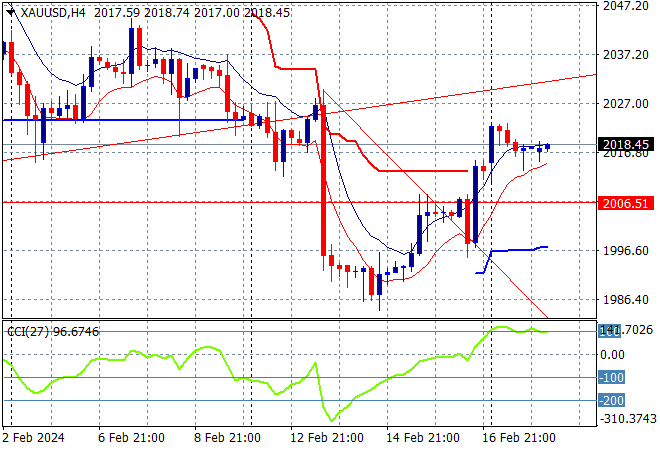

Oil prices are still on trend and holding on to their nascent gains from last week with Brent crude just above the $83USD per barrel level while gold is holding on to its recent gains as it bounces back to the previous support level above the $2020USD per ounce level:

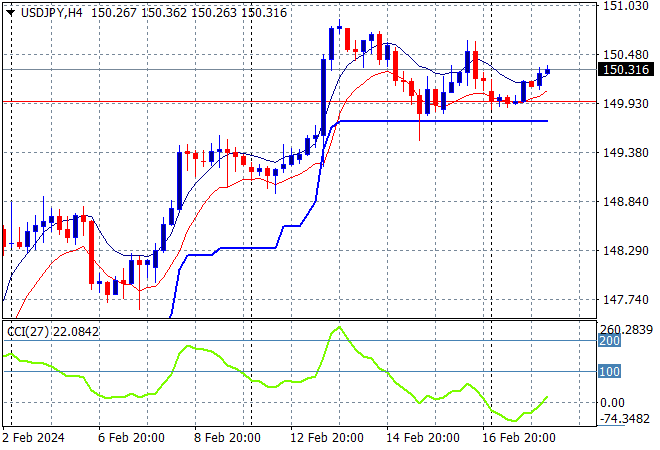

Mainland and offshore Chinese share markets are still somewhat hesitant after their break with the Shanghai Composite barely up while the Hang Seng is off another 0.3% to 16111 points. Japanese stock markets are also pulling back with the Nikkei 225 about to close 0.3% lower at 38379 points while the USDJPY pair is actually on the rebound, bouncing off the 150 handle:

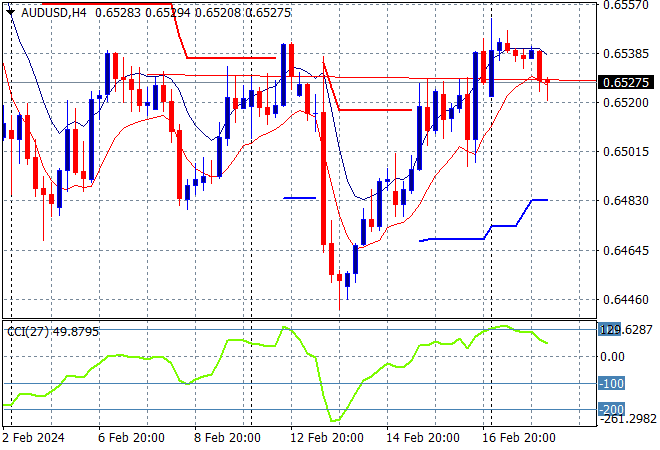

Australian stocks range traded again throughout the session with the ASX200 about to close 0.1% or so lower at 7665 points while the Australian dollar has pulled back from its Friday night bounceback to be just above the 65 cent level:

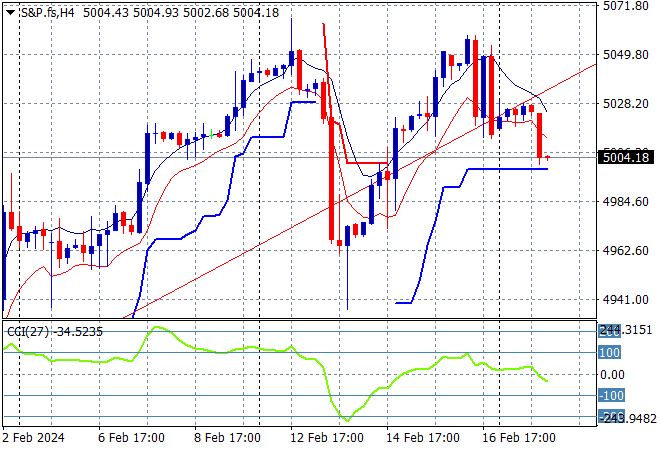

S&P and Eurostoxx futures have pulled back from their Friday night and overnight positions respecitviely with the S&P500 four hourly chart showing price action to catch up to futures that are barely holding above the 5000 point level:

The economic calendar ramps up very slowly overnight with the reopening on bond markets including some more Treasury auctions.